Staked Ethereum: The low yield of a US treasury bill with the high risk of crypto

The boring yield of US government notes combined with the risk, uncertainty and degen magic money box mindset of crypto.

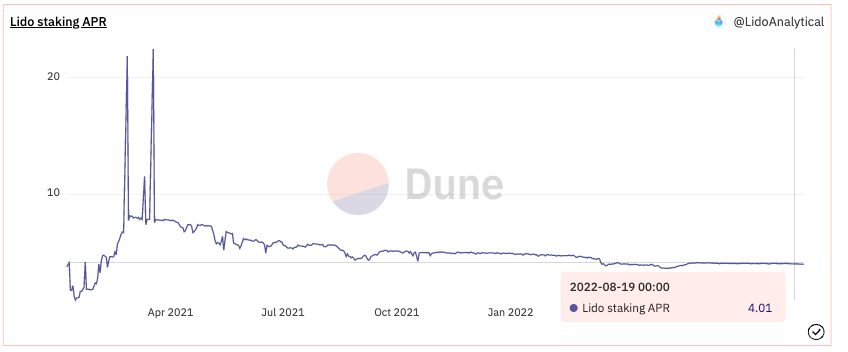

I’ve been thinking quite a bit about staked Ethereum (referenced as stETH) and the role it plays in Ethereum’s next big upgrade: “The Merge”. I cannot wrap my simpleton brain on why eth proponents (of which I am one) are framing it as a wealth creation event. I am long on eth as the catalyst for web3 adoption but when I view the “merge” and its associated staking yield through a financial lens, it is literally the worst of both worlds: yields of a US treasury bill with the risk of an unregulated crypto asset operating in a 24/7 off-shore casino. In this analysis, we’ll cover why there are no meaningful financial incentives to stake eth, as its annualized yield is akin to US treasury bills - a risk-free asset. Why take the risk for the same reward? We will review how invisible hand actors participating in staking Ethereum are doing it for one purpose: leverage, the same leverage responsible for the 2022 crypto winter.

To set the stage for this analysis, the tl;dr of the merge is:

Ethereum’s beacon chain merged with mainnet as its engine of block production (the ‘merge’)

Mining-based block production using specialized hardware and GPUs (proof-of-work) has been replaced with general-purpose computers that facilitate block production by staking Ethereum (proof-of-stake)

Ethereum issued by the network has decreased by ~90% making eth deflationary at gas prices above 15 gwei

Staking (validating blockchain transactions) is when you deposit Ethereum to activate the validator software. You are not allowed to withdraw your staked Ethereum until an unknown time after the merge is completed (currently guestimated at 12 months), pending some software updates.

Tons of content - here, here, here, and here if you want to learn more on the merge, but imagine instead of having buying machines to mine bitcoin (self-plug, I wrote a book on this), you just bought bitcoin, deposited it into some abstract software framework called the “consensus layer”, and the framework now uses your bitcoin to mine more bitcoin as a byproduct of validating transactions on the bockchain. Replace the word bitcoin with ethereum, and that is proof of stake + the merge.

The stETH ecosystem has been on a rip from 0 to 11,000,000 ethereum token deposits over the past 24 months. Around 32% of all eth is currently staked.

What I don’t understand is - why? Maybe I’m almost a boomer, maybe I’m only viewing this transaction through a financial framework, or maybe i’m just not a big brain crypto whale but this is a bad move with too much risk, especially at yields between 3%- 4%. Let’s break it down.

US Treasury Bills offer the same yield over the same redemption period with zero risk.

Let’s speed-run US treasury bills (t-bills) for the web3 natives. A US t-bill is a loan from you to the USA. Unlike a treasury bond denominated in 20 to 30-year notes, t-bills have short-term maturity dates (like staked eth, currently ~12 months after the merge) of 52 weeks or less, and can be bought directly from Uncle Sam via Treasury Direct.

You purchase the t-bill at the investment rate offered on the market and receive the face value at maturity. Here’s an example with $100:

US government offers you a $100 US t-bill with a 3.325% annual (52-week) yield

You give the government $96.68 (1-.0325))

The government gives you an IOU promising repayment in 52 weeks

52 weeks later the US government gives you back $100 - thank you, patriot!

This is exactly what is happening in eth staking land, except with hella risk and an unknown redemption window. So why do it? The answer is leverage.

In boomer finance, 1 us dollar = 1 us dollar. In Ethereum land, 1 eth = 1.030424024 eth (staked).

Staked ethereum is trading at a discount to its underlying asset Ethereum. Why? Unfortunately crypto financial markets, just like the boomer financial markets that control our 401k and retirement accounts, are all at the mercy of a small group of institutional investors and degen bros who made leveraged investments bets which triggered a bank run during the 2022 crypto winter.

How institutional investors fubared staked eth:

Institutional Investors are exchanges like Celsius (RIP) had at least $700m of exposure in staked Ethereum.

The ~$28B of crypto assets under management within Celsius, was leveraged, borrowed against and loaned out to fellow centralized exchanges who also leveraged, borrowed against and loaned out customer assets to other off-chain financial institutions.

These capitalist visionaries were forced to liquidate their leveraged positions when ethereum and bitcoin plummeted ~60%-80% from their peak due to widespread macroeconomic conditions. Depositors issued withdrawal requests (a good ole run on the bank, crypto style) but the problem with this level of leveraged exposure was the harsh realization that none of these exchanges actually had sufficient eth to cover the liquidation; it was all staked.

Given the merge upgrade requirements related to staked illiquidity; ‘unstaking’ is not an option, for at least the next 12 months post-merge, forcing exchanges to sell staked Ethereum on the open market. How did they do this? The same way degen crypto bros did it, except on a much larger scale. Keep reading.

Degens are also guilty as charged

Degens and institutional investors are really brothers from another mother, mutually to blame in this fiasco. We all participated by taking leveraged positions on staked Ethereum to borrow more Ethereum to buy Ethereum to borrow more Ethereum.

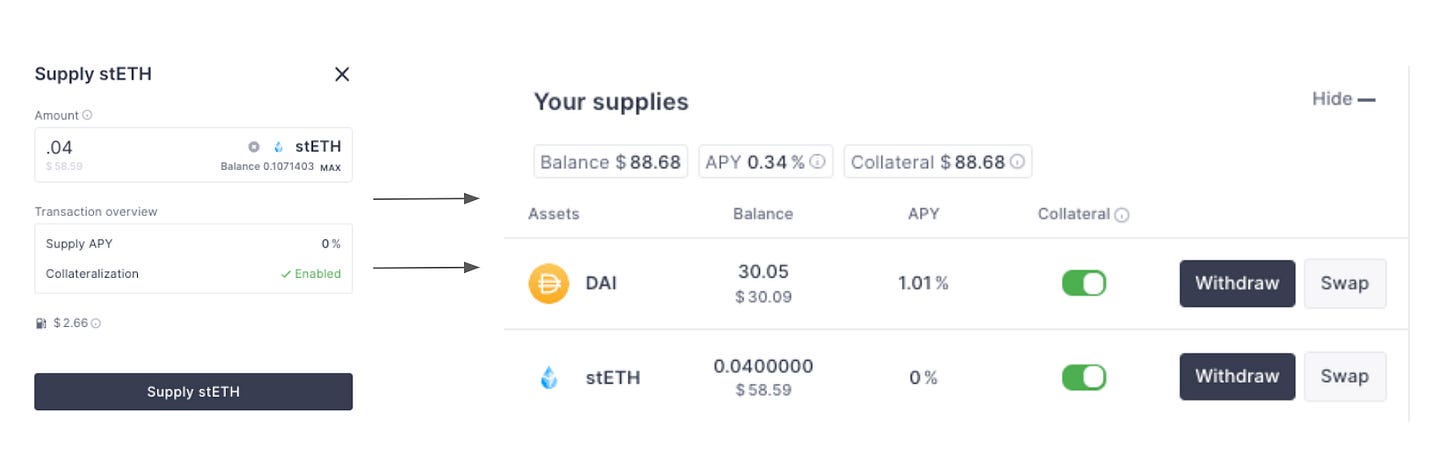

Initially, rank and file degens and crypto bros use exchanges like AAVE to lend and borrow:

These platforms have illusions of financial fiduciary and a self-enforcing system of checks and balances using financial metrics like Max LTV, Liquidation thresholds, and liquidation penalties

Let’s speed run an example with 100 stETH. We want to lend staked eth and borrow USDC. We’ll use numbers from the 2022 crypto boom:

At $6,000/stETH and 100 staked eth tokens, an equivalent of $600,000 USD is deposited. The max I can borrow is 82.5% of the deposit amount or 82.5 eth worth of USDC. With eth at $6,000 per coin, my max exposure to USDC is $495,000 (82.5 eth * $6,000 * $1.0).

The 82.5% is the “loan to value” (LTV). I now have $600,000 of staked eth (locked as collateral) and $495,000 of USDC which I can YOLO on my degen expeditions. What leveraged participants must be aware of is the relationship between the LTV and Liquidation Threshold.

The ‘Liquidation Threshold’ (LT) is the percentage at which a position is defined as under-collateralized. The LT varies by each token and we see AAVE’s current LT rate for USDC is 85%.

If eth or its staked derivatives decreases just 3 percent from the $6,000 price per coin to $5,800, LTV > LV. At current eth prices of $1,400, the person who made this trade got rekted. They were doomed from the jump.

Note: We do not have to worry about liquidation risks when we lend eth to borrow more eth. The ‘aave wrapped eth token’ (deposit token) and ‘aave wrapped variable debt eth token’ (debt token minted by aave) rise and fall at the same rate. You are subject to variable interest rate payments which have been as low as 5% and as high as 100% (immediately after the merge).

Lending platforms will automatically liquidate some of your position when the loan is under-collateralized as measured by their ‘risk parameter model’. This is the beauty of crypto, the loan agreement is embedded in the contract. There is no human counterparty risk. The code will automatically liquidate your position.

Aave’s risk parameter model is calculated using a ‘health factor metric,’ which quantifies risk based on the amount of collateralized eth, the liquidation threshold, and the total amount borrowed. This metric is displayed to the end-users, unfortunately, most apes and degens don’t know how to read; we only know number go up.

Using our 100 stETH example and USDC example with eth @ 6,000 USD, the Health Factor is calculated as:

H(f) = (100 eth * .85 ) / 82.5 eth = 1.03Note: Aave’s risk parameter framework including its health factor and liquidation penalty are eth denominated. This the platforms metrics used to measure insolvency are measured in eth. This makes ‘sense’ when lending eth, but when borrowing a non-eth asset like USDC, the amount must first be converted back into eth denominated terms

For example: If you lend 100 staked eth at $5,000 per coin (for a total of $500,000 USD of eth) and borrow $250,000 of USDC, the amount borrowed in eth denominated terms is ($250,000 USDC / $5,000 ) is 50 eth…

…If staked eth decreases to $2,500 - you still provided 100 of staked eth liquiditiy as a lender, but the amount of eth you owe has now increased. $250,000 of USDC is now 100 eth ($250,000 / $2,500) and you will be liquidated!

Loans with health factors < 1 are subject to automatic liquidation. Consider what happened with Ethereum dropped to $5,800, just ~2%. The health factor yields a <1 value, eth at $2,000, is a catastrophe, see table below.

Moreover, lending platforms like Aave will impose a liquidation penalty on top of the liquidation event itself. To maintain solvency and restore the H(f) to > 1, Aave liquidators will repay up to 50% of the loan and receive a 5% incentive.

In the aforementioned example where the health factor is < 1 at $5,000 eth:

This is very bad:

We provided 100 staked eth of liquidity

We borrowed 495,000 USDC or 81.25 of eth

Eth dropped from $6,000 to $5,000 price per coin

Our health factor reached <1 because our LTV is > the liquidation threshold

Aave liquidated 50% or 41.25 eth of the collateralized eth to cover the downward movement

Aave imposed a liquidation penalty equal to 5% of the liquidated eth or 2.06 eth

We paid a total of 43.125 eth leaving us 56.69 eth as collateral

We are left with 41.25 eth or $206,250 USD of debt

43.125 eth at $5,000 is worth ~ $215,625. 43.125 eth at $6,000 is worth ~ $258,750. This is problematic because although we borrowed USDC, the debt and the lending platform’s health factor is denominated in ETH. More eth must be sold to cover the liquidation event.

This is something that is glossed over in degen communities, the health factor of platforms like Aave, its liquidation structure, and fees are all denominated in eth independent of what token you’ve borrowed.

A visual depiction is outlined below. Conceptually lending platforms will liquidate your position when your collateral is below a liquidation threshold (box 2 below). The liquidated amount (50% in the case of aave) plus a liquidation penalty is deducted from your collateralized amount (box 3), and the amount you owe plus the amount of eth collateralized decreases proportional to the amount liquidated.

None of this can be stopped. You cannot call your local government official and demand a moratorium on Aave liquidations. Your agreement is embedded into the Aave smart contract and automatically executed. The net result? A mass liquidation of staked eth to offset a declining price in Ethereum.

This whole process is amplified by leverage services like “Ethereum Flexible Leverage Index” (2x eth exposure) and “ETH Max Yield Index” (3x eth exposure) which offer derivates (tokens) that track 2x or 3x exposure of the underlying asset. In these tokens, the smart contracts have the “buy → borrow → buy→ borrow” process engineered into the code, obfuscating the trades from the end user (perhaps to their demise), yet are still subject to the same liquidation thresholds and risks described above. This means higher highs and lower lows with a higher velocity and cadence.

What we can conclude from this analysis is the same result for the degen as well as the institutional investor; leveraged exposure of staked eth creates a cascading liquidation risk which directly impacts the value of the staked eth token relative to its underlying asset (Ethereum).

In ELI5 language: 1 staked Ethereum becomes worth less than 1 Ethereum despite being the same asset.

Enter the humans

Engineering, code, science, in all of its greatness is still fallible to its maker: the human. Given the continued downward pressure of eth, perhaps as a byproduct of over-leveraged staked eth, exchanges like aave have considered human intervention (via the DAO) to prevent a full liquidation aka run on the banks, if downward pressure continues. Ideas like disabling staked eth/eth trades at the exchange level, lowering liquidation thresholds to 50%, and pausing borrowing altogether are under examination. My question is, why? Aren’t crypto and web3 the frontier of liberty, self-agency, and a new era of finance? Why should a group of humans impose arbitrary financial constraints on an ecosystem due to bad-faith actors? If degens and whales lose 90% of their wealth from 12x leverage, good…

…if staked the eth/eth ratio is under collateralized at a ratio of 1 to 4…

…and continued deviation of the steth/eth pairing creates ~$90m USD of cascading liquidations plus ~$68m USD of insolvencies (just on aave)….

…well, aren’t these liquidation events a byproduct of an efficient market? Isn’t this exactly what we want as crypto enthusiasts seeking to escape a centralized system that serves the wealthy at the expense of the masses? A group of anon humans deciding policy on liquidation preferences for a $5b tvl exchange to prevent an insolvency event on a crypto whale with $30m of staked eth does not sound like a risk-free investment nor does it sound like a crypto first principle of decentralization and liberation from existing monetary systems. We must fight like hell and resist these ideas from entering the defi landscape.

Putting it all together:

We can make a case that staking Ethereum can be our individual contribution to a future of web3 and finance free from the shackles of traditional banks and close-loop invite-only hedge-funds. We can believe that staking Ethereum will move the planet to a greener future which incentivizes long-term holding over short-term selling. But we cannot make ourselves believe that staking Ethereum is another magic money box where 1 dollar goes in and 2 dollars reappear.

Specifically, staked Ethereum:

provides an annual yield less than US Treasury bills and related savings bonds

has no exit date where holders can redeem their investment; it may never happen

trades at less than its underlying asset as a byproduct of its over-leveraged position

Staked Ethereum is truly the worst of both worlds. It offers the returns of a t-bill with the risks of crypto. Unless you want to engage in degen 3x leveraged gambling, avoid it at all costs.

Stay alert,

John Cook

San Francisco, CA

August 27th, 2022

www.frontruncrypto.com

Supporting Content:

tweet of the week - “but have u seen my sex tape” - elon musk