Welcome back to work diamond hands.

How loose monetary policy and a centralized web3 financial ecosystem destroyed $2 trillion dollars of crypto wealth.

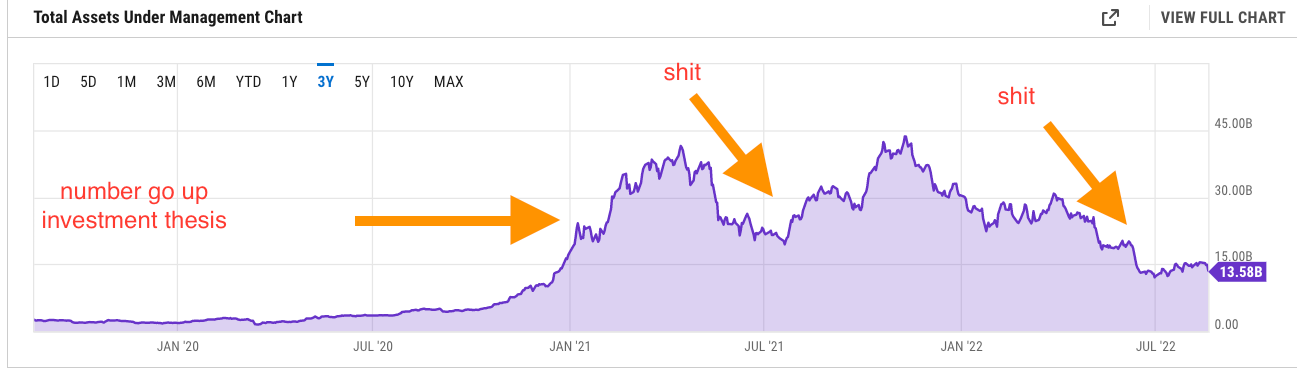

I’ve been thinking about the absolute wealth destruction which has decimated the crypto industry over the past 180 days, more specifically how it happened and what we can do to prevent it from happening again. My best guess is that the ~$1.5 trillion dollars of wealth destroyed (image 1) was a by-product of around ~$10-14 billion dollars of off-chain under collateralized investments (the focus of this analysis) and a $40 billion dollar collapse in a collateralized obligation backed by an algorithm (stay with me we’ll get there).

Said another way, $68 billion dollars of bad money and technology destroyed around ~$1.5 trillion dollars of wealth.

All of the “web3 venture capitalists”, general partners of “crypto funds”, and the crypto-twitter ecosystem at large, these captains of industry, the best and brightest talent ever to emerge from the ivys and beyond, were left holding the bags of sovereign institutions and Singapore shadow banks whose thesis revolved around the US federal reserve money printer, arbitrage of GBTC and BTC via leveraged off-chain trading, and something called an algorithmic stablecoin. Unfortunately, the wisdom of the elites didn’t account for declining market conditions as their overall market thesis was: “number go up”.

In this analysis, we’ll analyze the money printer go brrr and number go up investment thesis as well as its eventual result: diamond hands capitulating and returning to their job at wendy’s.

How “money printer go brrrrrrr”:

Here’s how the magic started. Loose monetary conditions facilitated by “quantitative easing” by the federal reserve during 2020 created $7 trillion dollars of new money (this is the money printer go brrr).

Quantitative easing explained-like-im-five:

The US Federal Reserve:

Buys treasury bonds backed by the faith of the US government from private institutions, member banks and foreign nations

The seller receives an IOU from the US government - we’re good for it brah

The government has cash $$$ to give to its plebs, corporate donors, and the billionaire class who actually controls this country

This is what happened during COVID, $2 trillion to $5 trillion dollars of money was created from thin air to support those impacted the most by the global pandemic; hedge funds, cruise and airline operates, private REITs, private colleges with billion-dollar endowments…you know, those really suffering. I’ve written about this waste in great detail for those interested:

So a bunch of money is created, the rank and file aren’t working, and those working from home are only pretending to work, the net result? Massive day trading across meme stocks and crypto tokens.

In 2021 over > 50% of all publically traded companies on NYSE and NASDAQ didn’t make any $$$$, for the finance wonks: trailing twelve months earnings per share was(TTM EPS) < 0. I anon posted this on Reddit, predicting a 2022 collapse, only to be downvoted to oblivion. Here’s the data, read it yourself!

As a result of the “money printer go brrrrr” aka loose monetary policy aka quantitative easing aka bailouts for the rich, the SP500 rallied 40% off its 2020 low by December 2021.

The money printer go brrr dilemma transcends far beyond the equities market, as periods of quantitative easing yield lower interest rates to encourage lending. This is why the US housing market has experienced 20% y/o/y price appreciation from 2019 through 2022. Sorry millennial, you wanted to buy a house? Maybe if you work really hard you’ll be able to afford an ADU in your CEO’s backyard…but i digress

Crypto is caught in the cross-hairs, specifically BTC and ETH which run 1 to 1 with the SP500. Moreover, “risk on assets” rise during periods of cheap money from low-interest rates (bond yields approach zero, and investors migrate towards equities). Here GBTC (the centerpiece of the meltdown we’ll be discussing) is running in parity with the SP500 (blue line)

So by 2021, the money printer is running 24/7, Americans are flushed with stimmy checks and cash in the bank, people aren’t working (or merely pretending to work), and access to capital is cheap. Enter phase 2 of the big brain investment thesis.

How number go up:

During this time of exuberance, generational wealth in crypto was being created from thin air. The all-time favorite I hear amongst the boomers who look at crypto like a Ponzi scheme are the “pictures of monkeys”. In 2021 a company called Yuga Labs created 10,000 pictures of a digital monkey called a “bored aped”, which at its peak, sold with an average floor price of $400,000. It was time for NFTs to shine and crypto to return to the public eye.

What recession? June 2022 BYAC 2488 sells for $1.2mm.

Retail and institutional investors flocked to the web3 ecosystem to capture alpha aka the opportunity to make YOLO money in crypto.

“Smart money crypto” (lolz) like Three Arrows Capital took long positions in premium NFT collectibles worth north of $45 million dollars; only to emerge in a bankruptcy firesale

…as much as we want to laugh at pictures of monkeys, the creme-de-la-creme of the number go-up craze was the GBTC → BTC arbitrage and off-chain counterparty risk.

Here’s how it worked:

Retail investors deposit US dollars into online exchanges like BlockFi and Celsius.

This is usually in exchange for easy fiat-on ramp and unsustainable yields - e.g BlockFi offering new depositors 8.6% APY on deposits (how??)

Other high net worth investors invest as limited partners into private funds e.g. Babel Finance or lend to trading firms like Genesis

These “smart money" centralized exchanges and investors make opaque investment decisions with depositors’ money primarily by leveraging other groups of investors in off-chain transactions, here is an example:

the Reddit bros gives $10 million dollars to the Stanford trust fund baby running Any-crypto-VC who promises a 15% yield back to Reddit bro

Stanford trust fund baby takes the $10 million dollars and gives it to daddy’s VC general partner who executes a contract with the Goldman Sachs to borrow up to $100 million

daddy’s VC general partner now has $100 million to invest as long as the $10 million in collateral stays above $5 million, which is the danger zone for the Goldman Sachs partner.

This is called under-collateralization but the VC general partner is good for it because he went to yale with the managing partner at Goldman Sachs

now the Reddit bros will not get their money back from Stanford trust fund baby unless the VC general partner can repay the loan to the managing partner at Goldman Sachs

All of this is counter-party risk

All performed off the blockchain (e.g. off-chain, you can’t verify sh*t)

and not subject to smart contracts (e.g. code)

The undercollateralized and leveraged loans were then lent to Thee Arrows Capital (3AC) in a method similar to the aforementioned process

Exchanges and private funds leveraged money directly and/or lent money to 3AC who leveraged funds with intermediaries

3AC deposits the BTC/cash into the Greyscale bitcoin fund, receiving up to a 38% premium on the deposit

This means 1 bitcoin deposited is immediately worth 1.38 bitcoin

After a six-month lock-up period, 3ac sells the GBTC on the “open market”

This creates a self-fulling prophecy of “number go up” by encouraging more depositors at every step of the process.

NUMBER GO UP!

For the visually inclined, here’s what happens:

Imagine a 38% instant return on an investment? Investors moved. GBTC bitcoin assets under management “number go up” all the way through July 2021.

At a glance, retail investors flocked to crypto banks to participate in the crypto craze, lured by high intro APY → crypto banks take the money, borrow against it and give to bigger investors → Bigger investors buy monkey pictures and GBTC → The cycle continues until a red herring is triggered (the algorithmic stablecoin)

From January 2020 through July 2021, BTC pumped from $10k to $50k.

This runs parity to the net asset value premium, and essentially the “aforementioned number go up” investment thesis.

What caused the NAV to flip and never recover?

My thesis is that 2021 was the year of the crypto ETF, specifically the introduction of competitive BTC/ETH investment products like:

Osprey BTC (OBTC)

plus the 80 other crypto investment funds launched in 2021 all acted as net detractors to the GBTC NAV. Neither the fall 2021 bull run nor Grayscale’s attempts to buy back $1 billion of stock shore up the NAV, the trust has traded at a discount ever since. ouch.

Still with me?

There are levels to this post-mortem analysis. We need to dive deeper into the role the NAV discount played in the 2022 crash as well as the fall 2021 run-up. The $1.5 trillion dollars of market cap destruction was triggered by $68 billion dollars of bad money and technology, and we’ve only covered the first ~$10 billion. In part 2 we’ll cover the leveraged degen activities of 2022 which contributed to the crypto crash and I’ll prove it with a fubar example of a 30x leveraged eth position that blew up in my face. We’ll then assess how defi would have prevented this catastrophe if all parties performed all trades on the blockchain, and finally dive into the other ~$50 billion bad money and technology that caused the summer 2022 crypto meltdown.

For those who can’t wait; fall 2021 crypto exuberance can be eloquently summed up in this meme:

John Cook

San Francisco, CA

August 21st, 2022

www.frontruncrypto.com

Tweet of the week - crypto investing seminar at a senior living facility