A case for $1,200 Ethereum and warning to DeFi degens

How the invisible hand of whales and retail traders YOLOing on derivatives will lead ethereum to $1,200 by the end of 2022.

Dear frontrunners,

Tomorrow is Ethereum’s merge. For those living under a rock, Ethereum is moving to a new consensus mechanism that makes the L1 one step closer to achieving its vision of ultrasound money: Ethereum as a deflationary asset. In my simple brain, this means the amount of Ethereum the protocol “pays” for security is less than the amount of Ethereum it collects via transaction and burn fees (revenue > expense).

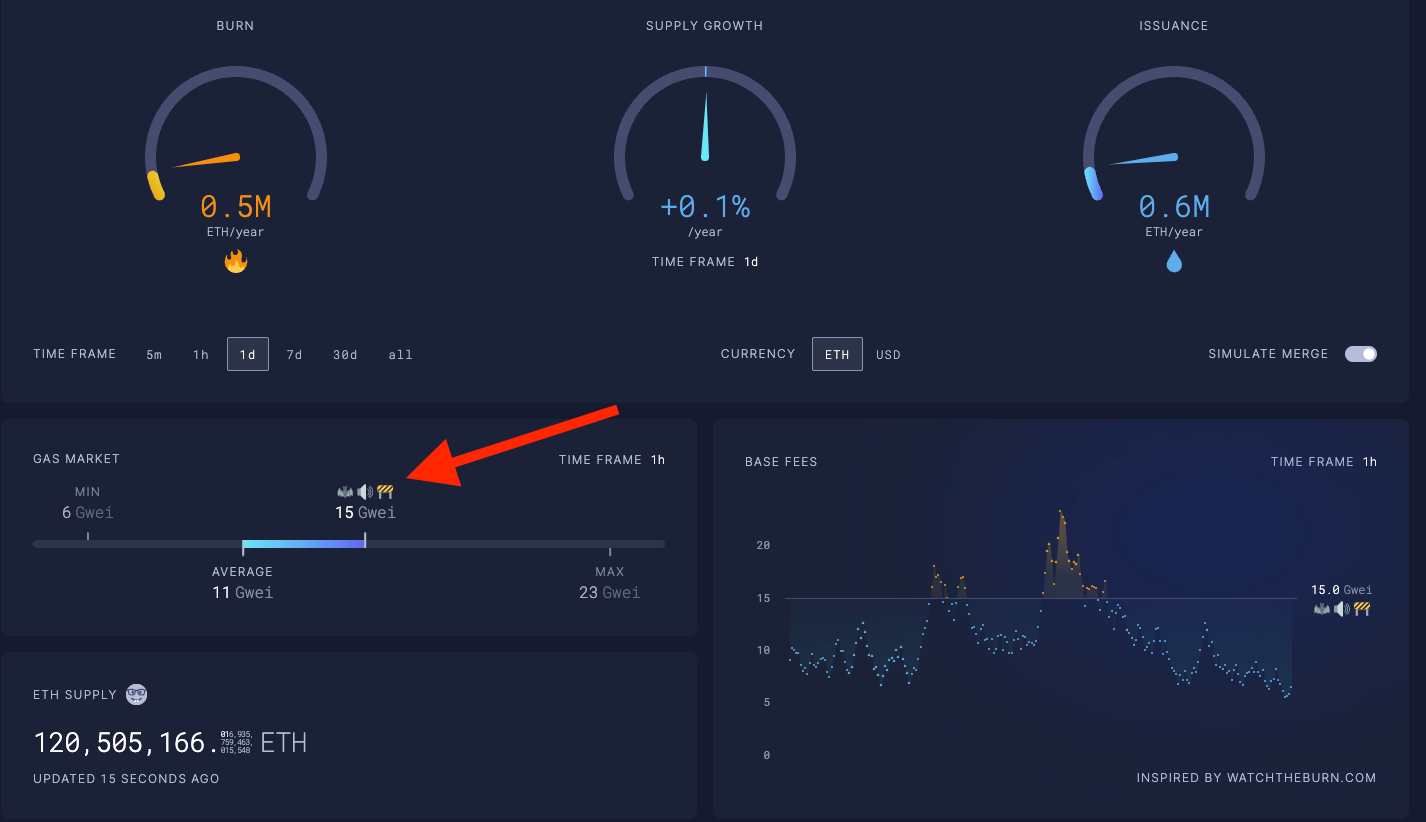

There’s some nuance around this, demand has to be high enough such that gas prices are north of 15 gwei, not a problem during crypto summer, but as of this writing, Ethereum is averaging 11 gwei per transaction, see below.

For those wanting to celebrate, the Ethereum Foundation is hosting a virtual viewing party here….but I digress, this article isn’t about the benefits of the merge, or Ethereum as ultrasound money, or the protocol’s vision for a “green future” with reduced emissions. I’ve thought a lot about the economic narrative surrounding the merge and all of the downstream degen activities the crypto community is YOLOing into in anticipation of this “wealth creation event”:

Lending staked Ethereum to borrow more Ethereum in anticipation of the ETHPOW fork:

Has caused utilization rates on lending platforms like AAVE to hit records as high as 85%

This is pushing short-term eth lending rates as high as 49%

Buying short-dated eth calls with a 9/30/22 expiration

This pushes the implied volatility (IV) of the contract as high as 400%

This causes an increase in the premium paid for the contract

This causes more traders to write the contract (or borrow naked against the asset)

This causes the price of the asset to go up

This causes the IV to go up, and the cycle repeats

I am an eth permabull but let’s be clear: the merge is not a wealth creation event and Ethereum will not be $8,000 by the end of 2022. The price action we’re seeing relative to the price eth is a byproduct of;

Large whales trading Ethereum derivatives:

writing short-dated contracts for deep out-of-the-money calls, collecting the premium

buying short-dated contracts for deep out-of-the-money 9/30 calls, then writing short-dated contracts for 10/30 in the money puts to hedge the downside

All of this produces increased demand in the underlying

Layer 2 platforms (like GMX) offering 3x-30x exposure on derivatives via “perpetual options contracts” → these are options with no expiration date:

traders “bet” Ethereum is going up or down, collateralize 1 eth for up to 30 eth exposure

The stakers of GMX/GLP et al charge the trader an annualized interest rate of 51% paid by the hour

Traders ultimately lose

Large whales and retailers staking Ethereum on lending platforms like aave, then borrowing against it in hopes of an ETHPOW token with a value > $0.

This is why I am predicting Ethereum to be under $1,200 before the end of the year. My case is below.

A (very recent) trip down memory lane

The degen activities I’ve just described leads me to believe that the DeFi community suffers from amnesia and short-term memory loss. Wasn’t it just a season ago that the web3 community was rocked with massive wealth destruction as a byproduct of over-leverage, under-collateralized and opaque off-chain transactions?

$10-$14 billion US dollars of wealth was destroyed by centralized exchanges like BlockFi, Celsius, et al…

$3-5 billion US dollars of is “just gone” via diamond hand VCs and private wealth funds like 3AC, formerly the “smartest guys in the room” who got rekted with leveraged staked eth and gBTC/BTC arbitrage positions

…and let’s not forget the $40-$60 billion US dollars of mostly retail investors’ wealth liquidated by algorithmic scam stable coins like UST/LUNA backed by nothing but a promise and an invisible algorithm. For the visually inclined and those who seek not to repeat the past, the cycle can be depicted below:

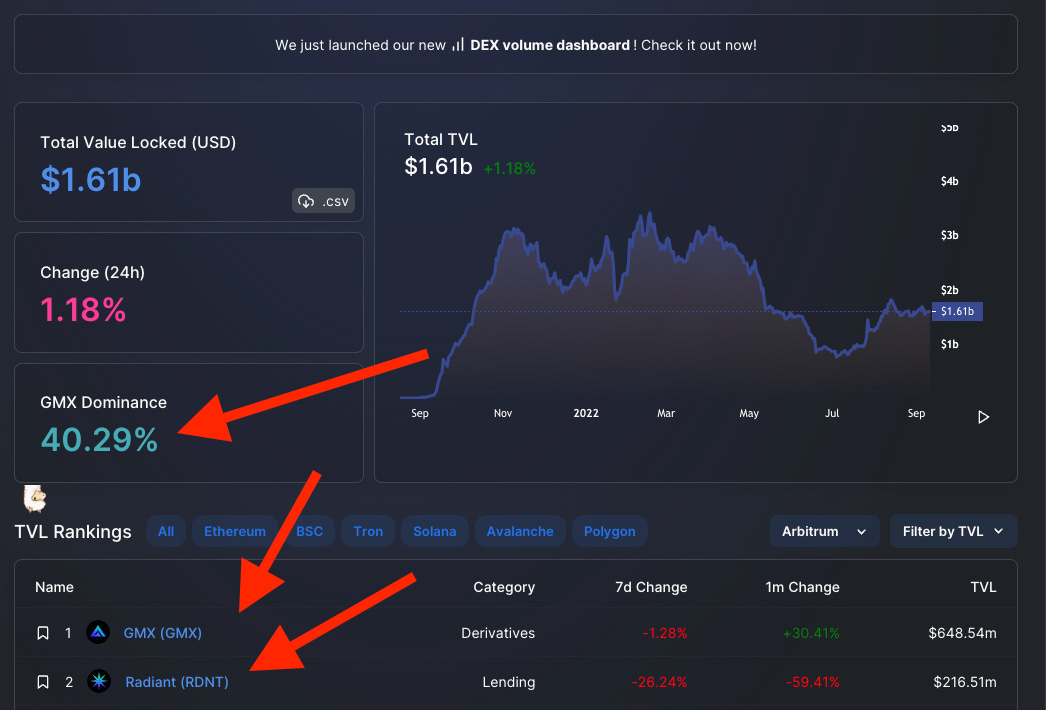

Yet at the time of this writing, what activity continues to permeate the DeFi community? Leverage, borrowing, and more leverage. 2 of the top 5 protocols as measured by fees collected by users are AAVE, a borrow/lending platform and GMX, an arbitrum DeFi app offering up to 30x leverage via perpetual option contacts. These are options with no expiration date but are subject to automatic liquidation when the price of the underlying drops as little as two percent!

The degen activities of leveraged trading via perpetual contracts like GMX and its derivatives: Vesta Finance (collateralized lending of GMX), Umami (collateralized lending GMX’s GLP token), and Mycelium (a fork of GMX) are clear indicators that traders having short-term memory loss and will soon be departing with their money.

The FOMO is real. The number one layer 2 by total value locked is arbitrum, of which GMX + Radiant (another lending platform) account for > 50% of total assets.

Is anyone making any money?

Am I wrong? Maybe eth will be $8,000 by EOY, and maybe people are making money?

This is really the only question that matters: is anyone making money by lending, borrowing, and trading derivatives? The answer is no. The average return on investment on AAVE is ~6.184% before fees. A risk-free rate of return on US treasury savings bonds is 9.62%, which is tax-exempt at the state level. Lending on AAVE is for sure an outsized risk relative to the return.

When borrowing costs are included, AAVE’s Ethereum ROI is -41%. The platform’s variable lending rate has spiked as high as 23%, 49% forcing their DAO to approve a snapshot vote which temporarily pauses ETH borrowing ahead of the merge.

This is because speculators degenerates are lending ETH/staked ETH and borrowing against the collateral for more Ethereum in anticipation of an Ethereum POW fork. In aggregate, the lending community has supplied $1.68 billion of eth/staked eth, wrapped BTC, USD, and DAI to be used as collateral to borrow approximately $1.22B of wrapped eth.

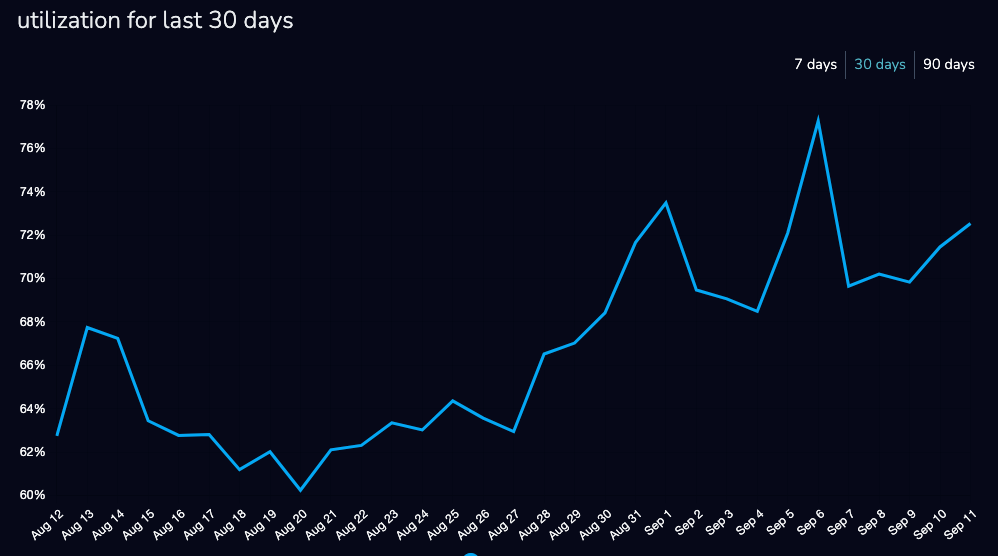

The rationale behind this “lend eth to borrow more eth” is the opportunity to “double” the total amount of tokens held in a given wallet. If you have 10 ETH before the merge, speculators believe that after the merge you’ll have 20 ETH: 10 in the POW fork, and 10 in the POS fork. The net result? Over 70% of Ethereum on AAVE is “utilized” (borrowed). Of the $1.6B eth borrowed, nearly $1 billion is in staked eth/eth alone.

I question the economic value of the 10 tokens on the eth fork given the underlying collateral will reside on the POS fork. As of this writing, the ETHPOW development team intends to freeze the aWETH contract, along with another ~100 DEX smart contracts like uniswap USDC, Balance’s Vault, Compound cETH, etc. This makes sense because the value of the underlying collateralized asset will be worth $0. If one WETH is used as lending collateral on AAVE, post-merge that one WETH cannot exist on both ETH POW and ETH POS.

My conclusion is that leveraged trades to maximize the quantity of eth-on-hand will be another wealth destruction event. The borrower will suffer capital losses as a byproduct of lending fees and downward pressure on the eth asset as traders exit positions.

As bad as the lending rates on AAVE sound, it’s actually much worse on GMX, the #1 derivative platform on arbitrum.

GMX is a complete rug pull for the majority of traders, the net position of trader profit vs loss on GMX before borrow fees …is…you guessed it..a cumulative loss. Traders in aggregate, lose more money on GMX than make profit…As of this writing, traders have made $37million USD on GMX derivative contracts but have lost $41million USD, before factoring in fees.

If we completely ignore the red flags associated with GMX dev team being a group of Chinese anon developers, the only individuals making any money are the ones staking GMX and GLP, this is because the losses of the traders are distributed to the GMX and GLP token holders. But it gets worse, traders on GMX are getting rekted on fees. Fees to enter the position, fees to exit the position, fees to hold the position (per hour) - all act as vectors of wealth destruction and negatively impact the borrowing position of the trader. In the aggregate, GMX has annualized borrowing rates on Ethereum are >51% APY.

This borrowing rate is what degens and retail traders are paying the platform pro-rata the utilization rate of the asset, in addition to an exit fee, entry fee, and swap fee:

There is a "Borrow Fee" that is deducted at the start of every hour. This is the fee paid to the counter-party (the LP) of your trade. The fee per hour will vary based on utilization, it is calculated as (assets borrowed) / (total assets in pool) * 0.01%. The "Borrow Fee" for longing or shorting is shown below the swap box.

The trading fee to open a position is 0.1% of the position size, similarly there is a 0.1% fee when closing the position.

Note that when depositing collateral into a long position, there is a 0.3% swap fee for the conversion of the asset to its USD value, e.g. ETH amount to USD value. This is to prevent deposits from being used as a zero fee swap. This does not apply to shorts. Withdrawing of collateral from longs and shorts do not have this fee as well.

Consider a 30x leveraged long eth trade with 1 eth as collateral:

This trade will cost the degen $151.88 to hold for 24 hours and is subject to automatic liquidation when the price of eth decreases to $1559.63 or 2.44% with a price per coin of $1597.64. In a 30-day trading window, Ethereum has traded on average, 17 days with a day/over/day change % of > -2%. This means for every 30 days you hold eth, the value will decrease by > 2% on 17 of those days. If readers have intra-day analytics, I’d be curious to know what the change rates look like hour by hour. My guess is not much better.

It’s the market, stupid

GMX, AAVE, and other players are only a small microcosm of the overall economic activity across the Ethereum blockchain. In the past 24 hours, over $30b USD of futures contracts were traded. The players behind these trades are the invisible hands who are influencing the price action of Ethereum, think institutional investors, sovereign wealth funds, and offshore Asian hedge funds. These traders do not influence the market, they are the market and the talk track we see on the twitter-verse is just a narrative that forms around price movement.

But what are these whales actually doing? And what can we extrapolate from their trades? My mental model for answering these types of questions, which has served me well in many parts of my life, is to keep it simple. There are over 400 technical indicators on glassnode which can be used to gain insight into trading patterns, but two very simple indicators to assess short-term price movements are: open interest and (implied volatility) IV on 9/30/22 and 10/30/22 contracts.

Open interest on Ethereum derivative contracts is at all-time high, surpassing bitcoin.

Platforms like FTX, GMX, Velodrome, Thales, Hegic, Lyra, Deribit, and many many more will let you trade contracts like ‘options’ to speculate on the underlying. A holder of eth will write a contract to sell eth at a strike price of $3,000. The buyer of the contract will provide the writer a ‘premium’. The writer hopes eth will stay under $3,000 which means the contract will expire worthless and the writer keeps the premium. The buyer of the contract hopes the price of eth will go over $3,000 to buy eth at a discount. Open interest represents the number of contracts (options) currently available on the market. More contracts are an indicator that many people are speculating.

But what are they speculating about? The implied volatility (IV) of an Ethereum contract on Deribit with an expiration date of 9/30/22 is > 200% for deep out-of-the-money (OTM) options. This is for sure degen trading as implied volatility represents one standard deviation of movement from Ethereum price over the life of the contract. A high IV is a bullish signal that traders think the price of the underlying (eth) will increase, and they’ll be able to capture the incremental value of the contract.

One standard deviation on Ethereum at $1,750 with a 200% IV produces a range of $-1,750 to + $5,250. This means traders see 3x upside ($1,750 * 3) vs the 1x downside to $0.

What’s concerning is that in the world of options trading, a high IV combined with an upward movement in Ethereum price does not mean the contract premium goes up.

This is because options that are ‘out of the money’ have $0 of intrinsic value. The value of the contract is a byproduct of its volatility and time value. Consider a call option with Ethereum priced at $1,750:

With a strike price of $1,000 the contract’s intrinsic value is $750 (price of the eth - price of the contract)

With a strike price of $2,000 the contract’s intrinsic value is $0 - it is “out of the money” - no one is going to buy an eth contract for $2,000 when it’s available on the market for $1,750

In bullet point number 2, the value of the option contract is a byproduct of its “extrinsic value” defined as time value and intrinsic volatility.

As time progresses linearly with respect to the contract expiration date (9/30/22) its value goes down, this is called time decay.

When implied volatility goes down, this is called IV crush, and the catalyst for option contract value going down even when the value of the underlying goes up.

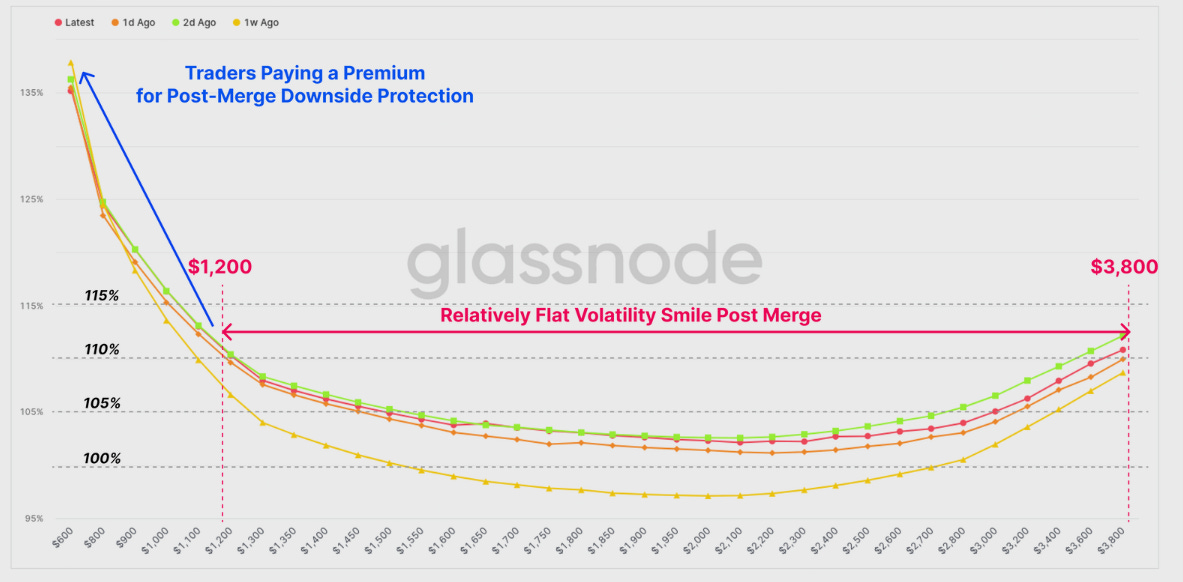

Can you guess what happens the month after the merge? Implied volatility on 10/30/22 contracts is crushed at ranges above $1,200. The 200% to 400% IV premium traders were paying on 9/30/22 contracts deep out of the money is non-existent.

This means the whales are placing their bets that Ethereum will be < $1,200 in October 2022 as measured by their IV or willingness to pay a premium for ‘downward protection. We can conclude:

Alot of people are trading Ethereum derivatives with short-term expiration dates or perpetual contracts with leveraged positions

Whales are bullish on Ethereum at price points from $1,700 to $5,200 for the month of September

Whales are bearish on Ethereum at price points above $1,200 in the month of October

Everything else is just noise.

The narrative: noise. The countdown: noise. Twitter and reddit: noise. Institutional investors and sovereign wealth funds are the crypto market and they are saying: Ethereum will reach $1,200 in by end year 2022. My positions?

40% - permabull long on bitcoin

40% - permabull long on ethereum

20% - riding with the whales

Staking on GMX

PUTS on COINBASE 10/30/22 expiration

premiums and IV are too high on crypto exchanges to justify the trade but COINBASE runs in parallel to eth and btc - with a much cheaper premium.

What do you think, and why?

John Cook

September 13th, 2022

San Francisco, CA

www.frontruncrypto.com

tweet of the week - “mfers that held through the dip”