What caused crypto prices to go up in January?

Is crypto's latest bull run a byproduct of strong fundamentals and new user adoption, the invisible hand of the Federal Reserve, or just another dead cat bounce?

Dear frontrunners,

Today we explore the 2023 price action within the crypto ecosystem against the backdrop of the uber-bullish narrative I’ve seen floating across crypto Twitter, Reddit, and various talking heads on substack.

“On-chain cyclical indicators are currently pointing to a classic bottom” - Bitcoin Magazine Pro 1/27/23

“This rally is different”- Bankless 1/23/23

“The digital asset market has seen a remarkable rebound”- Coinmetrics #191

Digital asset prices have been on a rip year-to-date 2023, and chances are you've read an article or tweet that lamented, “this time it’s different” or “we are on the cusp of generational wealth”, or “we will never see ETH below $1,000 in our lifetime”. Why not celebrate? All signs are pointing to green. Coin Metric’s Bletchley Indexes (CMBI) tracks digital asset prices across a suite of “crypto sectors”….

…and through January 2023, the median aggregate return is >40%. This means for every dollar invested in crypto, it would be worth $1.40 on 2/1/23, higher if you invested in metaverse tokens.

The talking heads on Bloomberg crypto and social media generally point to the following four themes when explaining upward price action:

Softening “macroeconomic headwinds”

This is a fancy way of saying the market believes the US Federal Reserve is “comfortable accepting that inflation has eased” and the worse is behind us. Inflation will flatline, the federal funds rate will increase at a slower & predictable rate, and the economic engine of the United States will normalize at a “steady state” rate of inflation somewhere between two and three percent.

Economists quantify this position by comparing the federal funding rates against short-term treasury yields in what is called a “crossover point” and then extrapolate future growth based on historical performance.

The image below contains two charts:

Chart 1 shows the benchmark of a US 2-year treasury yield compared to the upper bound of the federal funding rate. Note the high correlation (and partial explanation of why fixed-income bonds offer greater than four percent risk-free yield) .

Chart 2 (bottom panel) shows the spread between the 2-year treasury yield and the fed fund rates.

Economists theorize that when the 2-year treasury yield crosses below the upper bound of the federal fund rate, what follows is a period of equity growth. As of 1/31/23 2-year treasury yields have dropped ~ 50 basis points to 4.1949, which is below the federal funds upper bound rate target of 4.50.

(A) US 2 year treasury yield = 4.1949

(B) Upper bound federal funds target rate = 4.50

Market bulls projecting growth point to a corresponding backtest of the forward price action of the S&P500 from 1970 through now by analyzing returns of the S&P500 following the treasury yield & federal funds rate “crossover point”. The result? A median gain of 22.43% into 2024. Time to celebrate?

The S&P 500 historically struggled after the first month following a crossover. However, returns materially progressed as the index posted 12-month respective average and median gains of 15.37% and 22.43%. The index also finished higher 80% of the time during this period.

Historically, crossovers have also been a good sign for equity markets based on above-average returns following each signal for the S&P 500. - LPL Research

Does the market’s assessment of “softening macroeconomic headwinds” explain the boom in crypto prices, or is this another random walk led by economists attempting to explain the most recent round of irrational exuberance?

Deleverage within the DeFi ecosystem

A popular narrative within DeFi is that leverage drives price action, specifically related to liquidations or a “squeeze”. It is as follows:

Bull (long liquidation):

Traders bet the price of” ___insert your favorite token here____” will go up by buying a leveraged long futures contract (GMX, KuKoin, Binance, pick your poison)

The price goes down and the bull’s position is liquidated by a market sell

The market sell causes downward pressure, which triggers a new wave of liquidations, and the cycle repeats

Bear (short liquidation):

Traders bet the price of “___insert your least favorite token here___” will go down by buying a leveraged short futures contract

The price goes up and the bear’s position is liquidated by a market buy (buying back the tokens they borrowed but now at a higher price)

The market buy causes upward pressure, which triggers a new wave of liquidations, and the cycle repeats

You can see this price action play out with the Optimism token in the first week of February 2023…

..but when we span across the entire DeFi ecosystem by looking at Ethereum’s “open interest” (OI), which we define as the aggregate dollar value of all outstanding ETH futures contracts….

….the “this time it’s different camp” calls out the ~50% decline in aggregate OI from $13B to $6B as a bottom signal by contrasting it against the amount of investor capital deployed to stablecoins. Investors have been liquidated, forced out of the market, or made insolvent, and the ones that remain are sidelined into stablecoins “waiting for the right moment to re-enter”…

…but is the reduction in open interest combined with “dry powder" sitting on the sideline really a bottom signal, or another attempt to justify crypto investor sentiment?

Reduced volatility

Crypto-technical analysts also point to volatility and cost basis as indicators of a potential bottom. How? Implied volatility (IV) is at a 2-year low. We see BTC at-the-money IV at ~30% vs its May 2021 high of ~150%….

… and Ethereum’s ATM IV at ~62% vs its May 2021 high of ~220%.

But what does this actually mean? How is an IV of 62% “better” than an IV of 220%? Technical analysts like to use IV to measure stability and potential bottoms because it represents the “potential price range of an asset”. More specifically,

IV is expressed as a % of the crypto price

It is the predicted one standard deviation move over a 365-day period

If you don’t remember anything from your statistics class, this means:

Ethereum’s price should end up within one standard deviation of its current spot price 68% of the time in the upcoming 12 months

Ethereum’s price should end up within two standard deviations of its current spot price 95% of the time in the upcoming 12 months

Ethereum’s price should end up within three standard deviations of its current spot price 99% of the time in the upcoming 12 months

Using ETH’s current spot price of $1,500 and IV of ~60% and focusing on one standard deviation of movement, the consensus in the “marketplace” is that there is a 68% chance that at the end of one year ETH the asset will be priced somewhere between $930 and $2,430.

By extension, this also means there is only a 32% chance that ETH will be outside of this range. There is a 16% probability that ETH will be above $2,430 12 months from now, and a 16% probability that ETH will be below $930 12 months from now.

Technical analysts point to knowing the probability of an underlying asset within a certain range as an important indicator when determining what options to buy or sell.

When the IV on ETH was 220% on 5/21, its spot price was $4,100. This implies that the market believes with 68% confidence that ETH will trade between an upper bound of $13,120 and a lower bound of -$4,920. Not so useful right? At best we can extrapolate at times of peak volatility, marketplace consensus is uncertain.

A lower cost-basis and golden crossovers

Technical “chartists” (people who look at charts to predict the price movement of a digital asset) use asset volatility (i.e. low volatility = greater predictability of the asset’s future price range) in addition to a series of “cross-over” and “oscillator” metrics to predict the bottom in a Nostradamus like manner as follows:

The Mayer Multiple

Take the 200-day moving average of Ethereum (or Bitcoin, or whatever your token of the month is) and divide it by the current spot price;

if (< .08, buy signal, if > 2.4, sell signal)

The golden crossover

Take the 50-day moving average (DMA), 100DMA, and 200DMA

if 50DMA > 100DMA then buy

if 100DMA > 200DMA then buy

Point 2 can be extended by comparing the spot price against the 50/100/200DMA in a similar method:

if spot > 50DMA then buy

if spot > 100DMA then buy

if spot > 200DMA then hella buy

Extracted from Bitcoin Magazine’s PRO Market Dashboard

The realized price index

Take the average purchase value of all Ethereum (or Bitcoin, etc) in a specified time window, divide it by the number of ETH tokens in circulation

This produces an “average cost basis”

If the “average cost basis” is < the ETH or BTC spot price = bullish

People spend a lot of money to access market data aggregators under the pretense of “on-chain data alpha”, but the punch line is below, all signs point to a bull season.

For the visually inclined, Glassnode and Bitcoin Magazine have a robust chart catalog of these metrics which reaffirm the “crossover”:

You can re-create these metrics using your token of choice by clicking these links.

The buy signal.

We could go on and on with signals, but you get the idea: Token Terminal tracks 17 unique financial metrics, Glassnode has an on-chain metric catalog spanning over 200 KPIs and Coin Metrics does the same with over 3,000 crypto assets. There is enough “on-chain data analysis” to reaffirm the narrative de-jure of whatever asset or social media influencer you follow.

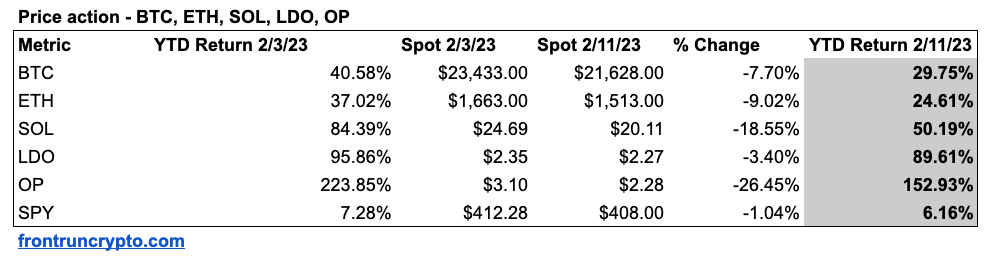

All of the “technical indicator” signals for BTC (and as an extension ETH), as of 1/31/23, pointed to a “buy now” bull theme. In fact, if you overlay the 2023 YTD performance of BTC, ETH, SOL, LDO, OP and the S&P500, you will indeed see price action that reaffirms this bull thesis: up and to the right.

So what does a retail trader do? They ape in. “Now is the time”, “crypto assets will never be this cheap in our lifetime”, “I missed the last bull run, I won’t miss this one”.

Was this you last week, is this you now? c’est la vie. Just 11 days after Bloomberg crypto and the talking heads on social media proclaimed this time its different, the market reminds us that, no this time it’s not different…

The same crypto assets up 10% to 40% YTD as of 1/31/23 are now down 5% to 25% in one week.

Retail traders who listened to the herd, bought into the technical analysis, oscillators, moving averages, volatility narrative, and “the fed soft landing”, aped into the latest bull run at exactly the wrong time, again. When the crowd is the loudest, that is the moment when we should all exercise the most caution.

Are technical indicators useless?

The challenge with the aforementioned technical indicators is they’re all retrospective, a quantification of past performance in an attempt to predict future outcomes:

The 50DMA crossing over the 200DMA on 1/30/23 doesn’t help us on 1/2/23.

Implied volatility forecasting a 12-month price range between $940 and $2400 with 68% confidence doesn’t make me confident in either direction.

A 50% reduction in future open interest sounds nice, but what about the remaining $6 billion?

27% of total capital deployed to stablecoins is notable, but historically it runs the inverse of ETH price action; when ETH price is high, stablecoin holdings are low.

Even if market indicators point in the correct direction (up), what’s not quantified in this exercise is the depth and duration:

Depth - How high (or low) will the target asset appreciate?

Duration - How long will the appreciation last before the asset reverts to its mean?

This is what makes apeing into a trade such a challenge. Even if you believe the indicators to be true, the depth and duration is unknown until a lagging indicator quantifies otherwise, and by that time it’s too late because the price action (downward movement) has already materialized.

All of this leads me to the punchline of this analysis and answer to the question “What’s causing crypto prices to go up?”

Crypto prices are going up because of its high correlation with US equities

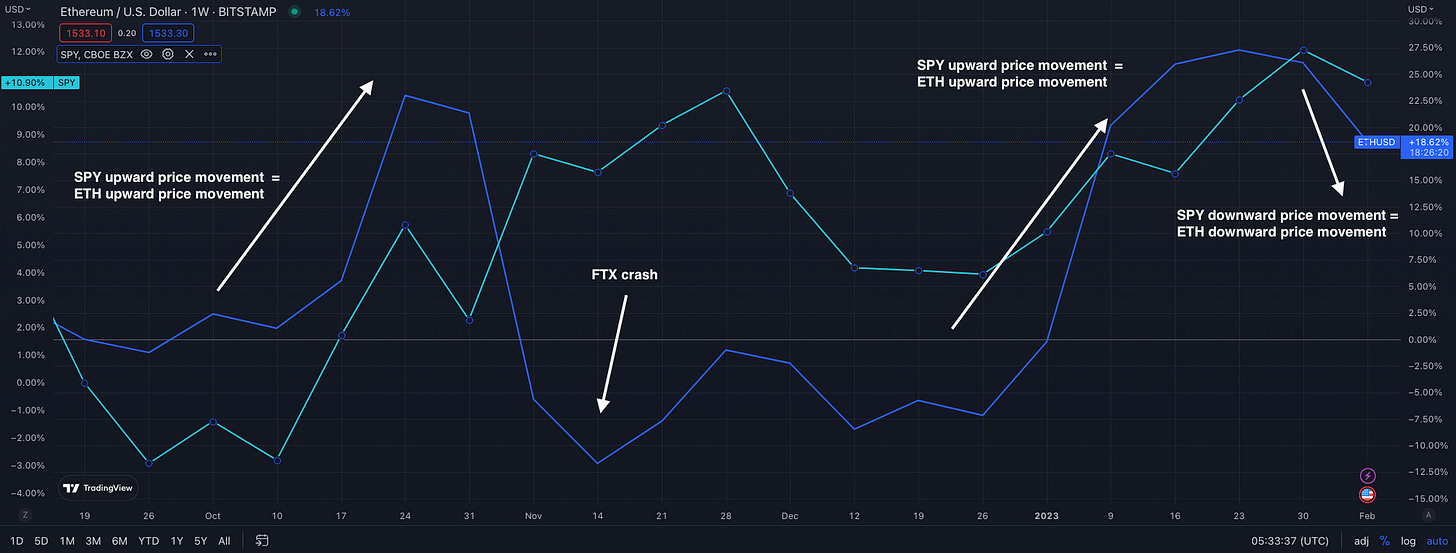

I am a crypto enthusiast. I operate a bitcoin mining rig and an Ethereum node. I believe that Ethereum will eventually become the global settlement layer of the next generation of financial systems. I believe in bitcoin’s potential to act as an eventual store of value and peer-to-peer payments system but I also acknowledge that, for now, Bitcoin is currently highly correlated to the performance of the S&P500 and broader US equities market. For clarity, I am not stating that rising equity prices are causing crypto assets like bitcoin to rise. It is being stated that crypto assets behave like high-beta tech stocks: high volatility with a high correlation to the market.

The crypto narrative of Bitcoin as a hedge against fiat currency debasement has largely been proven wrong. Bitcoin is “highly positively correlated” to the price movement of the S&P500 and Nasdaq 100. In the most recent 12 months, the only decoupling occurred in November 2022 when bitcoin performed worse than the broader US equities market due to the FTX collapse.

I also acknowledge that Ethereum is highly positively correlated to the performance of Bitcoin, and barring any major protocol change, you should acknowledge the same.

A positive correlation means that the price of two assets moves together.

A negative correlation means the two assets move inversely of each other.

Uncorrelated pairs mean the price action moves independently of each other.

The aforementioned chart ranges from -1 to +1 across the asset pairs. +1 indicates a perfect positive correlation, -1 indicates a perfect negative correlation and 0 indicates no correlation.

The data is saying that the market performance of ETH, SOL, LDO, and OP has a strong positive correlation to the market performance of BTC. Moreover, note the narrow range of the ETH-BTC confidence interval; the correlation matrix states a 95% probability that ETH price action is highly correlated to BTC.

Infact…I will take it a step further and state that, so far, Ethereum’s PoS migration has had zero impact on the price action of ETH the asset. All of the talks around net issuance reduction, elimination of buy/sell pressure, credible neutrality, perma-yield with staking derivatives, and corresponding predictions of ETH to $8,000 or $10,000 by EOY 2022, were all wrong. I took the contrarian point of view and forecasted Ethereum the asset to $1,200 by EOY 2022, and unfortunately, I was correct.

Why? Because as of this writing, ETH price action is highly correlated to the price action of BTC and the broader US equities market.

So what do we do? Do we just say to hell with it and buy SPY or QQQ? Absolutely not.

The aforementioned correlation quantifies the relationship in price movement between SPY and the target crypto asset. It does not measure the depth or nominal movement of the asset itself.

In plain English, if the price of SPY increase by Y%, the price of BTC, ETH, SOL, etc will increase by Y%*[an unknown X]. In the aforementioned table we saw a 7% increase in SPY spot price YTD through 2/3/23, but:

A 40.58% increase in BTC

A 37.02% increase in ETH

A 84.39% increase in SOL

A 223.85% increase in OP

We can conclude that when US equities prices go up by Y%, highly positively correlated crypto assets will increase proportionally by Y%*[unknown X]. This is the alpha. Until we reach a nirvana where crypto price action is completely decoupled from the broader US equities markets, here are three ideas on how to leverage this knowledge into a happier and wealthier future:

Idea 1 - trade high-correlation asset pairs.

If you want exposure to crypto as an asset class and are less concerned about which “layer 1 will emerge as the winner” or if the future of DeFi is a “multi-chain world”, the path of least resistance is to buy base-layer crypto assets that have the highest positive correlation with BTC and the lowest fully diluted market cap. Buy and HODL BTC isn’t a bad idea, either especially if Cathie Wood is right in her prediction that BTC will be $1.5 million by 2030. In the interim, L1s like ETH, SOL, NEAR are correlated to BTC price action and serve as an opportunity to participate in long-term upward movement.

Note this trade isn’t risk-free as it doesn’t account for black swan events which may trigger a decoupling from US equities. For example, if the 2022 Solana outages persist into 2023 and beyond, we can assume that will have a negative impact on the overall performance of SOL the token.

Idea 2 - trade emerging interest.

There’s an emerging field of interest around:

Liquid staking derivatives (especially after the SEC’s latest regulatory attack on Kraken via its staked eth derivatives)

e.g: Lido, Rocketpool, Stakewise

Real-world assets

Think of lending your BAYC as collateral to finance a single-family rental in Mobile, Alabama

Borrowing $50 million from a Maker lending vault to finance the construction of an O-Reilly Auto Parts

e.g: Clearpool, Centrifuge, Maple Finance, Homecoin, RealT, GoldFinch

Layer-2 ecosystems

Ethereum will only scale with the adoption of layer 2s (L2s). 1 gwei gas prices on L1 are a thing of the past and all new Ethereum entrants have been pushed to L2

e.g: Arbitrum, Optimism, Polygon, Loopring, zkSync

Undercollateralized lending

New platforms like sentiment are deploying to L2s which give users access to a “more efficient” use of capital by letting

degensindividuals enter into loan agreements where the LTV is > 100%Sentiment, Notional, Gearbox

There are many more and you can use a free platform like Token Terminal to quantify potential growth related to trading volume, daily active users, and developers. Review the amount of revenue the protocol generates vs its retained earnings. Take outsized bets on the individual tokens you believe to have the largest upside potential based on the emerging narrative’s total addressable market. If the token is new, you will have no historical data to measure its correlation against the broader equities market. If this makes you uneasy, it may be safer to buy and hold ETH/BTC or even SOL.

Note: I will publish a separate analysis on how I blend tradfi fundamentals with crypto-native concepts to help me pick the winners and losers. In the interim, I recommend avoiding YOLOing into any crypto asset based on its popularity on reddit or twitter.

Remember the $BONK coin from January 2023? Pitched on reddit and twitter as the “the meme coin with a mission”, it was created to support the Solana blockchain and act as a sign of solidarity within the ecosystem given the exodus of funds via the FTX bankruptcy. It’s down 63% in just the past four weeks.

Idea 3 - reject crypto narratives.

Finally, reject all narratives on crypto Twitter and Reddit. All attempts to explain broader crypto market movement on the backdrop of the “shorts are finally getting squeezed”, “leverage has been wiped out”, “Ethereum is net deflationary which means eth will be $10,000 next year”, “PoS has eliminated all sell pressure”, etc are all just that: narratives attempting to explain the current price action in the market. I encourage you to read the book Irrational Exuberance by Robert Shiller for more details.

It analyzes investor psychology and how humans attempt to rationalize bubbles, peaks, valleys, long-term asset price mismatch, and extreme price movement on the backdrop of herd behavior explained by compelling stories to justify existing price levels. Robert introduces a concept called “moral anchors”: beliefs that focus on the vividness, plausibility, and consistency of qualitative factors, rather than on quantities or probabilities. Take a moment and review your Twitter feed, is it a manifestation of moral anchors tied to a specific belief of your favorite crypto asset?

Closing thoughts

If you accept my theory that BTC/ETH price action is highly positively correlated to the US equities market, you may be asking, “What’s causing the price of US equities to go up?”. It’s certainly not a result of market growth and consumer spending; 82% of the S&P500 companies have issued negative earnings guidance for Q12023. In a nutshell, the invisible hand of the markets believes that J Powell is leading us to a soft landing conducive to a strong US domestic employment market with record low unemployment rates.

The markets think we’re not going to experience a recession. To quote Alfonso Peccatiello from the Macro Compass:

Powell didn’t push back enough, and so markets are now rallying hard in his face.

And given J-Pow’s lack of real pushback, markets won’t stop unless data comes in very hot (or recessionary). - Macro Alf

To be fair, Alfonso is forecasting a shallow recession in Q22023, but Goldman Sachs takes the contrarian point and predicts the likelihood of a recession to be less than 25%. LPL Research takes the middle ground, stating…

“…a recession will happen in 2023 but it will be shorter than the post-war average because consumers are on better footing with access to a hot labor market and large amounts of cash” - LPL Research

…and concludes with a bullish statement predicting 64 months of expansionary activity (read: equity prices go up) once the recession ends.

I’ve written quite a bit on recessions and financial institutions’ inability to predict the future with any meaningful amount of confidence (see bottom of post for links) and my prediction through 2023 is a flat year with the S&P500 ending at or near 4,000 (it’s currently 4,095). If you want to “predict” the performance of your favorite crypto token, start by checking its correlation to the broader US equities market, chances are: it behaves like a high-beta tech stock.

To knowledge and wisdom,

John Cook

February 11th, 2023

San Francisco, CA

www.frontruncrypto.com

✍️ Related content:

Article cover generated by DALL-E: “An expressive oil painting of a social media influencer using charts and data to convince his followers to buy the next ponzi coin.”