What you missed at EDCON San Francisco

A vision of ethereum's future post-merge, how to learn ethereum & vitalik in a dinosaur costume

Dear frontrunners,

This past weekend EDCON (Community Ethereum Development Conference) hosted their “Ethereum: A new era” conference at the Chase Center in San Francisco. Merge fever was definitely in the air but the conference served as an opportunity to explore scalability, security, and ecosystem collaboration as Ethereum prepares for 2023 and beyond.

We’re going to get creative at Frontrun and start our analysis with an intro video summarizing the article, starting now! Watch the video, read the article, what do you think?

It was a surreal moment to be in the stadium home to the Golden State Warriors - only to be surrounded by marketing material related to crypto, web3, and “the merge”. Maybe we have arrived?

How to learn Ethereum:

One area I’ve been thinking deeply about is Ethereum (and web3 in general) as a catalyst for mass crypto adoption. More specifically; what needs to be true for emerging technology like web3 to hit critical mass across normies who see technology as a means to an end. How can we appeal to those who don’t get excited about blockchain for the sake of blockchain? My theory is that mass adoption is predicated on ease of use and killer apps. I’m open to making the case that the ‘killer app’ of Ethereum and web3 is the automated market makers powering decentralized exchanges. If we extend this thesis to include borrow lending platforms like aave we see ~$30B of the $75B TVL in eth are all defi platforms that “use money to do things; save, borrow, lend, trade, buy”. These are money verbs, and this makes the killer app of web3 defi.

What’s problematic is that ether’s ease of use is really on a spectrum from non-existent to piecemeal training. For new participants entering the web3 ecosystem, learning is hard. Starting is hard.

Enter UETH aka “De University of Ethereum”. UETH, in addition to being the sponsor for EDCON San Francisco, is also an online learning platform that facilitates hands-on learning of the Ethereum ecosystem through “Proof-of Motivation” and “Skill Validation”.

Maybe traditional education can take a queue from technology, but the thesis is that as you progress through UETH’s curriculum you’ll have the opportunity to earn back any tuition costs as a byproduct of completing the curriculum. What a novel idea? Instead of shelling out $50k for an undergrad degree, the emphasis is on motivation from within rewarded with financial incentives for completion.

The progression through the UETH curriculum is a unique take on self-paced learning which enforces active participation with artificial intelligence. The AI requires you to respond to a series of open-ended questions testing your competency on the topic at hand, e.g. nodes. Although I am convinced that AI and ML are eating the world, a mechanism to reinforce knowledge through open-ended questions is a welcome alternative to just watching crypto youtube videos all day.

I actually went through some of the UETH curricula for funsies, and here’s how the onboarding test for blockchain node competency plays out. You progress through an individual topic; e.g. “what is a node” consisting of 1 to 3 pages + 3 multiple choice questions…

…at the conclusion of each topic, you’re presented with an open-ended question you have to answer, at which point the UETH “AI” parses your response for correctness.

UETH’s thesis is that this AI-enabled learning plus proof-of-motivation will serve as the foundation for greater crypto adoption, at which point UETH’s library will serve as your system of record for progress and validation to show to potential employers. I’ve personally started a notion-based encyclopedia of content which i’ve shared with friends who want to learn more about web3 but UETH seems like a promising platform for those looking to go ‘0 to 100’ in a sustained, organized structure.

If I were new to the web3 ecosystem UETH would be in my bag as part of a larger set of activities:

On-ramp $1,000 of fiat to an exchange (coinbase, ftx, whatever)

Convert the $1,000 to ETH

Pick an l2 (arbitrium, optimism, polygon)

Start exploring!

Benefits of the merge: energy and decentralization

Deploying beacon chain to mainnet aka the merge, was certainly framed as a +1 within the ESG umbrella. A dramatic reduction in energy consumption and a step toward a green future. I’m still conflicted on the implications for this as I do see the benefit of block verifications constrained by the physical and real world.

Moreover, I’m uncertain how economic security is enforced in a proof of stake world when a ‘51% attack’ would require 51% of staked eth. I draw parallels to acquiring ‘51% of the hash power’ in a PoW ecosystem and I’m led to believe that in PoS, control is really a byproduct of financial strength compared to PoW where control is a byproduct of physical hardware. Obtaining 51% of staked eth might be easier since its economic value is ~$15 billion. How would one obtain 51% of the requisite hash power needed to control bitcoin? The most common answer I hear is that a small group of mining pools control an outsized proportion of total hash power e.g. top 5 miners account for > 50% of the aggregate hash rate.

but the same parallels could be made with staked Ethereum, in aggregate 1 liquidity staking derivative provider - Lido, controls 80% (~4 million eth tokens) of the aggregate 5 million eth locked via pools.

Moreover, we have to call out the elephant in the room; Lido’s utility token is pre-mined, with 75% opaquely allocated to ‘founders and project’….

….and the distribution of LDO token holders is asymmetrical in that ~95% of LDO tokens are held in 1% of aggregate wallets.

This becomes a reinforcing prophecy of self-preservation when mechanisms put in place to limit a single LSD from controlling an-outsized portion of staking power were summarily rejected by its very own token holders. I mean why the hell not? Why do you want to limit your footprint in a growing financial ecosystem?

My conclusion on PoW vs PoS when viewed through the lens of the decentralization of power is a nuanced take where there is no clear winner or loser. BTC and ETH can and should co-exist together. It’s entirely possible to acknowledge the environmental benefits of reduced power consumption while raising potential risks of centralization with respect to LSDs like Lido who control an outsized proportion of staking power.

Benefits of the merge: economic security

A point of interest was the framing of Ethereum as a mechanism to enforce something called ‘cryptoeconomic security’ ; an idea that economic incentives can be programmatically added to the base layer to guide user behavior.

For the miner turned staker, Ethereum validators are now disincentivized to sell eth as the catalyst to cover operational overheard since hardware costs are eliminated and electricity costs approach zero. Slashing is promoted as an economic incentive to ‘encourage validators to behave’. Tactically this means stakers deploy 32 eth to validate blocks, and if the staker ‘misbehaves’ e.g. attempts to modify a block, signs two blocks concurrently, refuses to sign a transaction; their staked Ethereum can be ‘slashed’ or removed from the blockchain as a penalty.

This was on the backdrop of a broader theme related to censorship resistance; given the uncertainty around the tornado cash sanctions, exchanges blocking wallet addresses, and base layer address blocking; it was an appropriate topic to cover.

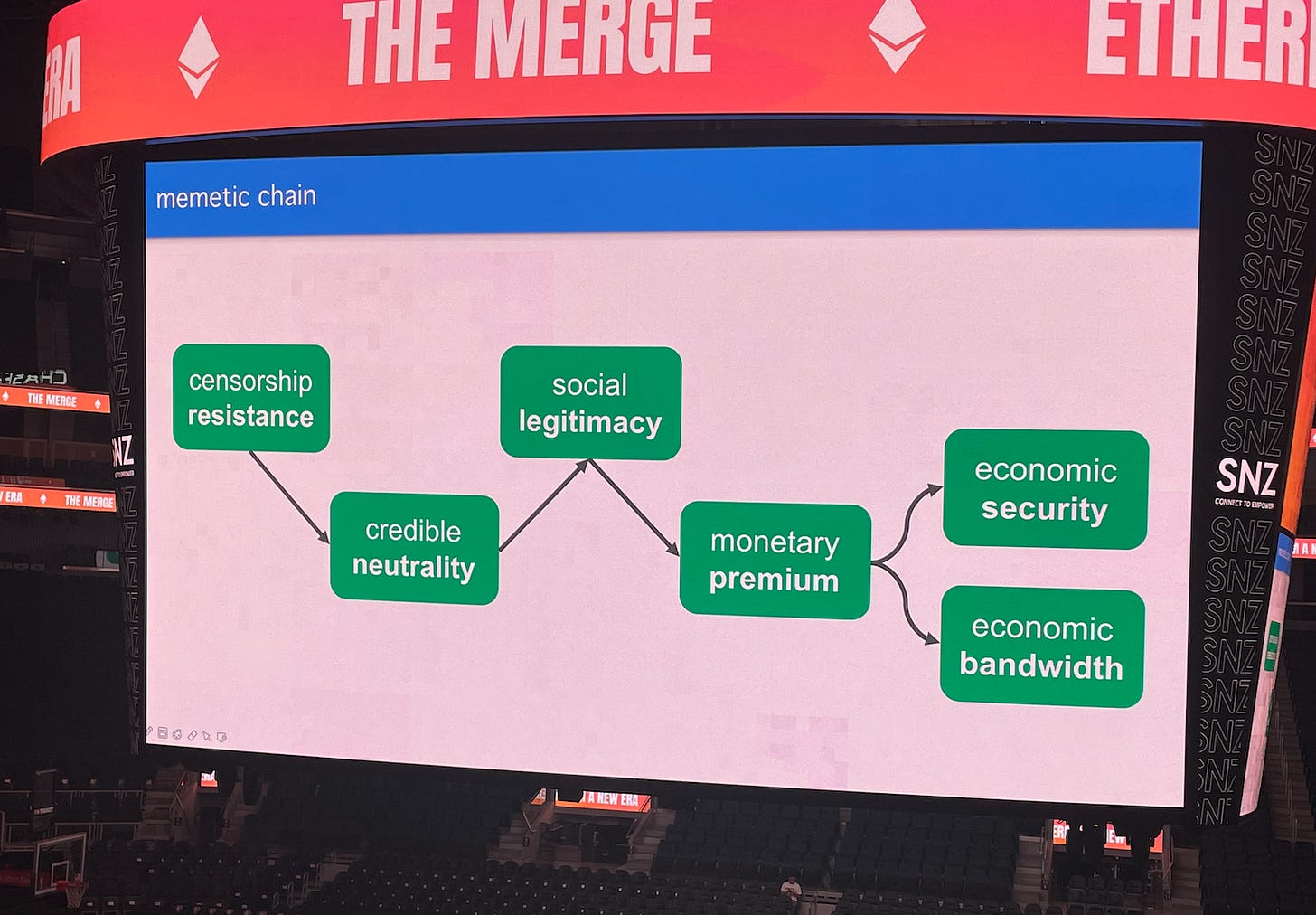

The framing is as follows; blockchains succeed or die by the monetary premium they can command (e.g. the defi killer app thesis). Monetary premium is the appreciation of eth the asset because it is the desired settlement layer of all financial transactions. The desirability of being the settlement layer of choice is a byproduct of economic security: incentivizing user behavior ‘to do good things on the blockchain’. With monetary premium, economic bandwidth goes up, which is a fancy way of saying people can do more ‘money-things’ on Ethereum; buy, spend, invest, trade, lend, borrow, etc at a higher velocity with reduced fees.

This entire thesis of monetary premium starts with censorship resistance, a noble idea that the system of rules which govern the web3 financial systems cannot be censored as a result of human intervention and evolving economic or political policies…because monetary policy is engineered in the code. The jury is still out on this, as we have to see how Ethereum responds to the tornado cash sanction, but assuming this plays out; Ethereum can establish itself as a neutral and credible party that is, again, not subject to censorship at the whims of an individual or political party.

My take is that censorship resistance lives and dies at the base layer, the code; if we begin to ban protocols or transactions by specific parties at this layer, censorship has won. Thus, if we can establish credible neutrality by not bending to the invisible hand of the government, social legitimacy is created which serves as the catalyst for the monetary premium and downstream benefits we mentioned earlier.

How to fight back against tyranny?

The Ethereum team presented an interesting mental model on censorship resistance across 4 pillars related to duration, cause, problem, and solution, and this is where we need to peel back the onion.

Consider a ‘weak censorship scenario’ - again this is all about validating blocks. I think the most common example we’ve heard is related to toxic maximal extractable value (MEV). This involves blocks being re-ordered in a specific way to maximize fees collected on a transaction; think you paying more gas. It’s not clear to me that this is a “bad problem”, could it not be the result of an efficient market prioritizing transactions with the highest gas first? A counterargument I hear is when individuals provide a gas-fee range, some arbitrage operators and front runners manipulate the block order to ensure you the end user pays the highest possible fee (MEV). An interesting project mentioned was flashbots which is attempting to create a marketplace for MEV transactions. You can deep dive it here.

A broader question to raise is the implications of ‘strong censorship’. Starting with our previous example where 51% of staking power is obtained by a group of bad-faith actors, the most optimal solution presented is a hardfork. I’m really conflicted on this given Ehtereum’s history of hard forks juxtaposed with its vision of ‘ultrasound money’ (deflationary monetary policy):

02/28/2019: Constantinople update, “The average block times are increasing due to the difficulty bomb (also known as the “ice age”) slowly accelerating. This EIP proposes to delay the difficulty bomb for approximately 12 months and to reduce the block rewards with the Constantinople fork, the second part of the Metropolis fork.”

1/2/2020: Muir Glacier update, “The average block times are increasing due to the difficulty bomb (also known as the “ice age”) and slowly accelerating. This EIP proposes to delay the difficulty bomb for another 4,000,000 blocks (~611 days)”

8/5/2021: EIP-1559 - London hard fork, “A transaction pricing mechanism that includes fixed-per-block network fee that is burned and dynamically expands/contracts block sizes to deal with transient congestion.”

12/8/21: Arrow Glacier Update, “The Arrow Glacier network upgrade, similarly to Muir Glacier, changes the parameters of the Ice Age/Difficulty Bomb, pushing it back several months. This has also been done in the Byzantium, Constantinople and London network upgrades. No other changes are introduced as part of Arrow Glacier.”

6/29/2022: Gray Glacier Update, “The Gray Glacier network upgrade changes the parameters of the Ice Age/Difficulty Bomb, pushing it back by 700,000 blocks, or roughly 100 days. This has also been done in the Byzantium, Constantinople, Muir Glacier, London and Arrow Glacier network upgrades. No other changes are introduced as part of Gray Glacier.”

Granted I’m not an engineer and my interests are better aligned to the economic impact of a digital currency; it’s unclear to me how the finality of the blockchain can be circumvented by code forks determined by a committee of engineers.

Also, thinking more practically; what happens to the DeFi layer in a hard fork? A group of minority (as defined by < 50%) engineers decide to fork Ethereum, maybe creating ETH3 or ETH4.

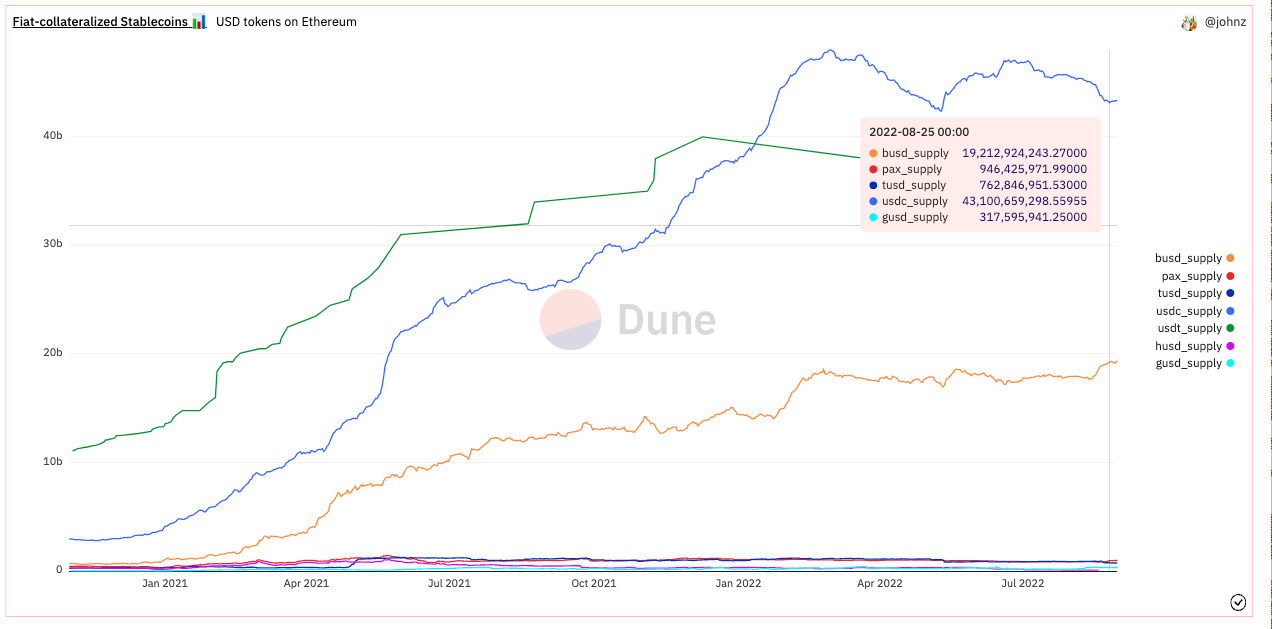

Looking at stablecoins alone; there’s ~$70B of fiat-collateralized stablecoins within the ETH defi market. What happens to the economic value of these tokens during a ‘strong censorship’ induced fork? At a minimum, wide-scale uncertainty and potential decline of total economic value. The coins become worthless.

Although the framing of the PoW → PoS upgrade is centered largely around environmental benefits, staker incentivized holding, and deflationary eth (ultrasound money); concluding that PoW = bad and PoS = good is an oversimplification of the security and economic risks of a blockchain that has the potential to be the future of money.

Life after the merge:

Merge aside, Vitalik’s thesis for “what’s next” revolved around scalability as a result of layer-2 optimization via data roll-ups (more data per block) and data compression, a reduction of data capacity as a result of encryption and compression algorithms.

We can agree that rolls ups are the desired scaling solution for Ethereum. Transaction fees on layer 1 are high enough that it discourages user adoption and potentially gives rise to alt-L1s. L2s like optimism and arbitrum frequently provide fees that are ~3-8x lower than the Ethereum base layer itself, and ZK rollups, which have better data compression and can avoid including signatures, have fees ~40-100x lower than the base layer.

Even so, these fees are too expensive for many users. Vitalik’s vision and solution to scaling rollups, is data sharding, which would add ~16 MB per block of dedicated data space to the chain that rollups could use. His vision, however, will be realized in phases: proto-danksharing followed by full danksharding.

Perhaps a phased approach might be advantageous but optimized execution is needed. When we frame Ethereum against established trad-fi payment processors like Visa which process > 65,000 transactions per second we can conclude that Vitalik and team are right, eth has a long way to go to achieve ‘ultra-sound’ money. The utopia of eth l1 being the payment processor for a global economy is still very far away.

Let’s with EIP-4844 ‘proto-danksharing’, named after its creators Protolambda and Dankrad Feist….

….is the implementation of a transaction format within the beacon chain to increase storage capacity to ~1MB, while danksharding increases block capacity up to 16MB. For those in boomer tech, think moving from relational databases to unstructured databases like mongoDB; SQL vs NoSQL.

Proto-danksharding (aka. EIP-4844) is a proposal to implement most of the logic and “scaffolding” (eg. transaction formats, verification rules) that make up a full Danksharding spec, but not yet actually implementing any sharding. In a proto-danksharding implementation, all validators and users still have to directly validate the availability of the full data. - from eip4844.com

Proto-danksharding instead creates a separate transaction type that can hold cheaper data in large fixed-size blobs, with a limit on how many blobs can be included per block. These blobs are not accessible from the EVM (only commitments to the blobs are), and the blobs are stored by the consensus layer (beacon chain) instead of the execution layer.

This leads to an ongoing discussion related to the storage capacity of each transaction for a node operator. Enter eip-4444:

Historical blocks and receipts currently occupy more than 400GB of disk space (and growing!). Therefore, to validate the chain, users must typically have a 1TB disk.

Historical data is not necessary for validating new blocks, so once a client has synced the tip of the chain, historical data is only retrieved when requested explicitly over the JSON-RPC or when a peer attempts to sync the chain. By pruning the history, this proposal reduces the disk requirements for users. Pruning history also allows clients to remove code that processes historical blocks. This means that execution clients don’t need to maintain code paths that deal with each upgrade’s compounding changes.

Finally, this change will result in less bandwidth usage on the network as clients adopt more lightweight sync strategies based on the PoS weak subjectivity assumption. - EIP-444 proposal

Proposal details related to 4844, 4444 and 4337 are available here, here, and here.

Vitalik in a dinosaur costume:

Last but not least, how appropriate that crypto O.G. vitalik buterin enters the conference in a dinosaur costume! MVP.

Stay weird Ethereum community, you’re perfect just the way you are!

John Cook

San Francisco, CA

August 30th, 2022

www.frontruncrypto.com

Improve your knowledge by reading these articles:

Ethereum: the merge, risk, and pitfalls of centralization

We can agree that the need for an ownership-based internet guided by first principles related to security, immutability, and decentralization are ideal north stars, but in the spirit of complete transparency, it’s at least a good exercise to ‘hear the other side’ (bitcoin) and their take on the limitations of Ethereum as a financial platform.

In this report, we will provide details on how the proof-of-stake mechanism works for Ethereum, using technical definitions provided from Ethereum documents. Second, we will evaluate the move to proof-of-stake from first principles, which will include an explanation as to why much of the reasoning for the move is possibly flawed. Last, we will cover the risk factors of the Ethereum PoS mechanism comparing and contrasting the governance to Bitcoin and a PoW consensus mechanism to articulate the fundamental differences between the systems.

In defense of bitcoin maximalism

An article written by Vitalik Buterin on April 1st, 2022 outlines, almost ironically, the case for bitcoin maximalism and how the crypto circle is a zero-sum game. Vitalik makes the case that intolerance, maxi mindsets, and digital freedom without the rule of an invisible hand are causes worth fighting. If this wasn’t written on April 1st, I’d consider it a legit piece of analysis, maybe it is?

What if Bitcoin is far more than an outdated pet rock tied to a network effect? What if Bitcoin maximalists actually deeply understand that they are operating in a very hostile and uncertain world where there are things that need to be fought for, and their actions, personalities and opinions on protocol design deeply reflect that fact? What if we live in a world of honest cryptocurrencies (of which there are very few) and grifter cryptocurrencies (of which there are very many), and a healthy dose of intolerance is in fact necessary to prevent the former from sliding into the latter? That is the argument that this post will make

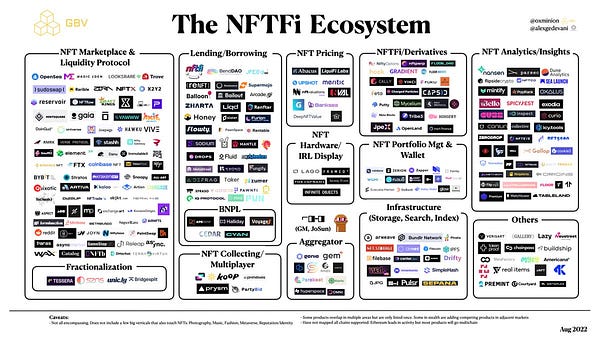

Gone are the days of just buying and selling NFTs. That’s so summer 2021. Watching the evolution of the NFT finance ecosystem has been mindblowing. From peer-to-peer lenders like NFTfi, to peer-to-pool lenders like BendDAO, to NFT trading derivative platforms like Hook (this is wild, think calls/puts), the finalization of profile pictures has arrived.

Loading NFTFi Summer, Soon. Based on @alexgedevani honest work. I've created a map for the NFTFi ecosystem. With 300+ projects on the list across different L1s/L2s and NFT verticals. I'm boooolish the future NFTFi sector. There are a LOT more projects that I haven't covered

Meme of the week - “One day son, this will be all yours”