Was Grayscale's bitcoin premium a leveraged ponzi?

Part 1 - We explore how Grayscale's BTC premium was a byproduct of centralized exchanges and hedge funds pumping demand using leveraged depositor funds

Dear frontrunners,

Previously we concluded the most recent episode of wealth destruction across the crypto ecosystem was a result of the co-mingling of depositor funds enabled by a ponzi coin with supply and demand artificially engineered by a centralized party: FTX. Both acts were crystalized as an attempt to backstop FTX’s partner hedge fund Alameda Research from insolvency vis-a-vis the summer 2022 crypto collapse. For those playing catch-up: check out these links.

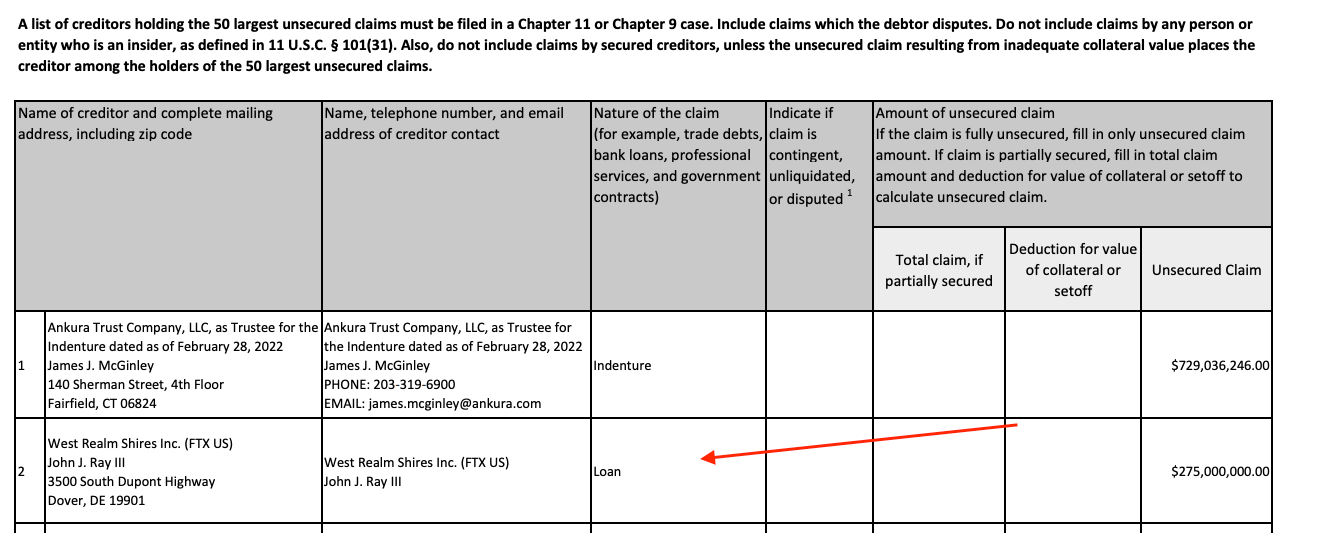

Unfortunately over the past week, we have witnessed the continued capitulation of centralized exchanges and hedge funds, most notably’s BlockFi's $1 billion bankruptcy due to the FTX/Alameda death spiral.

FTX and Alameda functioned both as a borrower, exchange desk, and creditor to BlockFi:

BlockFi used FTX’s platform to trade and had $355 million in crypto locked up due to FTX's bankruptcy

BlockFi loaned $680 million to FTX’s affiliated hedge fund Alameda Research as part of BlockFi's broader lending business before the crypto crash in May

FTX also provided BlockFi with a $275 million line of credit to avoid bankruptcy via the same crypto crash

BlockFi voluntary petition for bankruptcy. Source - Form 201.

This contagion is in addition to the following events which transpired over the past 7 days:

DCG’s emergency $500 million bailout to its subsidiaries (Genesis) as a result of exposure to FTX

Gemini suspending the withdrawal of depositor funds via exposure to FTX from its Genesis partnership

What were these funds doing with all this money?

Based on the best available information at the time of this writing, it is my conclusion is that BlockFi, Alameda, FTX, Grayscale, Genesis, DCG, Gemini, and 3AC all operated in a close loop group of eight crypto firms colluding to synthetically pump Grayscale’s bitcoin premium using leveraged positions funded by retail depositors.

In this 3 part analysis, we will:

Review the mechanics of the GBTC/BTC trade and its participants ← Part 1 (you are here)

Expand upon the fraudulent relationship between FTX and BlockFi ← Part 2 click here

Outline the intentional capital destruction of depositor funds with Genesis and Gemini ← Part 3 (soon)

Before we begin, a reminder:

The interdependencies amongst a handful of crypto lenders and exchanges: FTX, Alameda, BlockFi, Digital Currency Group, Genesis, Grayscale, Gemini, 3AC is a reminder that if we embed the traditional finance engine on defi crypto rails, catastrophe is always the result. Please:

Take custody of your wallet

Do not rely on regulators

Use centralized exchanges only for onboarding/offboarding fiat

Question *all* tokens and exchanges which offer yields higher than the risk-free rate of return

Do not trust CEX proof of reserves as they paint an incomplete picture of known exchange assets relative to unknown liabilities

Aspirationally, reject the traditional finance and capital market systems in favor of a trustless, permissionless, immutable ledger of transactions. Lending platforms like Aave, Compound, and Maker continue to operate within their liquidation framework, free of speculative bank runs and insolvency risk. It is not accidental. Bankruptcy is impossible on the blockchain. Let’s start.

A trip down memory lane

Remember the $60 billion of wealth destruction we witnessed in June 2022? It was a by-product of the following:

Enticed by > 10% yields, retail investors pumped money into centralized exchanges and funds like BlockFi and Genesis…

… which then took the customer deposits and directly or indirectly entered into long GBTC positions…

..unsatisfied with the 6 month lock-up period on GBTC positions…

..the same exchanges and hedge funds borrowed against the GBTC…

…by converting their positions into cash/US-denominated stable coins…

..to provide yield to their depositors…

..and repeat the loop with new depositor funds and new leveraged long BTC positions with the USDC collateral

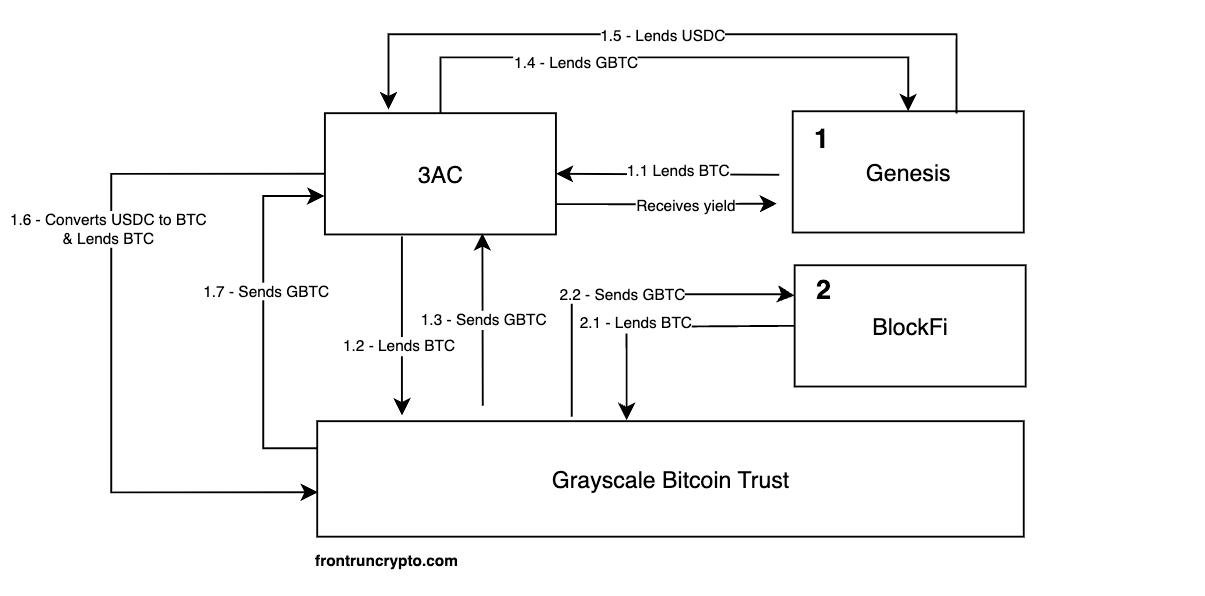

We diagram the flow of funds below, which we will explore in this analysis.

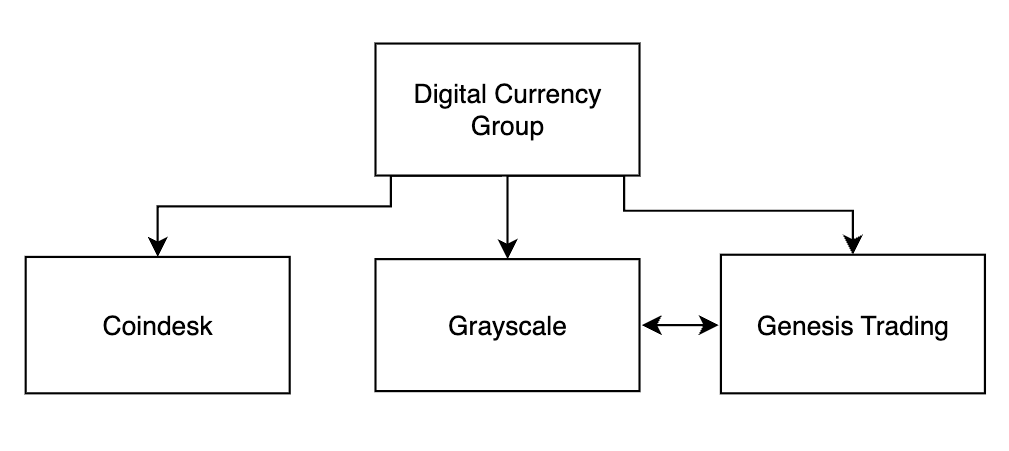

It is an insane proposition and worth diving into in greater detail given that the trade was facilitated by two organizations owned by the same parent company.

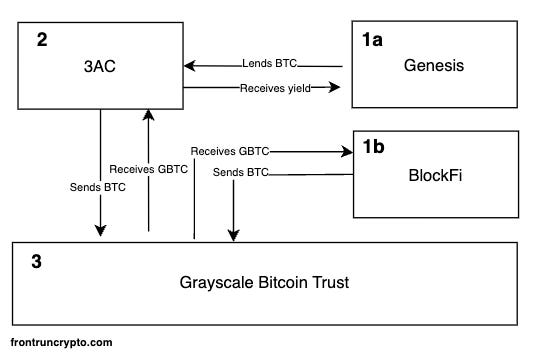

Genesis provides capital to hedge funds which are used to buy BTC via Grayscale’s trust. Once the hedge funds receive GBTC, Genesis incentivizes the same hedge funds with liquidity against their GBTC (via USDC) to buy more bitcoin and deposit more, leveraged, assets into the Grayscale Trust! All in the name of chasing the NAV premium.

What is GBTC and why was it trading at a premium to BTC?

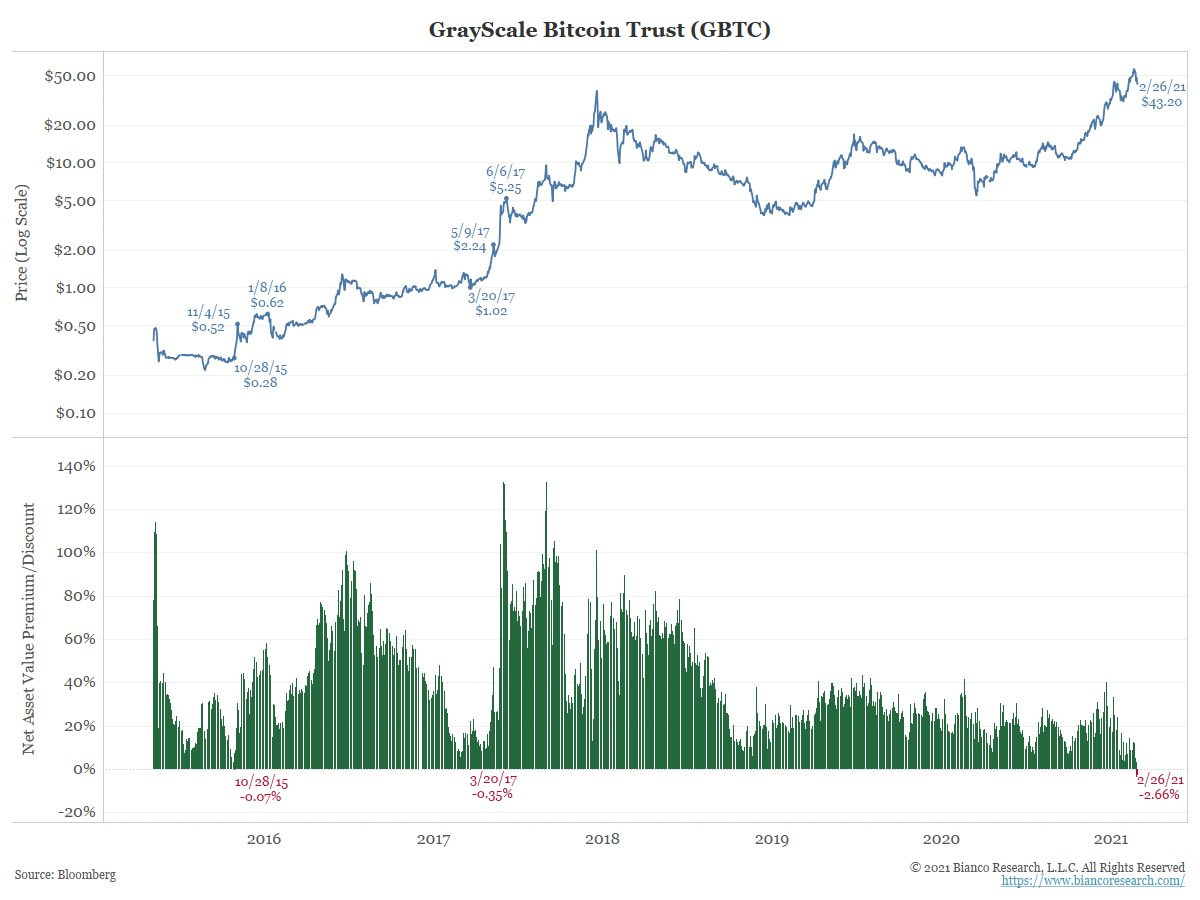

The Grayscale Bitcoin Trust (GBTC), a subsidiary of Digital Currency Group (DCG), is an investment vehicle constructed to give retail and institutional exposure to bitcoin but within the framework of the existing traditional finance system. Rather than going to a centralized exchange (Coinbase, FTX, Mt. Gox), investors seeking bitcoin exposure purchase the “GBTC” asset via their brokerage (Fidelity, eTrade, Robinhood) to gain exposure to bitcoin. Investors buy shares in a trust managed by a custodian; in this case, the custodian is Grayscale. During the 2017 to 2021 bitcoin bull run, investor demand created an environment such that the native asset value (NAV) of GBTC traded at a “premium”.

4 points:

“Premium” (or discount) is a reference to the difference between the value of the holdings of the trust vs. the market price of the holdings

The current value of the holdings, that is the underlying value, is also called Native Asset Value (NAV)

The current market price of the holdings is what the trust costs on the stock market

When the market price is higher than the NAV, the difference is called a “premium.” This means the NAV + premium = market price.

No one dictates this premium, it is a function of supply and demand. Traders create this premium as a result of trading, no entity or formula sets the premium. Below we see the price of GBTC and the variability of its premium from 2016 through 2021.

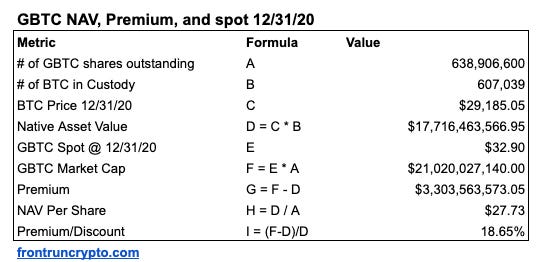

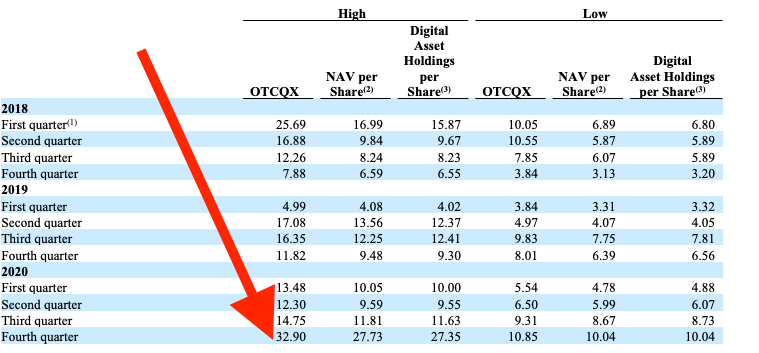

If we pick a point in time, for example, 12/31/20, using Grayscale’s earliest available 10-K, we see the GBTC spot price (OTCQX) trading at an ~18% premium to NAV.

When we explore GBTC’s FY20 10-K we see the trust is in the possession of 607,039 bitcoins with a NAV of $17 billion USD at $27.73 per share. The trust commands an ~18% premium via institutional and tradfi investors, with a spot price of $32.90 per share and a fully diluted market cap of $21 billion.

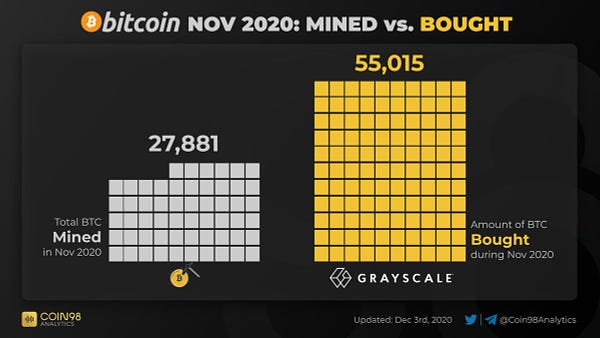

This leads to a point of clarification: one GBTC is a fraction of BTC. Institutional demand for GBTC during the 2017 through 2021 bull run was so high that Grayscale could not acquire enough bitcoin (remember this point). In November 2020, for example, Grayscale bought 2x the amount of total bitcoin mined that month.

Shares of GBTC were offered to the public at an approximate ratio of 1000/1. 1 GBTC = .001 BTC, 1000 GBTC = 1 BTC, depicted below.

In exchange for the privilege to buy fractionalized bitcoin within the traditional markets, Grayscale charged a 2% management fee. Through the end of 2020, GBTC was DCG’s cash cow, producing almost ~ $400 million in fees per year.

Everyone eats.

In the eternal chase for alpha and high yield in a risk-on-zero-interest-rate environment: crypto investors, hedge funds, and centralized exchanges all took note of the NAV premium trade. How could they resist?

BigHedgeFundCo sends Grayscale investor/depositor bitcoin

Grayscale gives BigHedgeFundCo “GBTC” worth approximately 1.2x to 1.5x of its underlying asset

BigHedgeFundCo sells the GBTC after its 6-month lock-up period

We know this to be true for BlockFi (an exchange) which had $1.7 billion of exposure to GBTC and Genesis (a trading desk, also owned by DCG) with $5 billion of exposure to GBTC via 3AC:

Lending a high beta asset for the variable yield of another high beta and over-leveraged asset might be a concern for some, but not the folks a 3AC, Genesis, and DCG. Unsatisfied with a 60% annualized return and a six-month lock-up window:

Genesis accepts the GBTC in the possession of 3AC as collateral for US dollar stable coins to further enable 3AC to buy more GBTC

Remember, Genesis and Grayscale are owned by the same parent organization DCG which is happy to facilitate the trade and reap the 2% management fee charged by Grayscale:

DCG (Genesis) made money as the BTC lender

DCG (Genesis) made money as the USDC lender

DCG (Grayscale) made money as the BTC trustee

3AC profited on the BTC / GBTC trade

BlockFi profited on the BTC / GBTC trade

All participants engaged in gluttonous series of incestual leveraged trades. Risk management? What risk management? AUMs grew into the tens of billions over a 48-month window and 20-something “crypto investors” were heralded as the titans of the industry until a black swan event e.g. the UST Luna collapse crushed demand and sent retail investors into a panic bank run withdrawing funds. As depositor interest evaporated, so did the GBTC/BTC NAV premium.

The GBTC/BTC trade, the golden goose of the crypto BigHedgeCo industry, their money printer go brr meme, was dead on arrival. Cascading liquidations, combined with a federal reserve on a mandate to crush inflation, sent an entire industry into “risk off mode”.

But one person survived, the white knight of crypto, the JP Morgan of our generation, Mr. Sam Bankman-Fried, CEO of FTX and majority owner of Alameda Research.

The genius fraudulent risk management framework of FTX enabled SBF to come to the rescue of the insolvent crypto funds and single-handedly save an entire industry:

While FTX was black Friday shopping for bankrupt crypto banks, other trading firms like Genesis were reeling from 3AC’s leveraged GBTC plays:

“The loans to this counterparty (3AC) had a weighted average margin requirement of over 80%. Once they were unable to meet the margin call requirements, we immediately sold collateral and hedged our downside.”

..and needed additional capital to avoid insolvency. Remember, Genesis was a lending intermediary to other lenders. One lender’s inability to pay is a domino effect of cascading liquidations.

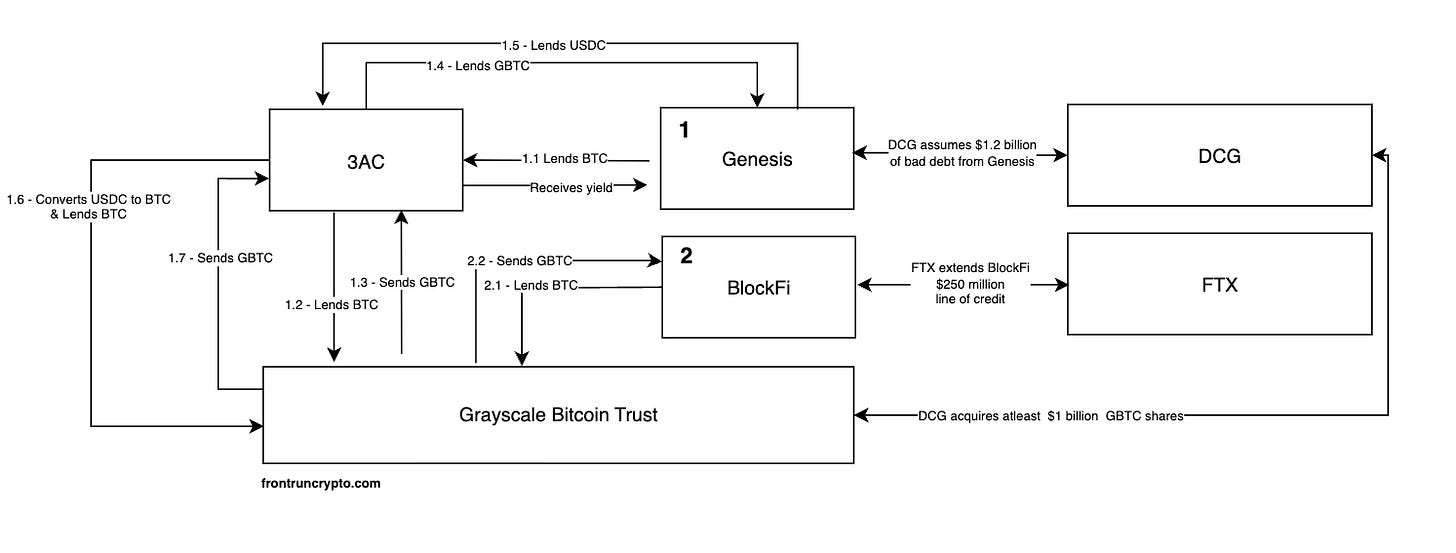

This eventually forced DCG (the parent company of Genesis) to assume $1.2 billion of bad debt from 3AC. Remember, the timing of the 3AC insolvency was around June 2022. DCG’s commitment to assume $1.2 billion of bad debt was in addition to the $250 million committed to buying back from Grayscale in March 2021, right around the time GBTC began to trade at a discount to its NAV.

We can now conclude:

FTX bailed out BlockFi via its collateralized FTT token - $250 million

DCG bailed out Genesis - $1 billion to $3 billion

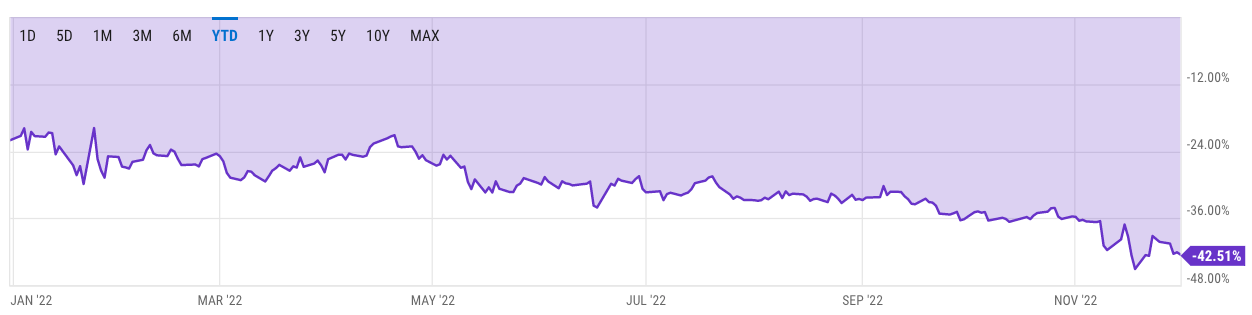

GBTC demand evaporated driving its share price from an-at-the-high of $50/share to ~$9/share as of this writing

3AC went bankrupt

…and last but not least, DCG became the largest holder of GBTC:

We expand our analysis to now include DCG and FTX:

FTX extends BlockFi a $250 million line of credit

Genesis’ parent company DCG assumes $1.2 billion of bad debt via the BTC → GBTC → USDC → BTC → GBTC trade made between Genesis and Grayscale

Grayscale’s parent company DCG acquires at least $250 million, then $1 billion, shares of GBTC

It only gets worse.

The entire analysis thus far has been a run-up to the FTX collapse, we have yet to include any of the collateral damage via the FTX/Alameda research collapse, which we will cover in parts 2 and 3 of this guide.

Until then - readers, please be aware that although tragic, this guide is at best an incomplete assessment of the broader 2022 crypto collapse. We have not included:

The $300 million Vauld bankruptcy and acquisition by Nexo, another centralized exchange with a now questionable liquidity profile

The $3 billion Babel Finance Liquidity crunch

..it goes on, and on, and on, and on. The total cascade of damage is still being quantified. Take custody of your keys, question all yields, and only use centralized exchanges for fiat onboarding and offboarding.

To knowledge and wisdom,

John Cook

December 2nd, 2022

San Francisco, CA

www.frontruncrypto.com

Article cover generated by DALL-E: “A van gogh style painting of hedge fund analysts trading imaginary money”

Yolo trade of the week: 🚀 ARK funds acquired 315,259 GBTC shares in November 2022