Analyzing the complex relationship of Gemini and Digital Currency Group

Part 1 of Untangling Digital Currency Group | We explore the relationship between Gemini Exchange, its "Earn" program, Genesis Lending and the role of Grayscale's bitcoin and ethereum trusts.

Dear frontrunners,

In this 2 part series, we explore the interdependencies between Digital Currency Group (DCG), Grayscale, Genesis, and its relationship with Gemini.

In part 1 (this post) we outline:

The complex relationship between Gemini Exchange, Genesis Global Capital, and Gemini’s Earn program

Allegations of conflicts of interest between Genesis and Grayscale

Questionable lending practices of Genesis

Part 2 will cover:

Claims of Grayscale malfeasance & intentional deception

DCG’s apparent conflict of interest

Part 3 will cover:

Accounting irregularities and potential fraud Genesis

Conclude with an assessment of the complex legal structure within the DCG ecosystem which made this insanity possible

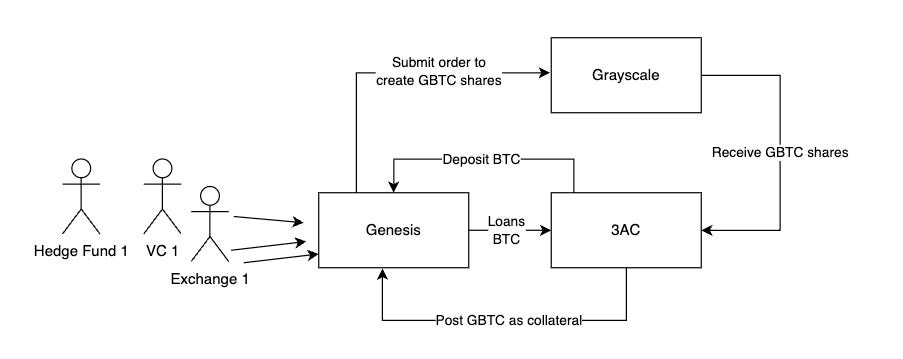

For those who don’t remember why this became a hot topic: On 11/16/22 Genesis suspended redemptions & new loan originations. This impacted lenders like Gemini, who deployed depositor capital to Genesis to earn yield, as depicted below:

Genesis profits on the spread between the rate it charged to borrowers & the rate offered to depositors like Gemini. Gemini profits by charging a 4.29% “agent fee” to retail traders. Retail traders got whatever yield was left. This program had a name, it was called “Gemini Earn”:

When Genesis announced its suspension on 11/16/22, it was revealed that $900m worth of “Gemini Earn” funds were now at risk of default.

Since that announcement, there have been a series of hot takes all over the place:

Genesis is bankrupt with a callable note to DCG that will also force DCG into bankruptcy

Genesis knowingly received depositor funds from FTX

Genesis is the alter ego of DCG’s CEO Barry Silbert

Grayscale is co-mingling funds with DCG affiliate entities

Grayscale is intentionally slow-walking the ETF conversion to maximize its trust management fees

Grayscale is a ponzi

Gemini acting with gross negligence

Gemini colluded with Genesis to offer unregistered crypto asset securities

Gemini is guilty of security fraud

DCG facilitated risky undercollateralized loans by letting 3AC use Grayscale shares as collateral for Genesis loans to pump the NAV and management fees

DCG is committing accounting fraud

Everything is ok, there are no problems 🔥

Who is right? We answer this by analyzing the role of each firm individually and overlaying any interdependencies along the way to form a conclusion based on, at best, an incomplete picture.

Genesis

Genesis Capital is a crypto broker-dealer. In plain speak:

Genesis bought, sold & traded digital assets on behalf of themselves (acting as a dealer)

Genesis bought, sold & traded digital assets on behalf of other firms (acting as a broker).

Within Genesis Capital, a subsidiary called “Genesis Global Capital” (Genesis Capital” was formed to act as a lender to other financial institutions. From 2018 to 2021 Genesis Capital generated more than $244 billion in loans with $16 billion outstanding as of November 2021. The capital Genesis obtained to fund these loans was borrowed from institutions and exchanges like Gemini

.

Despite the opaqueness of Genesis, its lending desk business model was straightforward:

Profits = ( Rate Genesis charged to borrowers - Rate Genesis offered to depositors).

With firms like Gemini offering ~7% yield on its stablecoins, and Genesis charging a loan fee as high as 22%, the lending desk was earning as much as 15 cents per dollar loaned.

It is claimed that Genesis Capital« took the funds provided by firms like Gemini and loaned it to hedge funds like 3AC:

Although it might seem odd that Genesis loaned capital to 3AC to generate yield rather than keeping it in-house via its broker-dealer function, it wasn’t illegal. Aspects of legality are brought into question on the basis that the relationship between Genesis & 3AC was intentional because the asset used to collateralize the loan were shares of Grayscale’s Bitcoin and Ethereum trusts:

Genesis loans Bitcoin and Ethereum to 3AC

3AC deploys BTC & ETH to Grayscale’s Bitcoin & Ethereum trusts

3AC receives GBTC & ETHE shares in return

3AC posts GBTC & ETHE shares as collateral to Genesis at an LTV of 80% with a 22% loan fee ⚠️

For example, Three Arrows Capital (“3AC”) recently defaulted on approximately $2.3 billion in loans to Genesis that were collateralized in part with Trust shares. Some of the loans included a 22% “loan fee” payable to Genesis, and an 80% collateral level. To meet the loan requirements, it appears that Genesis accepted shares of the Trust along with shares of other Grayscale cryptocurrency trusts. - Block & Leviton Demand Letter

Genesis loans more bitcoin to 3AC

3AC repeats the loop

3AC did this because the GBTC/ETHE shares traded at a premium to the underlying NAV. This means for every BTC or ETH deposited into the trust, 3AC would receive a GBTC/ETHE share worth 1.4 BTC or 1.4 ETH. Then after a 6-month lock-up period, 3AC would exit its position by selling the GBTC/ETHE shares and post a 40% profit.

An important point of distinction is the step where the GBTC and ETHE shares are “created” by depositing shares of BTC/ETH into the trust. Grayscale’s trust entered into an agreement with Genesis Global that it was the only legal entity that could accept orders to create or redeem shares of GBTC/ETHE. Until October 2022, Grayscale wasn’t even the authorized participant for its own products.

This means Genesis acted as 3AC’s lender as well as Grayscale’s authorized participant:

Genesis was not only the lender of BTC/ETH, but also the only entity allowed to create shares of GBTC/ETHE. Speculation from Gemini is the guilty party in this trade is actually Genesis and not 3AC. 3AC was just the vehicle for Genesis to swap bitcoin & Ethereum for GBTC/ETHE within the trust.

Genesis booked these interactions with 3AC as bona fide, collateralized loans. It is becoming clear, however, that this was not the case at all. In reality, 3AC was acting as a mere conduit for Genesis, allowing it to enter into what were effectively swap transactions of bitcoin for GBTC shares with the Grayscale Trust. In this transaction, Genesis was betting that shares would be worth more than bitcoin in the future. The 3AC “loan” was the bitcoin leg of the swap and the 3AC “collateral” was the GBTC leg of the swap. 3AC was a mule shuttling the assets between the parties, and as a result Genesis ended up owning massive risk. - Gemini letter to DCG’s board

When the GBTC/ETHE NAV premium subsided, Gemini claimed that Genesis not only failed to close 3AC’s position, but:

Genesis continued to lend funds in an effort to keep a flood of GBTC/ETHE shares from entering the market.

Genesis failed to capture *any* of the GBTC premium - ceding it to 3AC

Genesis sole existence was to keep pumping BTC/ETH into Grayscale trusts to capture management fees on behalf of its parent company DCG

Keep in mind this is around June/July 2022. Once 3AC capitulates, Genesis had approximately $2.36 billion of bad debt via the 3AC fallout and was only able to collect approximately $1.2 billion, leaving Genesis with ~ $1.1 billion of uncollectable bad debt, which is assumed by its parent firm DCG.

A contention made by Gemini is how can it be possible that a lending desk with an 80% collateralization requirement…

…was only able to collect 50% of the provided collateral, which we now know to GBTC shares? This question will need to be answered in a court of law.

FTX

Despite a $1 billion blowout, Genesis continued to operate into the fall. It wasn’t until the fall 2022 fallout of FTX, that Genesis confirms it has $175 million of exposure on FTX..

..and DCG has to step in with a $140m, then $340m infusion of cash across the Genesis global entities to facilitate interest payments and continued solvency.

By the end of November 2022, it was disclosed that Genesis shopped around for $500m to $1b in emergency funding from Apollo Global Management and Binance. Binance declined citing a conflict of interest and as of this writing, there has been no confirmation that Apollo or any entity outside of DCG has provided Genesis with any capital. At this point, DCG’s position is that any insolvency related to the Genesis Lending business is isolated and had zero impact on any sister firms or its parent org.

We now know Genesis used institutional money to fund Grayscale share purchases in partnership with 3AC but what institutions, and how much? Based on publically available information, we can confirm:

$300 million from Dutch exchange Bitvavo

$900 million from Gemini

We will focus on Gemini, but for those interested in learning about Bitvavo and its relationship with Genesis, consider reading this blog.

Gemini

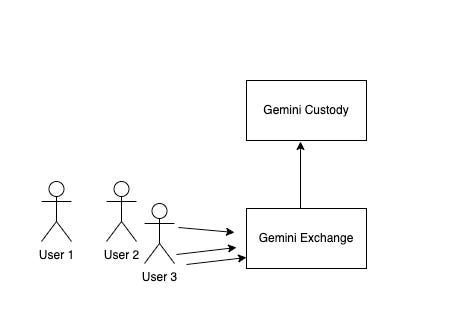

Gemini is a centralized crypto exchange. Users interacted with the platform by buying, selling and trading ETH, BTC, and other digital assets. From 2015 through 2020, trading fees were the primary driver of revenue for Gemini, which charged between 99 cents to 1.49% of the total transaction depending on the size of the trade.

During the height of the 2020-2021 crypto bull cycle, The Winklevoss brothers (owners of Gemini) moved to expand the brand into new corners of the crypto ecosystem including:

Investing in a metaverse

Selling a “Gemini Crypto Rewards” credit card

Launching a “Gemini Earn” program (our focus)

Before the Earn program, depositor funds were not deployed to other institutions to earn yield, assets were custodied by its subsidiary “Gemini Custody”.

With the launch of Earn, Gemini members were now able to earn yield on digital assets….

..but to participate in this program, Gemini members had to agree to a different set of disclosures and authorization agreements which fundamentally changed the legal relationship between Gemini and its users. In response to a class-action lawsuit filed against Gemini, The Winklevoss twins stated Gemini earn participants…knew what they were getting into:

The authorization agreement contains important disclosures, and Gemini Earn participants were required to read …. before participating in the program.

….Gemini Earn participants agreed and understood that in making the independent decision to lend digital assets to Genesis, those assets would leave Gemini, and that a total loss was possible. In the Authorization Agreement, Lenders agreed

YOUR AVAILABLE DIGITAL ASSETS WILL LEAVE OUR CUSTODY, AND YOU ACCEPT THE RISK OF LOSS ASSOCIATED WITH LOAN TRANSACTIONS, UP TO, AND INCLUDING, TOTAL LOSS OF YOUR AVAILABLE DIGITAL ASSETS. - Gemini’s response to class-action lawsuit

Gemini is claiming that users in the Earn program were required to read its terms of service prior to participating and that a complete loss of principal is possible. How many people do you think read the ToS?

What I found to be interesting in this claim is how Gemini framed its role with Genesis and its Earn depositors, specifically:

[Gemini is] not a principal to any Loan, and we have no obligation or ability to return the Loaned Digital Assets from your Borrower in the event of a Borrower Default.

Gemini’s claim is:

Earn participants are lenders

Gemini is the agent acting on behalf of the lender

Genesis is the borrower

I encourage everyone to read Gemini’s response to the lawsuit brought on by Earn depositors. It is a harsh reminder that crypto banks have no obligation to act in the best interest of their depositors.

Gemini’s position is that it has no legal and/or fiduciary responsibility to the participants (lenders) of the Earn program. It was only acting as on-behalf of the lenders as an agent, as outlined below:

Do you think Earn members had any insight into Genesis’ loss minimization strategies, loan & collateralization requirements, its role as an authorized participant in Grayscale shares, who Genesis was lending money to, the solvency of any Genesis borrowers, its due diligence, exposure limits or margin management? I don’t.

Do you think Gemini has any responsibility to its “lenders” to disclose any material information which may impact their “borrowers” ability to repay? Or should Gemini just sit back and cash the check? Gemini failed to provide even the most basic financial statements outlining the wealth and well-being of any of its lenders.

More importantly, even if this information was provided to Earn members, would they know what to do with it or how to interpret it? Not a chance in hell.

What does the SEC think?

On 1/12/23, Just two days after Gemini’s response to the plaintiffs in its class action lawsuit, the SEC charged Both Genesis and Gemini with selling unregistered securities via the Gemini Earn program.

Genesis and Gemini began offering the Gemini Earn program to retail investors, whereby Gemini Earn investors tendered their crypto assets to Genesis, with Gemini acting as the agent to facilitate the transaction. Gemini deducted an agent fee, sometimes as high as 4.29 percent, from the returns Genesis paid to Gemini Earn investors. As alleged in the complaint, Genesis then exercised its discretion in how to use investors’ crypto assets to generate revenue and pay interest to Gemini Earn investors. - SEC

Notice the word choice of the SEC:

Gemini earn participants are investors

Investors tendered crypto assets to Genesis

Gemini acted as the agent

The SEC contends this framework constitutes an offer and sale of securities under applicable law and should have been registered with the Commission. Given the position the SEC has taken with respect to “crypto asset interest-bearing accounts”, I surmise their end game is to classify any digital asset and/or account that yields interest as a "security”.

Recall that in February 2022 the now defunct BlockFi was subject to a $100m fine imposed by the SEC for violating the “Investment Company Act of 1940”. Why? BlockFi was offering interest-bearing accounts, just like Gemini. Ouch.

We can extrapolate that Gemini was at least incentivized to maximize end-user participation in the Earn program via its agent fees. Moreover, we can conclude that Gemini was at least tangentially aware of the legal implications related to launching an interest-bearing account program via the SEC litigation with BlockFi, which happened 12 months prior.

I am going to make a leap and assume Gemini really didn’t give a sh*t about any of its depositors/members of the Earn program. Its board of directors, the founding team, and attorneys all sound like broken records: We are just the agents collecting a fee.

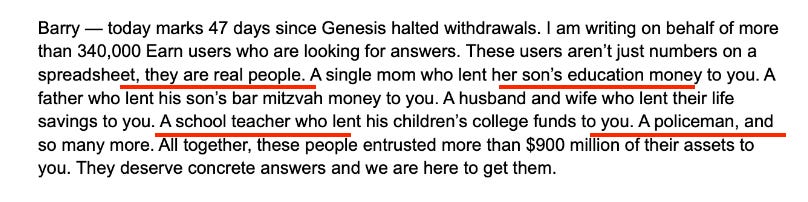

So the next time you read a Twitter post by the Winklevoss twins lamenting about how “real people have been impacted…like the single mom who loaned her sons education money to you, or the father who lent his son’s bar mitzvah money to you…or what about the husband and wife who loaned their life savings to you? The school teacher? The policeman?”…

…take it with a grain of salt. It is a PR stunt & there is plenty of blame to go around.

Conclusions

I theorize the main reason the Gemini Earn program was DOA from the jump is that Genesis and Gemini failed to acknowledge the possibility of mismatching maturities.

Gemini Earn members issued short-term loans to Genesis via Gemini, callable at any time. For example: if I loan 1 ETH into Earn on Monday, I can withdraw 1 ETH on Friday.

Genesis issued longer-duration loans to borrowers like 3AC. For example: Genesis loans 10,000 BTC to 3AC who buys GBTC that must be held for 12 months. Setting aside claims of leveraged borrowing with 3AC, it appears the risk management desk of Genesis failed to model a bank run.

Clearly, I’m simplifying, but the point remains, short-term collateral was used to facilitate long-term borrowing. When the depositors of the short-term collateral collectively demand their money back, you have a bank run.

In traditional finance, banks lend out depositor funds all the time, below is an example of Fidelity’s FDIC-insured Cash Management account:

…Fidelity takes depositor funds, loans them to partner banks, earns a yield, and remits a small portion of the yield back to the depositor. This is called a “fractional reserve system”. So why have we experienced zero bank runs in our generation? Traditional finance has a lender of last resort: The US government, who is standing ready to lend banks money.

Moreover, there is a robust set of banking rules which limit the amount of risk that banks and credit unions are allowed to take with deposited funds in cash deposit accounts. Crypto has neither of these safety nets.

With that said, let’s not understate the following:

There were leverage trades between Genesis, 3AC, and Grayscale

Genesis issued loans to 3AC under its stated collateralization threshold

Genesis was the only legal entity allowed to create shares of GBTC/ETHE

Gemini Earn’s terms of service outline the possibility of complete loss of principal, which no one read.

…and my hot take: Gemini’s compassion for its burned Earn customers is a facade. An illusion to save the brand image of its founders. Want to know what your bank really thinks about you? Read its terms of service.

In part 2 we’ll dive into claims related to DCG’s financial accounting fraud with Genesis, Grayscale’s conflict of interest, and tie it all together in a master plan or one hell of a coincidence of coincidences.

To knowledge and wisdom,

John Cook

January 15th, 2023

San Francisco, CA

www.frontruncrypto.com

✍️ Related content:

Article cover generated by DALL-E: “A roman art drawing of Leonardo da Vinci convincing Claude Monet to lower the collateralization requirements of his bitcoin loan in exchange for a higher interest rate”