The economic triangle of death

When stuff costs more, consumers spend less, and companies stop growing: a prediction of the future.

Dear frontrunners,

Today let’s take a step back and assess the broader economic uncertainty surrounding us. This will serve as the foundation for a subsequent analysis to be published related to corporate valuations and the hemorrhaging of cash seen in private firms in web3 and technology.

Depending on where you source your news, there is no limit to the amount of FUD we’re collectively experiencing:

Hyperinflation and claims of debasement of the US Dollar

SEC regulatory overhead killing crypto innovation in the United States and beyond

AI displacing a generation of people and industries

An impending “great financial crisis” off the back of multiple regional bank failures

A hawkish fed committed to keeping funding rates “higher for longer.”

A potential US government default as a result of political grandstanding and unwillingness to work together for the greater good of Americans

It goes on and on, but you get the idea. For today’s companies and the consumers they serve, we are entering a stage I jokingly call the economic triangle of death:

Stuff costs more

Consumers spend less because stuff costs more. Stuff costs more in part of the global supply chain that has destroyed America’s ability to build things domestically, the proliferation of corporate greed, and regulatory policy that adds layers of fees to corporations which are always passed onto the consumer.

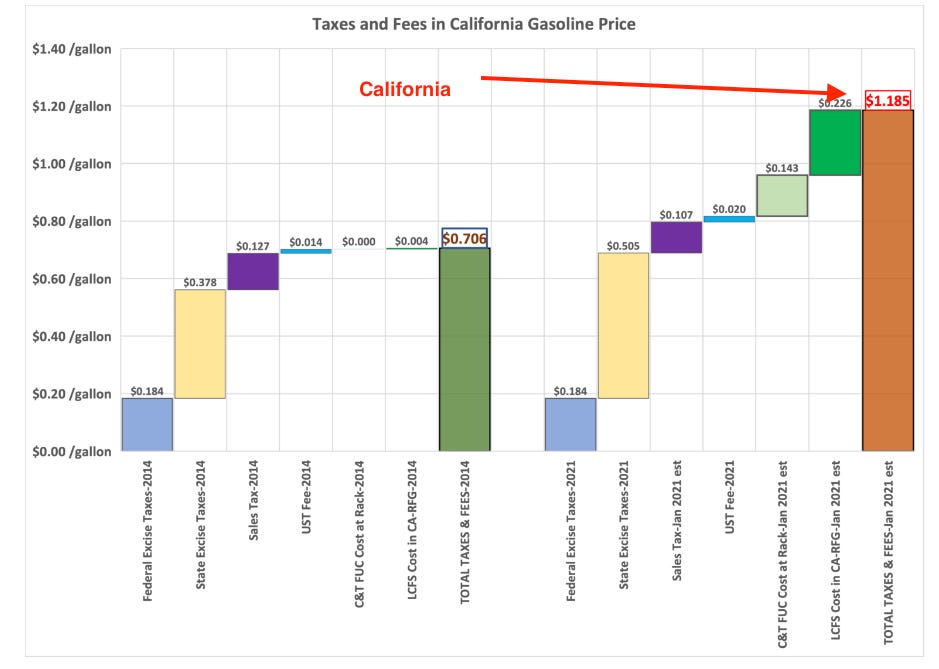

A convenient example is gasoline in California. The median price of gasoline in California is > $5.00 USD / gallon, of which ~$1.18 are taxes and fees. This is .80 cents more than the average state tax gas elsewhere in the USA.

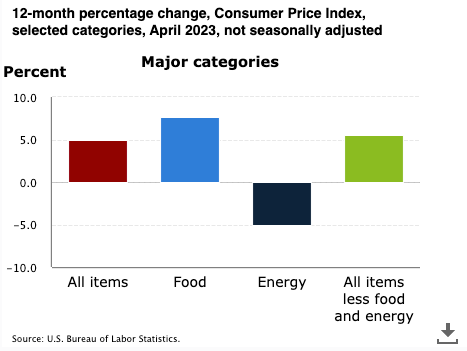

In the most recent inflation print from May 2023:

Core inflation rose 4.9%

Food prices increased 7.7%

Core inflation excluding food & energy increased 5.5%

Although I am happy to see energy (gasoline, electricity) decrease by 5.1% keep in mind there was 49.1% run-up y/o/y from 2021 to 2022. Moreover, housing data is clear and undeniable: Home prices have been at levels of unaffordability not seen since the early 80s..

…and we have experienced the fastest rate of change in principal and interest payments in the past 20 years…

…culminating in a housing market that has locked a generation of young people out of homeownership for the foreseeable future. This is not a hot take, it is real:

Aggregate months of housing inventory is somewhere between one and three months at any given time; we should be at 10 months…yet housing prices are going DOWN. How is this possible?

The answer is, again, affordability. Stuff costs more, in this case, homes. When inventory is low, demand should be high. When inventory is high, demand should be low. We are in this weird economic cycle where inventory is low, and demand is low because houses are so unaffordable, a generation of 20 to 30-somethings have just said no thanks and instead opted to travel the world.

Consumers spend less

Consumers spend less because stuff costs more (gas, eggs, cars, houses, iPhones, gym memberships, health insurance, everything). They also spend less because they feel uncertain about their job prospects and ability to create wealth and/or provide for their family.

We can point to the proliferation of layoffs in calendar year 2023 as a point of concern. Within the tech ecosystem alone we have experienced 193,860 layoffs across 671 companies. We are already 120% of the 2022 figure yet only five months into the year. There is a gauntlet of employment and jobless claim reports we can glean from to better understand employment prospects outside of the tech ecosystem:

The 5/11/23 Jobless claims (unemployment) came in worse than expected. Consensus 245,000 applicants for unemployment vs actual 264,000

The May 2023 Challenger Job-Cuts report outlined 66,995 layoffs in April, a 176% increase y/o/y and 322% compared to the first four months of 2022

Apathy transcends both employees and employers: the NFIB small business optimism index, a survey that tracks employer sentiment across a basket of topics including employment, capital outlays, inventory, economic outlook, sales, and more, is down for the 16th month in a row and below the 49-year average.

The uncertainty surrounding employment prospects and employer optimism manifests itself in a broader metric we call “consumer sentiment”, a quasi-scientific approach to gauging current and future economic conditions. The results from the May read are in line with this analysis; sentiment fell 57.7 from 63.5 m/o/m, below the consensus forecast of 63.0.

Why? Concerns of a declining labor market, inflation, rising borrowing costs, and the failure of Congress to avoid a default via their inability to pass a budget. Add in more chaos via elevated inflation expectations from J. Powell’s latest read…

Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks. - FOMC May 3rd 2023

…is an esoteric way of saying: the worst is yet to come. Maybe this is why consumer credit rose by $26.5B in the past 30 days, 73% above what was predicted by the “experts”.

Companies stop growing

Consumer credit has a complex relationship with corporate debt during a recessionary environment or foreseeable economic uncertainty. Consumer debt goes up as the cost of corporate debt also goes up.

This increase in the cost of capital, the amount corporations pay to borrow, in the best scenario reduces corporate spending and in the worst scenario, drives corporations to bankruptcy when debt service as a % of income, called “the debt service coverage ratio” passes a point of no return.

You can read more about the ratio here but the tldr is when the debt service (denominator) approaches an amount equal to greater than revenue (numerator) or EBITDA, or however your finance team wants to calculate it, corporate death is imminent.

If debt service = $100m and revenue = $200m you are thriving

If debt service = $100m and revenue = $125m you are approaching death

If debt service = $100m and revenue <=$100m you are dead my friend

This happens when variable and/or short-term debt is refinanced at the prevailing market rate. There is around $27 trillion of corporate debt (bonds, loans, revolving credit facilities) powering our global economy and approximately ~$6.5 trillion is due in the next 36 months.

This means $6.5 trillion of corporate debt must be paid back or refinanced by 2025. What will happen when these corporations which financed debt at 1% are forced to refinance at 5% or beyond? There are only 3 options:

Refinance at a higher rate = increase to the debt service coverage ratio

Pay the debt off = Decrease in corporate earnings

Bankruptcy = death to the shareholders and mass layoffs for the rank and file

We can see the implications of this corporate “credit squeeze” unfolding in real time: less than two percent of small businesses (which employ >50% of the private sector) plan to expand in 2023. This means less hiring, fewer raises, and more layoffs as we described above.

So why do we care?

Analyzing macro data is an interesting activity, but sometimes we can’t see the forest through the trees. Most of us are just trying to provide for our families, participate in our community, and do what we can to thrive. Nonetheless, we should care because all of this impacts corporate profits. Corporate profits drive wealth creation and liberate low-income families from the shackles of poverty to climb the socioeconomic ladder and create generational wealth for their loved ones. When corporate profits go down, everyone suffers.

It is the rank and file that share the outsized burden of economic pain.

The raised you worked for? Gone.

The job requisition for a new role on your team? Eliminated.

The value of your 401k? Decimated.

How? A simple example is depicted with the P/E ratio below.

Corporate profits are the E in the P/E ratio, and, said another way, represent the number of dollars an investor is willing to pay for one dollar of profit.

Side bar: For my crypto friends reading this, here is an article I wrote in 2022 outlining the application of traditional finance metrics to digital assets like Lido’s $LDO token. PS I was right.

When earnings go down, one of two things happens:

The P/E ratio goes up

The share price goes down

If the P/E ratio goes up, the share price remains the same, indicating individuals are willing to pay more to own the asset; introducing risks associated with “overvaluation”.

If the share price decreases, the P/E ratio remains the same, indicating asset class parity with the individual stock. Alf at the Macro Compass shared an analysis on economic sentiment as measured by the S&P 500.

The S&P 500 realized earnings per share (EPS) is ~$223, hovering in this range since the start of 2022 (chart 1, left)…

…yet the 12-month earnings growth projections (chart 2, right) is decreasing and flat. In July 2022 corporations forecasted EPS growth of ~$240, and today May 2023 are forecasting EPS growth of ~$224. Said another way:

The investors who owned SPX in July 2022 expected a ~ 10% growth in earnings in the following 12 months

But received no actual earnings per share growth

…yet as of May 2023 the S&P500 index sits at ~4,124, an 8% increase from its July 2022 price of 3,800.

How does the price of a company, index or crypto asset go up when earnings go down? The answer is multiple expansion or said another way, people are willing to pay more to own the asset. SPY is trading at ~ 23x earnings, above its 20-year median value of 17x. In this climate, these valuations are not sustainable.

Why? Because when corporations stop growing, when consumers spend less, and when stuff costs more, the only path is down. This is the economic triangle of death, and we are experiencing it now.

Note I am bearish on SPX to 3,800 by EOY 2023. I’ve written about it here. Please DYOR.

To knowledge and wisdom,

John Cook

May 13th, 2023

San Francisco, CA

www.frontruncrypto.com

Article cover generated by DALL-E: “An oil painting of investors running around with their hair on fire as they witness their life savings vanish.”