The bear case on Lido: Ethereum's largest staking protocol is hemorrhaging cash

An analysis of why the LDO token is yet another worthless crypto coin pumped by VCs to unsuspecting retail bag holders.

Dear frontrunners,

Happy new year, and a special welcome to the new subscribers! Our goal is clear: provide readers with the knowledge and wisdom to participate in the next generation of wealth creation: crypto. This includes learning how to identify winners and losers. Today’s loser? Lido and its LDO token.

In this post, we reflect upon the meme-like investment thesis that fueled the 2020-2021 bull run and define what I believe to be signs of continued capitulation into 2023. I’m focusing on Lido because it is the single largest liquid staking derivative protocol on Ethereum, and its LDO token commands a $1 billion market cap. I am 100% convinced if Lido were a traditional finance company, it would be bankrupt or in an active firesale.

What is the value of an asset that lost $100 million in 2022 and will continue to lose more than it earns for as long as it exists? Keep reading to find out.

Lido is perma-unprofitable

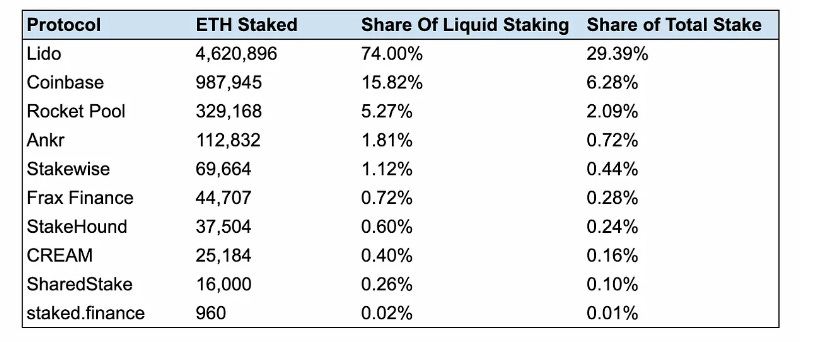

For the uninitiated: Lido is the creator of “Staked Eth” (abbreviated stETH), an Ethereum liquid staking derivative that accounts for 74% of the total liquid staking derivatives (LSD) market and ~30% of all staked Ethereum.

Lido has two ERC-20 tokens:

stETH = Lido’s tokenized version of staked Ethereum

LDO = Lido’s utility token to govern its DAO

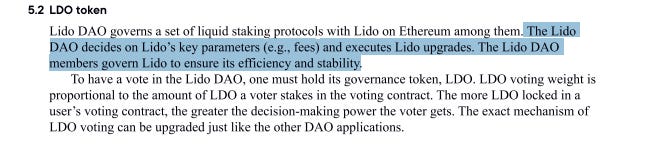

Lido governance is enforced by the “LDO” token. The LDO token is economically irrelevant and worthless. From its whitepaper:

LDO is just another utility token that grants its holders:

Governance rights in the DAO

Fee parameters and distribution oversight

Oversight of node operators

How much revenue collected from Lido’s staking infrastructure accrues to its LDO token holders? The answer is zero. Not a single penny of protocol revenue or staking fees goes to LDO holders.

Revenue from stETH, Lido’s tokenized version of staked Ethereum, accrues to the Lido DAO treasury and its insurance fund, not the LDO token holders, yet the LDO token has a fully diluted market cap of ~$1 billion. This is irrational.

Moreover, the LDO token is pre-mined & pre-sold: Lido’s founding members and early investors control 64% of the LDO supply:

At time of writing, founding members of the Lido DAO possess 64% of LDO tokens. These are locked for 1 year, after which they will be vested over 1 year. At the time of writing, the only unlocked LDO in existence are 0.4% airdrop distributed to early stakers and DAO treasury tokens - Source Lido

..and the remaining 36%? Controlled by its DAO. 🙄 Starting to see a trend?

The LDO token:

Is highly centralized & controlled by insiders

Has a low float of $100k-$1m in daily volume

Is economically irrelevant: no revenue from Lido’s tokenized staked Ethereum accrues to the LDO holders

The max circulating supply of LDO tokens is 1 billion, with approximately 827,000,000 currently in circulation. How?

The early investors and employees of Lido who hold the LDO token were subject to a 12-month holding period plus a 12-month vesting schedule. This means that although Lido minted 1 billion tokens, only ~.4% of the LDO supply was initially “unlocked” and available on the public market…until now:

The aforementioned 24-month holding period has passed, and investors plus early employees are free to dump their LDO to unsuspecting retail bag holders…

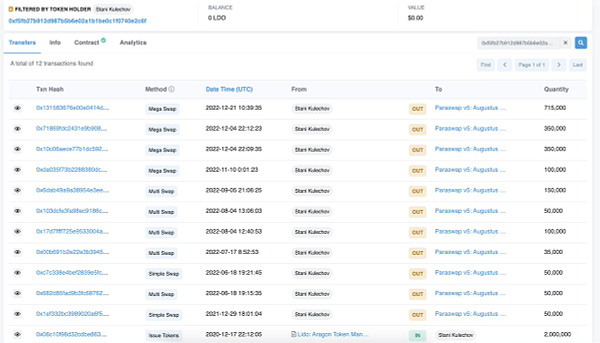

…like early investor Stani Kulechov who closed his entire position by dumping selling 715,000 LDO tokens to retail bag holders…

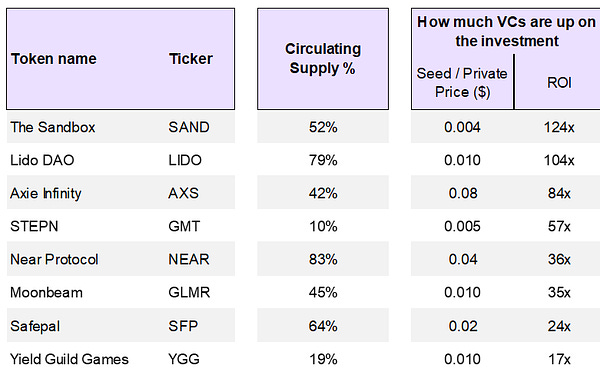

...but can you blame him? Early investors are gonna do what early investors do: shill worthless crypto they bought for fractions of a penny onto unsuspecting retail bag holders. Stani’s pre-tax profit on LDO is at least 100x:

To recap:

LDO is a worthless utility token

Early investors bought the LDO token for fractions of a penny and dumped it to retail bag holders at the conclusion of their vesting schedule

But it gets worse, the LDO token is the main “asset” in Lido DAO’s treasury, accounting for 75% of its total value. Moreover, the treasury controls ~20% of the total circulating supply.

If Lido needed liquidity to cover an unexpected emergency and suddenly had to offload 20% of the total LDO circulating supply to the public markets, how do you think that would play out? Would there be a buyer on the other side willing to pay spot?

Absolutely not, LDO is illiquid and the aforementioned valuation of its treasury is imaginary, a byproduct of “mark-to-market accounting”, a term to describe how the aggregate value of an asset is measured by a small % of shares traded:

….Basically, only some small shares of an asset get traded. But we value the entire asset at the price that those shares trade at. This is called mark-to-market accounting. And it means that the amount of cash you could sell an asset for is different from the value that your asset is logged as. - Noah Smith, Wealth is Imaginary

We saw this with the illiquidity associated with the FTT token. My best guess is that if Lido DAO had to liquidate its LDO tokens *today*, it would get ~10% of its fair market value.

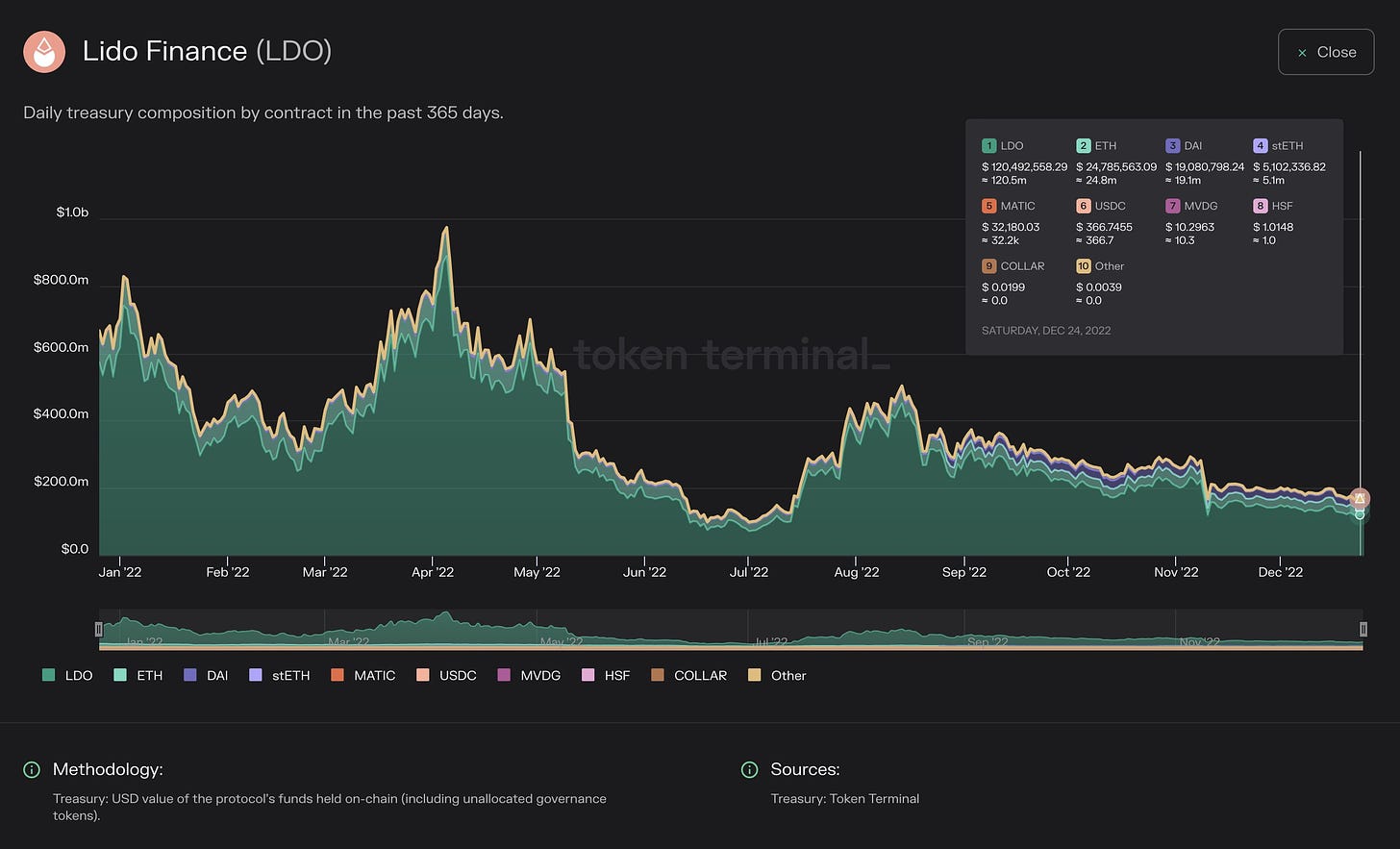

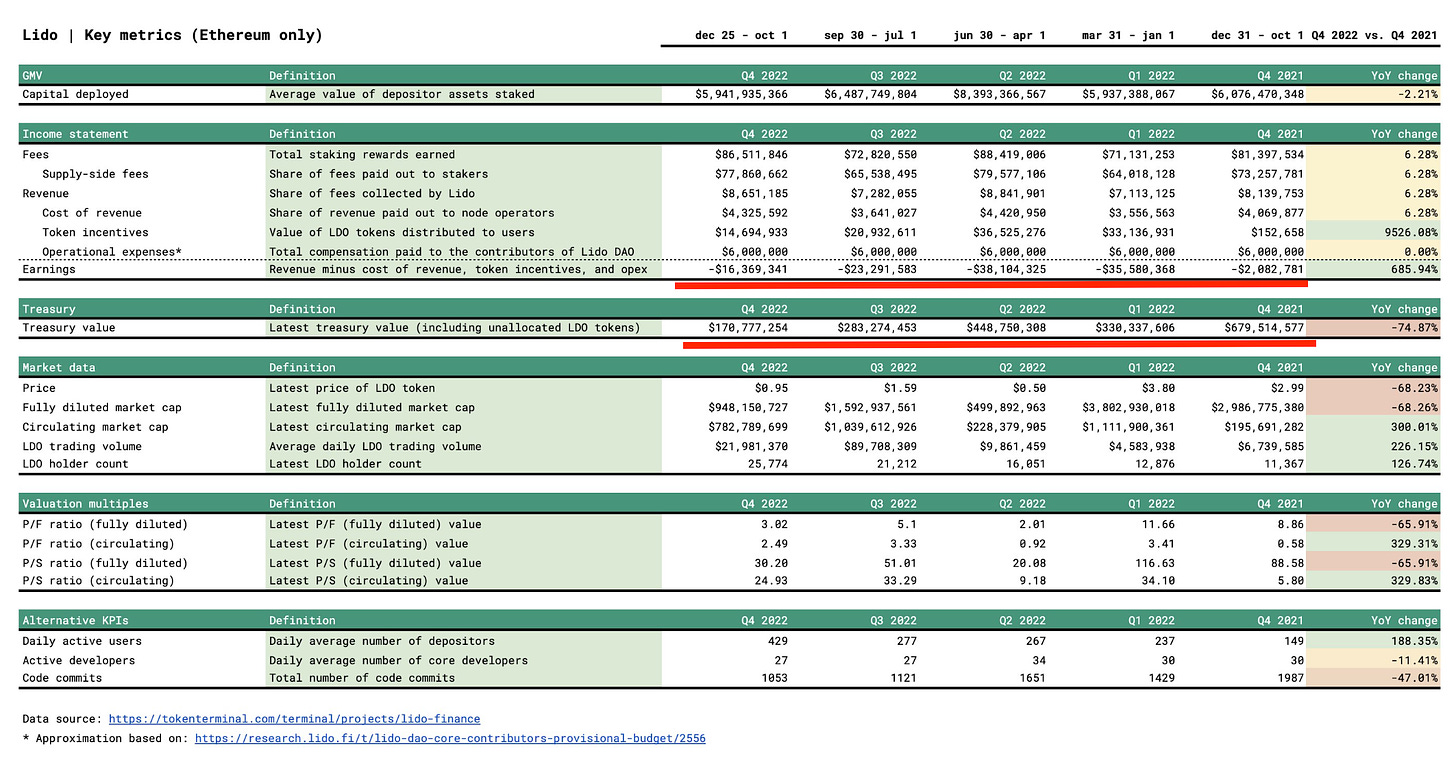

All of these points lead us back to our original theme: Lido is perma-unprofitable. Last week, Token Terminal released a “Lido key metrics” dashboard, outlined below:

Key highlights across its most recent four quarters:

Lido paid out ~$280 million in staked fees

Lido post a net profit of -(~$100m)

Lido’s treasury decreased by 70% from $679 million to $170 million ☢️

There is no scenario where Lido will ever achieve profitability. Even if Lido eliminates 100% of its token subsidy, the cost of revenue associated with node operators and DAO members is still greater than the share of staked revenue retained by Lido.

Did I mention that zero percent of staked eth revenue accrues to the LDO token? The same token that accounts for 75% of the DAO’s treasury, which has also decreased by 70% over the past 12 months? 🪦

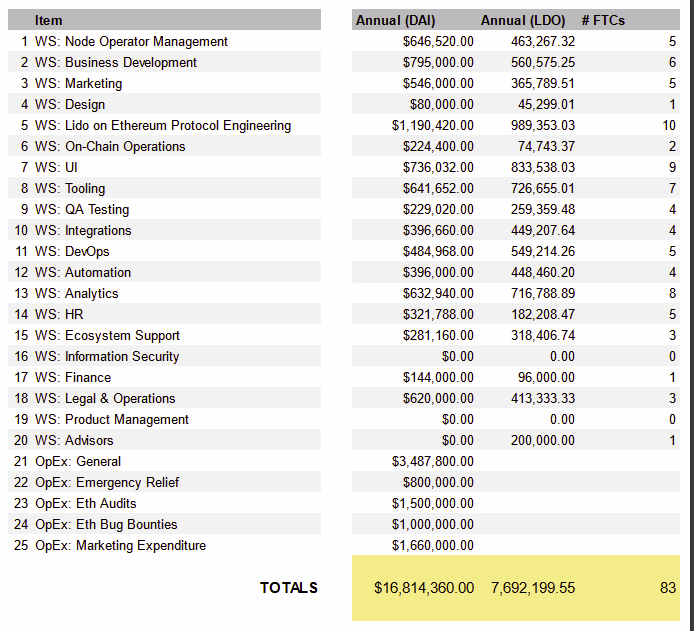

Moreover, Lido’s operating expense is $24 million/annualized. WTF? How is this possible? Per Lido’s DAO, their engineering team is only ten people who operate as contractors. This means Lido isn’t even responsible for ancillary expenses required by employers who hire FTEs. Expenses like providing your employees with health insurance, a 401k, etc.

So what costs Lido $24 million/year? Answer: a lot of non-engineering stuff. Lido’s biggest expense is marketing & business development. Lido spends more on marketing ($3m) than it does on protocol engineering, node operations, and bug bounties combined ($2.8m).

Crypto natives usually hand wave away this analysis by saying something along the lines of:

“Crypto is a new paradigm that operates under a different set of economic incentives”

“It’s totally normal for a DAO to have 80% of its treasury in its utility token”

“Shut up, John you don’t know what you’re talking about. Go back to traditional finance!”

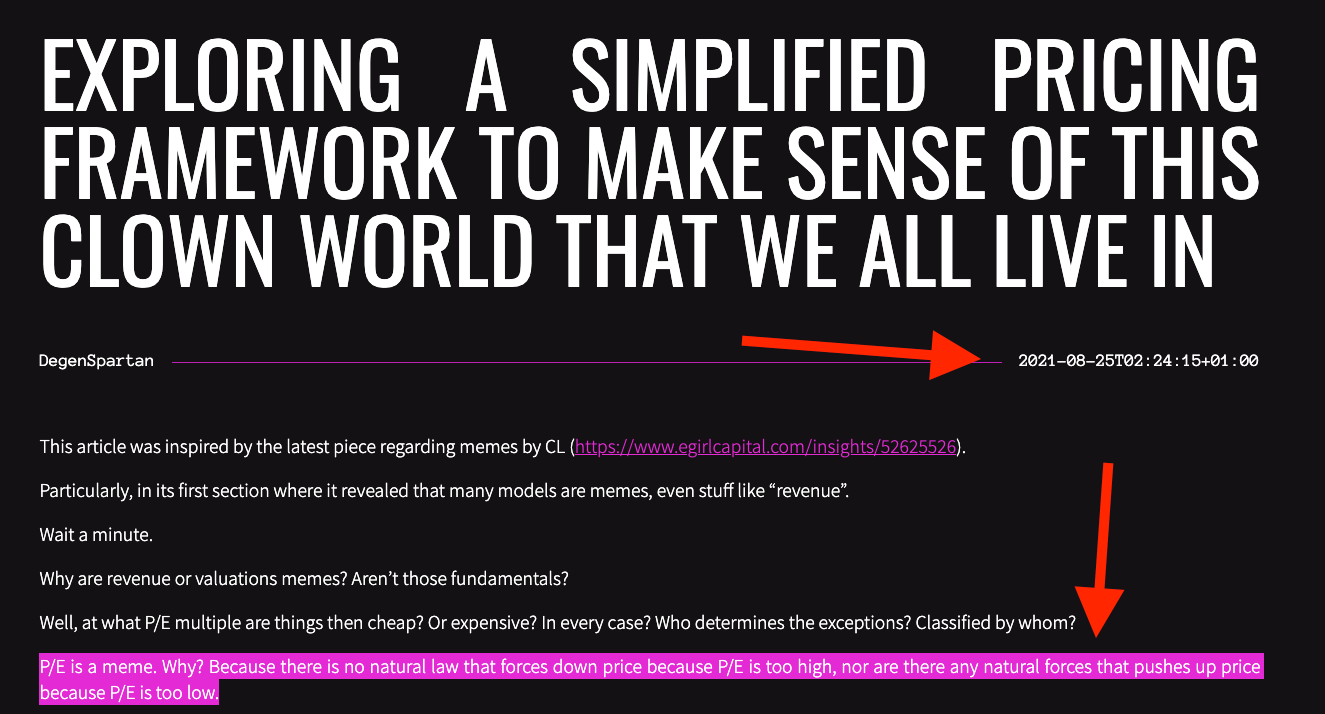

At least, that was what they were saying in 2021 when eth was trading between $2500 and $4000. eGirl Capital, a “crypto VC” and “thought leader” published an article last year blasting traditional finance metrics like earnings per share and “P/E” ratio as tradfi memes. Failure to accept crypto’s “new paradigm” of token valuations is a construct of the boomer generation destined for poverty as a new wave of crypto-economists builds new valuation models on the graves of Warren Buffet and Charlie Munger.

This line of thinking was wrong then and is wrong now. Digital assets with no “economic benefit” accruing to its token-holders will go to zero, every single time. In crypto land, “economic benefit” means:

(Revenue collected by the protocol ) > (token subsidies + operational expenses) and/or

(Token burn) > (token subsidies)

Tokens that violate these two principles will always goto zero. Yes, speculation and greed-induced short-term bull runs may appear along the path to zero, but when it ends there is always a bag holder who loses. Will it be you?

Investors like Stani Kulechov invest in private seed rounds because of preferential pricing not available to retail investors. If you do not have a seat at the seed round table, then you are a retail investor.

P/E ratio, earnings, profitable business models, and a deflationary token supply schedule are not memes. These metrics serve as sound financial guardrails to ensure investors make wise decisions with capital allocation. Crypto tokens do not operate in an alternate universe where the basic laws of economics and value accrual don’t apply.

If you buy a token void of intrinsic value, be prepared to depart with your money. To quote members of the Lido DAO:

After a year and a half waiting, nothing good related to the 99% of $LDO holders has happened. The amount of ETH staked with Lido passed 30% total market share... but, can you believe that such a ‘successful’ project’s token(aka. share) price has just hit its initial price a year and a half ago.

$LDO does not have much interest tied to the project, resulting in the holders being abandoned all the time, which is very inappropriate. I think that $LDO should be given more rights and interests like this post.

The LDO token is the governance token with no real value for 99% of the token holders, since the top 100 holders hold more than 95% of the total supply. - Lido DAO

So, what is the value of an asset that lost $100 million in 2022 and will continue to lose more than it earns for as long as it exists? The answer is zero. I am shorting LDO by collateralizing it against USDC to capture what I believe will be continued downward pressure in 2023 and beyond. DYOR before you do the same.

To knowledge and wisdom,

John Cook

January 2nd, 2023

San Francisco, CA

www.frontruncrypto.com

Article cover generated by DALL-E: “An oil painting of Pablo Picasso trying to convince Leonardo da Vinci to invest in a worthless crypto coin”

Thanks for sharing your analysis John; As the price of LDO drops, so will the confidence and will make space for the most decentralized staking protocol - "Rocketpool" to gain a significant marketshare .. I would be short LDO and long RPL here.

ser, please stop this FUD. Yes, I'll grant you, your thesis is based on specific verifiable facts, and inescapable conclusions based on those facts. However, it runs counter to my hopium inspired instincts--so I disagree.

Sincerely, the crypto bros