Swimming in a sea of mediocrity and excess pork: The US Cares Act

How to spend $2.2 trillion dollars without helping those who need it the most.

March 25th 2020, the United States Congress passed the “Coronavirus Aid, Relief, and Economic Security Act” or the “CARES Act”. It was a $2.2 trillion dollar tax pay funded bail out as a result of a stalled economy from shelter in place orders at the national, state and local level. Of the $2.2 trillion dollars allocated via the US Cares Act[1], $349 billion dollars were allocated to the “Paycheck Protection Program” (PPP) [2], a forgivable loan program for “small business owners” which allocates up to $10 million dollars to cover (primarily) payroll costs, mortgage interest, and other operational expenses.

The spirit of the PPP was to encourage employers to keep employees employed and not furloughed or unemployed. SBA owners are able to get up to 75% of the loan amount forgiven if it is used to cover payroll costs. Unfortunately, there were many loopholes that ultimately served as a mechanism to abuse the program. Another job well done by the cesspool of mediocrity known as the US Government. The US Cares Act has carve-outs for restaurants and hotels which DO NOT limit the number of employees. Originally the PPP was designed to target small business owners with < 500 employees. Due to lobbying from the “National Restaurant Association”, this regulation was removed for restaurant and hoteliers[3].

The result? Pork Barrel Politics which privatizes gains and socializes losses.

A Sampling of the fat

1. Ruth Chris Steak House with 5,700 employees receives a $20 million dollar forgivable loan. They bypass the $10 million cap by applying under 2 LLCs[4].

2. Kura Sushi qualifies for a $6 million dollar PPP loan which will be used to cover rent[4].

3. PUBLICLY TRADED Shake Shack (SHAK) with $595 million dollars in revenue (2019) qualifies for a $10 million dollar forgivable loan[5], only to return after the intense scrutiny it faced from the public at large.

4. PUBLICLY TRADED Potbelly Sandwich Shop (PBPB) with $409 million in revenue (2019) qualifies for a $10 million dollar forgivable loan. CFO gives himself a $100,000 bonus[6][7].

5. Taco Cabana, owned by Fiesta Restaurant Group which generated $660 million dollars of sales in 2019 receives $10 million dollar forgivable loan[8].

6. Dallas Hotel Owner receives $60 million dollars PPP loan bypassing $10 million dollar cap via multiple LLCs. Defaults on debt obligations. Uses $60 million to pay for debt. Issues shareholder dividends. [9]

7. Lindbald Expeditions (LIND) cruise operator with a $250MM market cap and $137 million of cash on hand receive $6.6 million dollar PPP loan.[10]

8. Autonation (AN) car dealership with a market cap of $3 billion dollars AND a Fortune 500 company receives $77 million of PPP loans bypassing $10 million dollar cap via multiple LLCs[11]

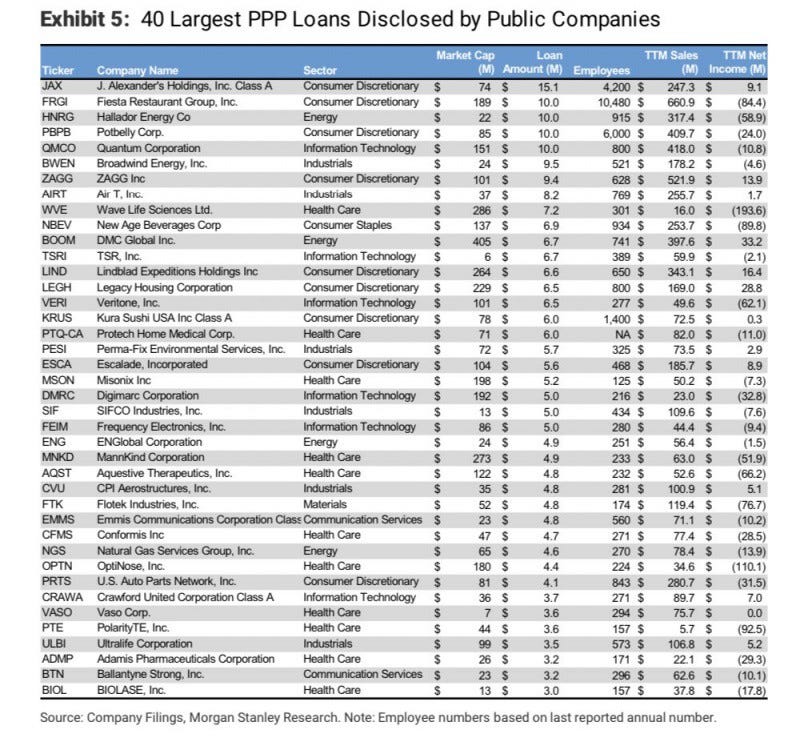

Atleast $824 million dollars of the Paycheck protection program went to publicly traded companies[10]. A leak reported from Morgan Stanley’s company filings[13] outlines the 40 largest PPP loan disclosed by public companies can be found below.

Universities and local governments are also complicit

What’s more ridiculous is that this insanity exists at all levels of society, not just corporate America. The University of Michigan, with a $12 BILLION dollar endowment receives $25 million dollars from the US Cares Act[12]. Harvard University, with the world’s largest endowment valued at $40 billion dollars, receives $9 million dollars from the US Cares Act[17] In Aggregate $14 billion dollars were allocated to universities to cover “the coronavirus emergency”[14]. See the sample table below for details.

What is even more pathetic is that our elected state officials are now demanding that the $150 billion dollars of emergency funding allocated to cover COVID-19 related expenses “is not enough” and now “demand more money and greater flexibility” as to how the funding can be spent[15]. How pathetic.

The result? The people who need help the most, don’t receive it.

The net result of this waste? The $349 billion dollars allocated to the Paycheck Protection Program is depleted in just 13 days with 10% of the funding going towards forgivable PPP loans in excess of $5 million dollars. That means $35 billion dollars were given to the largest corporations in America with minimum loan amounts > $5 million[16].

The “Economic Injury Disaster Loan” (EIDL) program which provides $10,000 as a forgivable grant with no re-payment terms via a $17 billon dollar carve out from the PPP ran out of money in 12 days after approving 1.7 million applications WITH NO INCOME VERIFICATION. All individuals had to do was indicate they operated as an “independent contractor” and were guaranteed to receive a minimum of $1,000, even with $0 in revenue. People are literally posting on the internet saying “$1,000 deposited into my bank, what does this mean?”[22] We are funding individuals with no proof of income to warrant an EIDL. Atleast we can take solace in knowing that the SBA is so incompetent that their EIDL application portal was HACKED, compromising the identity of atleast 8,000 applicants. Of course no resource will be taken against the government, just lip service and a “free year of credit monitoring”[23].

What about the “everyman”? You know…the Joe regular who was supposed to receive their $1,200 stimulus check from their $293 billion dollars barrel carve out of fat called the US Cares Act? They’re still waiting. Only 30% of eligible tax filers have received their check[18]. How is the United States Treasury incapable of distributing $1,200 checks to its citizens yet can manage to spend $349 BILLION dollars in just 13 days?

The icing on this pork filled cake? The House has just passed “phase 2” of the US Cares Act authorizing more than $484 billion dollars towards small business owners and hospitals[19]. I am 100% confident the majority of this funding will be wasted and not help those who need it the most. I cannot wait to see how Boeing will lobby congress to grant an exemption for their industry… Don’t worry we, the American tax payer, will be sure to pay for the poor planning and greed of corporations via the $1.8 trillion dollars (that is a “one” with 12 zeroes!) added to the U.S Budget Deficit over the next decade [20].

Welcome to America. Shame on you SBA Administrator Jovita Carranza. Shame on Donald Trump. Shame on ALL of the publicly and privately held corporations with ample cash taking advantage of this broken system and shame on us, the American Taxpayer, for letting this happen.

JR

San Francisco

April 2020

References