Somebody else has both of our sh*t and they're watching us fight over it

The opacity of recent recession debates are intentional and designed to keep you confused, poor, and irritated while the wealthy continue to prosper.

Unless you’re actively avoiding all corporate news, your friends social media posts, and the entire twitterverse (kudos to you for all three), you’ve now seen another class divide reach newspaper and television headlines: The American economy and its path towards a 2022 recession.

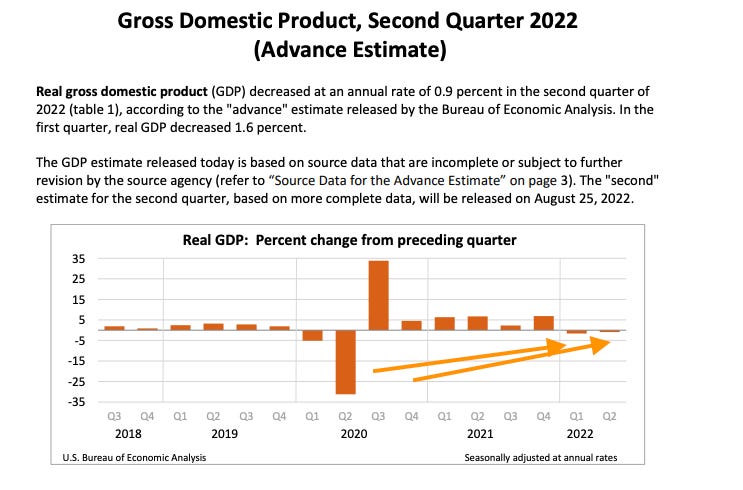

The definition of a recession taught to American business school students technically defines a recession as two consecutive quarters of negative inflation-adjusted gross domestic product growth.

This is what I learned at my overpriced MBA program USC Marshall (go trojans!), this is what is taught in business curriculum today[1] (for now), and this is the definition used by finance professionals at large when discussing a recession with their high-net-worth clients[2][3].

Now - depending on what blog, news station, podcast, personality or political party you follow, the results are distressing and confusing, it truly is a spectrum:

On the lolz side of the spectrum:

“Yes we’re in a recession but you’re using the wrong definition so it doesn’t matter”:

“No we’re not in a recession but if we are it’s because the Biden administration did such an exceptional job facilitating economic growth that one is approaching”:

“It doesn’t matter what your definition of a recession is because we just changed it”:

The Biden Administration on the definition of a recession before and after the July 2022 readout:

This isn’t a partisan issue, if the (R)s were in charge, no doubt a similar deflection would be made. The point of this analysis is not to convey to you that we are in a recession or not, here’s the GDP data from our government’s data team (formally called the Bureau of Economic Analysis), it is real and undeniable, detailed analysis can be found here. You decide:

Real quick….Gross domestic product (GDP) is:

the sum of money people spend on stuff (cars, video games, hair cuts, stuff you buy everyday, services you use everyday) +

the amount of money companies spend investing in stuff (buildings, land, inventory) +

the amount of money the government spends on stuff (roads, schools, national defense) +

the amount of stuff we export to other countries (cars, oil, planes) - the amount of stuff we import from other countries (cars, oil, iphones)

It’s a big number, the table below is in billions and it says in Q22022 our GDP (based on the above formula) is ~$19,681,000,000,000 or 19.6 trillion dollars. In Q12022 it was ~$19,727,000,000,000 or $19.7 trillion dollars. When these data nerds at the US government calculate GDP they take the difference from Q22022, Q12022, and Q420221 , and if it’s negative for 2 quarters: boom we’re in a recession.

There’s a little more nuance in that these figures are derived from something called seasonal adjusting. It’s an attempt to account for the seasonality in month-to-month data sets by creating something called a seasonality factor then dividing the unadjusted rate by the aforementioned factor. The final point of confusion is that “GDP” metric is “real” which means it is calculated on an “inflation-adjusted basis”. If inflation is 10%, but the growth is 5%, the “nominal” rate is 5% but the “real” or “inflation-adjusted rate” is -5%. Confusing? It doesn’t matter, it’s on purpose.

So there it is, using the data nerds data set and the formally official-now-unofficial definition of a recession with a seasonally-adjusted-annual-rate inflation-adjusted formula used to derive “gross domestic report”, we are in a recession.

The counterpoint to this is that our esteemed experts now define a recession as a much broader set of economic conditions which extend beyond the seasonally adjusted blah blah blah GDP of the USA. What are these characteristics you might ask? Nobody knows. This is not the Onion, Bloomberg now wants us common folk to believe that a recession is now an art and not a science.

Recessions come in a dizzying assortment of shapes, sizes and guises. Some are dubbed panics, others depressions. History shows that no two recessions have the same causes or effects.

The new marching order is that the National Bureau of Economic Research (NBER) and its “Business Cycle Dating” subcommittee, consisting of 8 boomers, are now responsible for formally identifying a recession:

So these people, and their diverse set of world experience, who i’m sure have day-to-day lives which resonate with the common man, will now tell us if we’re in a recession (or not). Independent of political partisanship, this is problematic because all of us are fallible, subject to the broad spectrum of human emotions: greed, fear, fame, and corruption. I’ll save my bitcoin pitch for another day, but this is why we need to ditch the current banking system. It is corrupt. It is subjective. It is at the mercy of a group of people (in this case 8 people) who define the path of economic activity.

This leads us back to our original topic. Are we in a recession? According to the NBER sub-committee on business cycling data, no. If you’re a one-percenter with at least $10MM in investable assets, RBC Wealth Management will take your money, invest it for you, charge 1%, and gives you this pretty recession score card below (no charge this time).

RBC thinks the yield curve indicator is neutral because the recent spread has narrowed but surprise surprise every-time since 1954 when the curve flipped, a recession occurred. Yield curves “invert” when investors flee to short-term 1 year US treasuries as a ‘flee to safety’, thereby increasing the yield (return) of the 1 year treasury such that it is greater than the yield (return) of the 10 year treasury. Most importantly”

Unemployment claims are down, employment rate is up are noted below, ~580,000 non-farm jobs were added this past month. Doesn’t the chart below look pretty?

I must call out the elephant in the room: more Americans are forced to obtain 2nd jobs to fight inflation. 5% of all families now have an individual working > 1 job.

The remaining indicators of the RBC Wealth Management Scorecard include:

The “Conference Board Leading Economic Index” or US LEI is a proprietary algorithm of 10 economic indicators created by a private company called the “Conference Room”; their conclusion:

“Amid high inflation and rapidly tightening monetary policy, The Conference Board expects economic growth will continue to cool throughout 2022. A US recession around the end of this year and early next is now likely. Accordingly, we’ve downgraded our forecast of 2022 annual Real GDP growth to 1.7 percent year-over-year (from 2.3 percent), while 2023 growth was downgraded to 0.5 percent YOY (from 1.8 percent).”

Fed funds rate vs nominal GDP growth - every cycle where the fed funds rate (the rate at which the Federal Reserve lends money to other financial institutions) is greater than the nominal GDP growth (not risk-adjusted) rate, a recession occurs:

Free cash flow of non-financial corporate businesses - is a comparison of much cash is generated by non-financial businesses as a percentage of GDP. When the amount of cash generated by non-finance business as % of GDP is < 0, a recession occurs.

ISM new orders minus inventories is a metric tracked by the Institute of Supply management; applicable to the manufacturing industry (cars, planes, boats, etc). When outstanding inventory is > new orders for a given cycle; a recession occurs:

Are you still here? Does any of this really matter?

So let’s recap, a recession went from being 2 consecutive quarters of negative GDP growth to being art, to being determined by a committee of ivy-league boomers, to being a composite index of 7 economic indicators which includes an indicator that is a composite of 10 economic indicators.

The purpose of this analysis was not to convince you of the correct definition of the word “recession”, its not to extrapolate a specific political agenda, nor was it to outline the nuanced analysis and endless iterations economists, corporate media, and data people go through in an attempt to justify their point of view.

We are here to say the quiet part out loud: This is all intentional. The abstract definitions of economic activity, constantly changing definitions and general lack of transparency are all part of a larger framework to keep you confused while the wealthy get wealthier and you remain poor. They want you, us, Americans, to fight each other so the American oligarchs and its corporate donors continue to profit off of you and keep you from climbing the economic ladder.

In part 2 we’ll explore the real economic implications for the people as a result of this constant state of economic and solution confusion. Until then, take a moment, watch this hella funny Theo Von skit and remember that we the people are not each other’s enemy.

Stay Alert.

John Cook

San Francisco, CA

August 7th, 2022

www.frontruncrypto.com

Quote of the week:

“You think I took all your sh*t….and I just don’t have it?” - Theo Von