S&P500 2023 Forecast: Wall Street says "not sure"

We review 2023 Wall Street forecasts for the S&P500 and conclude there is no conclusion.

Dear frontrunners,

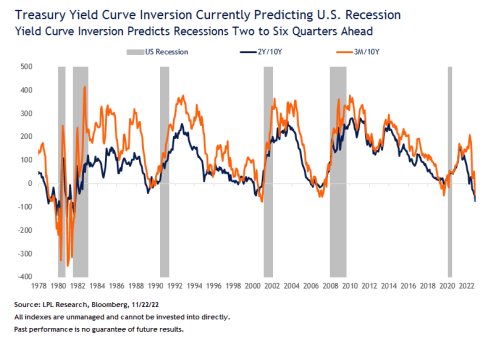

Previously we discussed the dispersion of opinion with respect to economists’ ability to answer the following question: “Are we in a recession?”. We explored how institutions quantify the word “recession” and what macroeconomic indicators are used. The general consensus is there is no consensus. Some institutions reference the 3M/10Y yield curve inversion, some firms rely on a composition of metrics that assess economic health across a spectrum of market indicators, and some firms organize behind “proprietary algorithms” where they don’t disclose any details.

Below is Goldman Sach’s recession forecast for 2023 with an assigned probability of 35%. Aggregated against a backdrop of ~500+ other forecasts with a median probability of 65%. Every forecaster has a different opinion. The net-net is an abundance of noise with no actionable insight.

I subscribe to the philosophy of beauty in simplicity and defer to the 3M/10Y yield curve inversion as the barometer for a recessionary environment. It has been an accurate predictor since 1950 and is easy to understand. When the yield of a 3-month treasury is > the yield of a 10-year treasury, the yield curve is inverted, an economic predictor of an impending recession.

For readers who need a speedrun on expansionary and/or recessionary indicators, yield curve inversion, or core CPI, I encourage you to read this analysis first.

What about the stock market?

This leads us to our current topic - wall street forecasts of the S&P 500 for 2023. As part of the broader “everything bubble” the entire market, from equities to crypto, to gold, to used cars, has seen substantial drawdown off the back of a growing dollar and pivot in monetary policy.

In 2022 the S&P 500 reach a peak drawdown of -24.82% from its all-time high and has currently normalized around -14.25%. This means every dollar you invested at the peak is currently worth 85 cents.

Given that the S&P500 is trading at ~3,900 at the time of this writing, we ask 2 questions:

What were Wall Street’s S&P500 predictions for 2022?

What are Wall Street’s S&P500 predictions for 2023?

2022 S&P 500 predictions

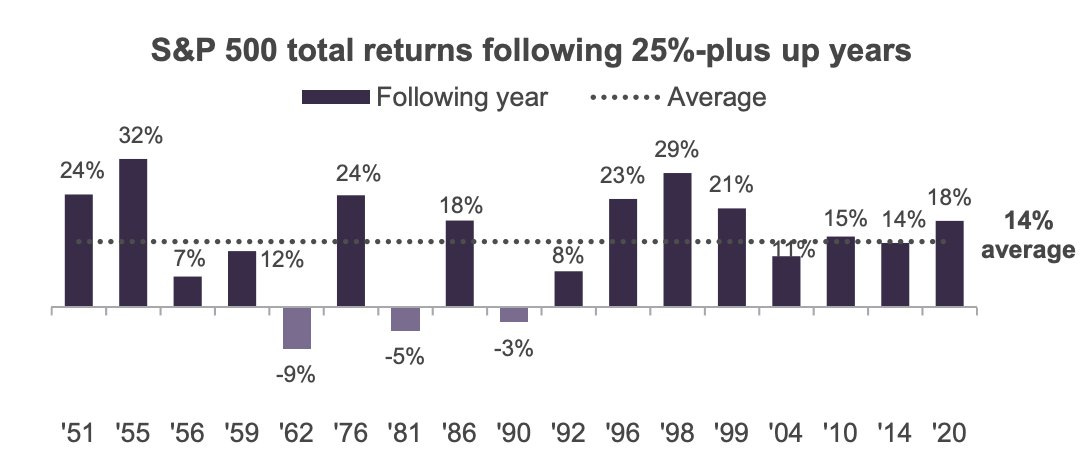

The general thesis for 2022 was an expansionary environment with an annualized return of somewhere between ~10% and 20%. The rationale behind this was the blowout year the S&P500 had in 2021, posting a return of > 27%.

In an analysis performed by Truist Advisory Services going back to 1950, when the S&P500 posted returns > 25%, the following year also performed positively with an average return of 14%.

“…Going back to 1950, when the S&P 500 had a total return of at least 25% in a year, stocks usually rose in the following year. The outcome during that 71 year stretch: stocks advanced 82% of the time, or 14 out of 17 instances” - Truist Advisory Services co-chief investment officer Keith Lerner

…and other “chief investment officers” echoed similar opinions:

"We encourage our clients not to get out, to stay in the market. When the recoveries hit, when the sentiment changes, it happens so quickly that often by the time you're able to get back into the market, you have already missed out - Erin Gibbs, Main Street Asset Management chief investment officer

…while the research companies like DataTrek, a data company, predicted 10%+ growth for 2022.

With the S&P 500 reaching a third straight year of double-digit gains, the odds are good for a fourth year of 10%-plus growth. That's because when the S&P 500 makes three-year strings of double-digit years, the next year sees an average return of 8.4. - Jessica Rabe, co-founder of DataTrek Research.

Even Credit Suisse, the invisible hand that controls the global economy, couldn’t resist posting double-digit growth projections on the backdrop of robust economic growth predicated on cheap money and loose monetary policy.

It goes on and on, other S&P500 2022 projections:

Bullish:

BMO - 5,300

Credit Suisse - 5,200

Citigroup - 5,100

Goldman Sachs - 5,100

JP Morgan - 5,050

RBC - 5,050

Deutsche Bank - 5,000

Bearish:

Even the bears were only predicting downside risk such that there was zero, not negative, growth. Note the S&P500 ended 2021 at 4,778.

Barclays - 4,800

Bank of America - 4,600

Morgan Stanley - 4,400

As of 12/7/22 the S&P500 sits at 3,931.

They were all wrong. The bulls were too bullish, and the bears weren’t bearish enough. Every single institution failed to see the inflationary pressures and over-employment headwinds that plague today’s US economy. I again call out how these institutions are framed as “smart money investors” where astute investors go for alpha. This is an affirmation to me that institutional investors and corporate banks and beholden to the same bias and humanistic flaws which permeate retail investors. Always do your own research.

2023 S&P 500 predictions

A similar story is told as we look ahead to 2023. It is a broad spectrum of opinions with zero agreement. From Sam Ro’s substack (he posts exceptional content about the broader financial markets):

Bullish:

“Equity markets are projected to move higher in the near term, plunge as the US recession hits and then recover fairly quickly. We see the S&P 500 at 4500 in the first half, down more than 25% in Q3, and back to 4500 by year-end 2023. - Deutsche Bank S&P500 2023 forecast

Deutsche Bank: 4,500

Wells Fargo: 4,300 - 4,500

BMO - 4,300

Jefferies - 4,200

JP Morgan - 4,200

Bearish:

Citigroup - 3,900

UBS - 3,900

Morgan Stanley - 3,900

Barclays - 3,675

“We acknowledge some upside risks to our scenario analysis given post-peak inflation, strong consumer balance sheets and a resilient labor market. However, current multiples are baking in a sharp moderation in inflation and ultimately a soft landing, which we continue to believe is a low probability event.” - Barclays S&P500 2023 forecast

Bull, bear, or crab?

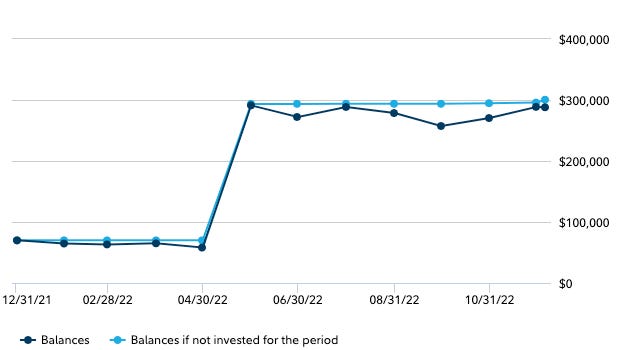

My opinion of the next 12 months are mixed. In q2 of 2022 I deployed ~$300,000USD of capital across a broad basket of equities which I believed would outperform the market, only to be met with neutral to negative results.

The above chart says I would have the same outcome if I just let the cash sit in a money market account. I think I would have beaten the market if I bought 6-month t-bills, which are currently paying 4% APY. So take what I’m about to say with a grain of salt; it is not investment advice.

When I look at the broad basket of recessionary indicators as measured by the Conference Board Leading Index, which is inclusive of the 3M/10Y yield curve, it has been an accurate lagging recessionary indicator since ~1975. The most recent print indicates more economic uncertainty with a recession in Q22023.

Venture and private capital serve as another indicator to assess broader investment appetite, and if we look at the growth of venture capital investment over the past 10 years:

We can conclude there has been a prolonged and consistent upward change in net asset value. This becomes problematic in 2020 when the NAV has more than doubled the total invested value in the previous years.

Factset makes an interesting observation:

Understandably, contributions and distributions would not rise at the same rate as NAV in the case of a rapid rise in consumer demand for the underlying technologies. If this enormous NAV is not quickly captured through distributions, the gains may evaporate for general and limited partners just as easily as they arrived. - Edward McCormick Factset 2022

When consumer demand for technology-enabled products is high, investor distribution is low (investors want to let it ride). If there is downward pressure in the economy, which we are experiencing now, VCs are more likely to exit in their positions to capture returns for their LP. It is a vicious cycle where decreased earnings trigger early distributions, which trigger decreased earnings which trigger early distributions.

As consumer confidence in technology and crypto has shifted from skepticism to enthusiasm to distrust, I think we are poised for substantial downward risk in 2023. The rise of drawdowns and defaults could create significant risk for retail and institutional demand.

I am predicting a bear 2023 with the S&P500 ending CY23 at or near 3,900. Maintain your crypto allocation at no more than 20% of your total net worth, deploy extra cash to short-term t bills or high-yield cash deposit accounts like Merril Lynch, max out your retirement accounts, and prepare for a cold year ahead.

To knowledge and wisdom,

John Cook

December 7th, 2022

San Francisco, CA

www.frontruncrypto.com

Article cover generated by DALL-E: “A cyberpunk wallstreet analyst creating excel models to predict the stock market”