No winners in 2022

Top 3 topics for the week of 12/25/22: Crypto VCs fail to deliver | Binance Mega FUD | Ethereum banned

Dear frontrunners,

Merry Christmas and happy holidays! Frontrun has been a gift that has been giving all year. The amount of interest this publication has received in 2022 is a reminder that crypto/defi/web3 is very early in the maturity curve, and there continues to be unfilled demand for shill-free research, tutorials, and guides.

True to our first principle of “the realization that the information you need to win is already available”: we are introducing a weekly review of the crypto ecosystem, focused on the most impactful charts, analysis, and headlines. We’ll explore three topics that transpired over the week and include links to other impactful research reports, newsletters, and crypto forecasts of value. We have one goal: cut through the bias we experience in traditional and institutional crypto publications.

Our three topics this week:

Why crypto funds are failing in 2022

Binance mega FUD

Paxful crypto exchange bans Ethereum

To knowledge and wisdom,

John Cook

December 25th, 2022 🎄

San Francisco, CA

www.frontruncrypto.com

1. Why crypto funds are failing in 2022

Many years ago, early in my traditional finance journey, I realized the majority of actively managed funds fail to consistently outperform the market. We’ve all heard the stories:

In Burton Malkie’s “A Random Walk Down Wall Street” coins a r/wallstreetbets worthy meme called a “random walk”: the idea that a blindfolded monkey randomly selecting stocks can outperform professional investors:

On Wall Street, the term “random walk” is an obscenity. It is an epithet coined by the academic world and hurled insultingly at the professional soothsayers. Taken to its logical extreme, it means that a blindfolded monkey throwing darts at a newspaper’s financial pages could select a portfolio that would do just as well as one carefully selected by experts. - Burton Malkie, “A Random Walk Down Wall Street”

This is not an anecdote. S&P Global publishes an annual “US Persistence Scorecard” which quantifies fund manager performance against their broader asset class to ascertain long-term performance, and the data is clear: actively managed out-performance is short-lived, with few funds consistently outranking their benchmark.

The November 2022 report concluded, it was statistically impossible to find consistent outperformance:

Over a five-year horizon, it was statistically near impossible to find consistent outperformance. Among all actively managed funds whose performance over the 12 months ending June 2018 placed them in the top quartile within their respective category, not one fund in any of our reported fixed income and equity categories remained in the top quartile in each of the four subsequent one-year periods ending in June 2022. - S&P Global US Persistance Scorecard

To reiterate in plain-speak: yesterday’s winners are today’s losers.

So now you’re thinking, “Ok John, but this is a crypto blog, not a Berkshire Hathaway annual newsletter”. This is true, but token valuation and crypto-economics don’t operate in an alternate universe where rules of free cash flow and value accrual to tokenholders do not apply.

Specifically, the pump and dump of crypto valuations in 2021 persisted for 2 reasons:

A government-induced stimulus combined with a global work-from-home mandate created an environment where consumers had money and nothing to do: so they bought crypto and meme stocks

Synthetic yields created by ponzi tokens offering 100% APY encouraged crypto degens to “yield farm” and “liquidity mine” - the act of staking tokens, to earn yield in the form of worthless protocol/utility tokens which are immediately

solddumped on the open market

Both aforementioned points violate a fundamental role in crypto and the broader equity valuation framework: the price of an equity (or token) is the sum of its free cash flows.

In crypto speak it means protocol tokens must burn more coin than is minted. Failure to respect this rule results in an inflationary hellscape, every single time. The loudest critique I hear against my position is that “we’re still early in the crypto journey, we should focus on market share and not earnings/revenue accrual”. This is a flawed argument in that “market share proponents” fail to see the difference between:

A crypto token that is not profitable now but will be profitable in the future

versus

A crypto token that will never be profitable ever

Point 1 - Obvious examples are bitcoin and Ethereum. Their tokenomics supply schedules are “not profitable” in that both protocols mint more btc/eth than they burn for now, but not forever.

For Ethereum - when protocol demand increases, the blockspace becomes more competitive which means the base fee paid by transactors will increase above the block reward amount issued to stakers. The net result is a profitable blockchain. This was implemented via EIP-1559 as depicted below.

For bitcoin - there is a hard cap of 21 million btc on a controlled supply schedule. New bitcoin is mined every 10 minutes. The amount of mined bitcoin is fixed, currently 6.25 BTC per 10 minutes. This is throttled by bitcoin’s difficulty algorithm. As blockchain demand increases, bitcoin’s mining difficulty goes up. As blockchain demand decreases, bitcoin’s mining difficulty goes down. The net result is a controlled supply schedule of btc until all 21 million coins have been mined until ~2140, as depicted below:

Point 2 - if btc and eth are examples of sound tokenomics, the losers of 2022 are the crypto ‘assets’ that have flawed tokenomics and an inflationary token supply schedules: luna, ftt, sol, axs, sand, mana, near, cro to name a few. These are tokens that are not profitable now and will never be profitable ever. This list should be a surprise to no one.

Terra/Luna was a synthetic algorithmic stablecoin backed by imaginary money.

Specifically, Terra was anchored to $1 through the algorithm that burned Luna tokens to create new Terra tokens. A % of Luna is removed from circulation and the remainder was deposited into Lunda Foundation’s treasury. The idea was that burning Luna tokens makes them more valuable due to the decreasing supply, but this is counterbalanced by the creation of new Terra, which stabilizes the overall price at $1. Conversely, if demand is low for Terra, Terra holders can exchange to Luna, allowing them to bank a risk-free profit while maintaining the price peg.

What I just described is a ponzi: the value of one Terra dollar enforced by an algorithm to burn/mint a worthless token (Luna) used as a peg.

FTT and all exchange tokens are utility tokens with zero economic value accruing to its token holders. In a previous article we outlined the serious flaws of FTT: centralized ownership, no value accruing to its token holders, low volume, and completely pre-mined. Retail holders were left holding the bag after the November 2022 rugpull:

Mana and Sand are social platforms that promised society a new metaverse: a collection of digital worlds where humans can escape the monotony of real life in a Ready Player One type setting. The problem? The graphics sucked. Mana and Sand were propped up by VC money and not community engagement. Both platforms averaged less than 1,000 daily active users and as of this writing, less than 400 people are on Decentraland (mana is the crypto token of this metaverse) right now. Decentraland had an $11 billion valuation on November 21…for 400 users!

We could continue this analysis for every token in the bottom 25 and it’s the same story:

Inflationary token supply schedule

Flawed tokenomics

Pre-mined VC preference

Low user adoption

We belabor these points because it is the tier 1 crypto funds that are keeping these terrible products on life support, at the expense of their LPs. Every single tier 1 crypto fund has underperformed the crypto asset class as a result of these poor investments.

Sequoia, Multichain, and Coinbase Ventures, to name a few, have all failed to outperform Bitcoin and Ethereum. Their LPs are paying a ~2% management fee to fund this persistent underperformance and should demand accountability, but all the VCs are offering is a worthless apology under the pretense of “we are in the business of taking risks”.

The failures I’ve described with actively managed funds in the equity space and their inability to outperform their asset class are the same investment failures that permeate across the crypto ecosystem. Crypto VCs are not gods we should idolize and look to for wisdom and knowledge. They are beholden to the same greed and hubris as their traditional finance counterparts.

The advice that has served me well throughout my entire investment career, which has been my framework for picking more winners than losers (although I still pick losers): look for crypto tokens with a sound supply schedule that returns value to its token holders.

2. Binance Mega FUD

The recent exchange outflows of Binance and poor PR skills of its CEO CZ have triggered an onslaught of fear, uncertainty, and doubt across the Binance smart chain ecosystem.

Initially started by the mass exodus of BTC from its platform:

The FUD has morphed into rumors of insolvency as a result of temporary withdrawal suspensions across a broad basket of stablecoins including USDC…

…which paired nicely with Binance’s auditor Mazars removing its proof-of-reserve attestation related to over-collateralization of bitcoin reserves:

Mazars has indicated that they will temporarily pause their work with all of their crypto clients globally, which include Crypto.com, KuCoin and Binance. Unfortunately, this means that we will not be able to work with Mazars for the moment," a Binance spokesperson said

Mazars Added that its proof-of reserve reports do not constitute either an assurance or an audit opinion on subject matter. Instead they report limited findings based on the agreed procedures performed on the subject matter at a historical point in time."

This is also on the backdrop of BNB’s questionable tokenomics, specifically related to the centralization risk of how only ~18% of the BNB token is in circulating supply to non Binance-owned wallets.

Reading between the lines, it appears that the BNB token is the collateral for the entire crypto derivatives industry…or at least most of it. Binance controls this market, and by owning > ~50% of the entire float and they subsidize financing costs against it as collateral.

Given that Binance has also acquired Voyager for ~$1 billion:

Voyager Announces Agreement for Binance.US to Acquire Its Assets.

The Binance.US bid, which sets a clear path forward for Voyager customer funds to be unlocked as soon as possible, is valued at approximately $1.022 billion and is comprised of (i) the fair market value of Voyager's cryptocurrency portfolio at a to-be-determined date in the future, which at current market prices is estimated to be $1.002 billion, plus (ii) additional consideration equal to $20 million of incremental value. The Company's claims against Three Arrows Capital remain with the bankruptcy estate, and any future recovery on these and other non-released claims will be distributed to the estate's creditors. - PR Newswire

It is my hope that this acquisition is not funded and/or collateralized by BNB tokens. We outlined a similar acquisition of BlockFi by FTX earlier this year, collateralized by FTT tokens. The result? FTX in bankruptcy and the defunct BlockFi now listed as a creditor in the FTX bankruptcy proceedings!

3. Paxful bans Ethereum

Paxful is a peer-to-peer lending platform that recently removed Ethereum as a trading asset under the guise of integrity above profits. In a leaked note, their CEO compares Ethereum as a proxy for apartheid and his role is to protect users. Oh brother. The leaked email is below:

Paxful’s CEO frames the ban across three dimensions:

Ehtereum’s proof of stake is flawed

Ethereum is not centralized

Ethereum’s ERC20 derivative tokens are a floodgate for scams and rug pulls

I wish he put more thought into explaining why proof of stake is flawed, but my assumption is it’s related to two themes:

The wealth gap created by stakers. Only a small subset of Ethereum community members can afford the 32 eth requirement. This group profits from transaction fees and gets richer at the expense of the retail community.

His comparison to eth as a “form of fiat” is probably a reflection of the dynamic supply/demand schedule of minted Ethereum which runs counter to bitcoin’s “hard money” philosophy of crypto as sound money with a fixed and scarce supply.

His note on Ethereum’s centralization risk is questionable at best given the four largest bitcoin mining pools generate > 50% of the network’s hash. If Ethereum is not centralized, neither is Bitcoin.

Finally, his statement on the proliferation of rug pulls is reasonable and should be addressed, but not by banning Ethereum. Rug pulls are an ecosystem-wide issue. According to Solidus Lab’s 2022 “rug pull” report:

8% of all eth tokens are programmed to automatically execute a rug pull

12% of all Binance tokens are scams

15 new token scams are created every hour

There were over 117,000 token scams in 2022, an increase of 41% from the prior year…

…with the most common type being “honey pots”: scams, where the smart contract has code that does not allow buyers to resell their tokens.

Token derivatives of sound crypto assets like Ethereum are really a symptom of a problem: an uneducated and/or uninformed retail community that lacks the knowledge or education to differentiate a sound investment from a pump and dump. Banning Ethereum is not going to solve this problem. Why not ban US dollars because ponzi scams are executed in fiat currency? Ban cars because people drive drunk? What if we banned all physical items with the potential to inflict harm on other individuals? To hell with it, let’s also ban all investment opportunities where investors are exposed to downside risk. Better safe than sorry.

For Bitcoiners embracing philosophies of self-sovereignty and financial freedom, banning Ethereum is a move we’d expect from a tyrannical dictator, not a group of freedom-loving libertarians!

Other content published this week to increase your knowledge and wisdom:

📈 Frontrun

📈 Across the web:

Decentralized social media: A guide to the web3 social stack by Coinbase

Pantera Capital December 2022 newsletter - The need for trustless systems

📊Chart of the week:

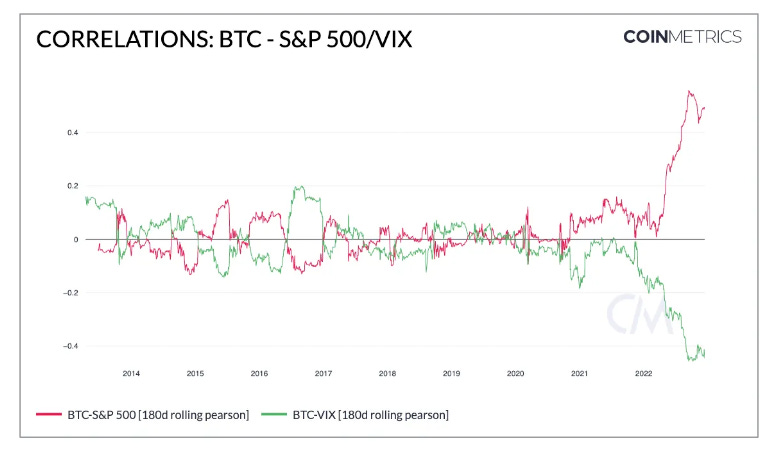

Correlation between Bitcoin, S&P500, and volatility: In 2022 the correlation between BTC and the S&P 500 increased to its highest level all time, with BTC moving tightly in sync with stocks and moving against volatility (as measured by the VIX).

Article cover generated by DALL-E: “An Andy Warhol style painting of investors explaining why they've failed to outperform the stock market”