Is now the time to buy Grayscale's bitcoin trust?

A review of Grayscale's bitcoin trust investment thesis, regulatory hurdles, and potential return

Dear frontrunners,

Grayscale’s bitcoin trust (GBTC) is trading at near record lows of 48.51% discount to its net asset value as of 12/28/22. Said another way, $1 of bitcoin can be bought for 52 cents. This has reignited my interest in the trust as a potential 2023 investment. Given we are all here to generate wealth and front-run the opportunity…

…the questions related to GBTC as an investment were at the top of my mind throughout Christmas: Is now the time to invest in GBTC? Will we see spot parity with bitcoin in 2023? Imagine having dinner with your family but all you could think about was the GBTC/BTC spread. 🤓

In this analysis, I define:

Key assumptions

The investment thesis of GBTC

Identify what regulatory actions must happen for GBTC to reach upside spot parity

The trade and potential upside

Usual disclosures: please do your own research. Conviction is built in the details.

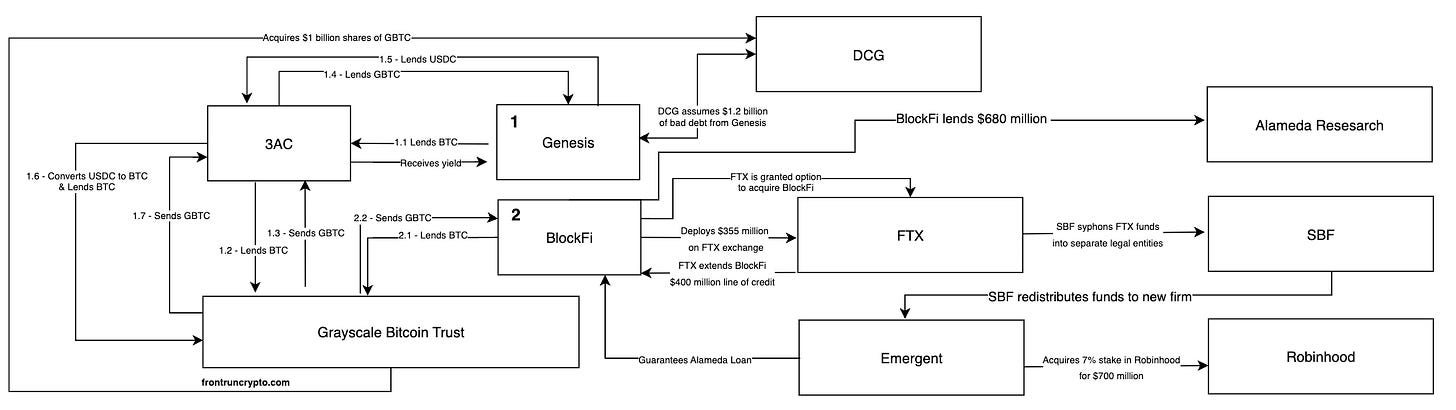

Note in a prior analysis, I reviewed the interdependencies of GBTC amongst a close-loop set of actors: DCG, Genesis, 3AC, Alameda, BlockFi and defined how the trust was used to create synthetic market demand, which served as the catalyst for GBTC’s 2019 premium:

The system of counterparty trades and cycle of leverage are depicted below. For those readers wanting a more in-depth review of how these actors colluded to pump the GBTC price, take a moment and read this analysis first.

Given:

How GBTC was used to generate synthetic returns

The FUD related to Grayscale’s parent company Digital Currency Group's rumored insolvency

The role Grayscale’s sister firm Genesis played in facilitating US dollar-denominated loans backed by GBTC

I concluded the trust’s discount to NAV was a reflection of the aforementioned risks, potential insolvency and shelved the entire investment thesis.

Shifting opinions

My opinion has shifted given recent disclosures by Coinbase Custody Trust, the custodian of Grayscale’s bitcoin, who reaffirmed that Grayscale’s bitcoin assets are secured and not used as collateral in a manner similar to FTX:

This is the most important assumption to be noted in this assessment: US-domiciled public crypto exchanges under US regulatory supervision are solvent.

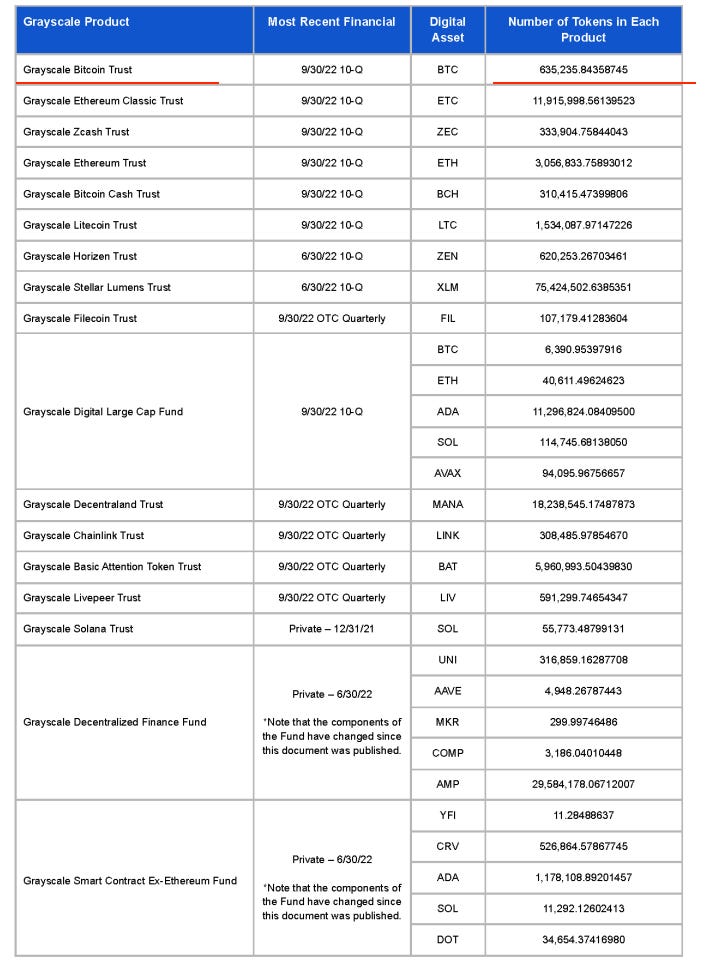

I am assuming that all public crypto exchanges and trusts regulated by the SEC/CFTC are solvent and trustworthy. In plain-speak, I trust that Coinbase is really in possession of the 635,235 bitcoin tokens they’ve stated in the aforementioned disclosure.

Why? The regulatory compliance mandated by the SEC/CFTC for US-domiciled crypto exchanges has proven to be effective to-date. All exchange catastrophes we’ve witnessed have been a byproduct of unregulated off-shore crypto firms domiciled in The Bahamas, Antigua, Hong-Kong or some other far-away land with a loose regulatory framework and/or governing body that can be sold to the highest bidder.

For example, the FTX regulatory probe commissioned by the US DOJ, SEC, and CFTC is centered around FTX Trading Ltd, a legal entity domiciled in Hong Kong & The Bahamas.

The loss of depositor funds, claims of comingling with Alameda Research, SBF’s use of FTX as his personal piggy bank; it’s all related to assets custodied by entities outside of the United States. The legal entity of FTX.US (dba as LedgerX) is not included in the regulatory probe related to the theft of depositor funds.

Note the LedgerX letter to customers outlining the solvency of the exchange:

….which is reaffirmed in the declaration of FTX’s chapter 11 bankruptcy proceedings:

Should I see US crypto exchanges under SEC/CFTC regulatory oversight engage in acts of customer deposit theft, illicit comingling of funds, or other illegal activities, my position on GBTC may change, but until then, we operate under the assumption that all public crypto exchanges & trusts regulated by the SEC/CFTC are solvent and in-possession of depositor funds.

The investment thesis of GBTC

As of this writing, GBTC is trading at a discount of 48% to its underlying asset.

Said another way, $1 of bitcoin can be acquired for 52 cents. Should:

The GBTC/BTC spread converges toward upside parity, or

Grayscale find a way to redeem its GBTC shares at its NAV

…it represents an upside of 94%. Note the $100,000 simplified trade below.

A 94% ROI sounds compelling, especially against the backdrop of the broader crypto market underperformance, with 2022 returns ranging from -29% to -100%.

What’s impactful in this assessment is GBTC’s inability for its holders to sell the underlying bitcoin asset and exit the position.

I personally draw similarities to eth stakers in that once Ethereum is deployed to Beacon Chain, it’s a one-way street. Stakers can’t redeem staked eth until the Ethereum Foundation releases an upgrade allowing withdrawals.

In Grayscale land, investors deploy US dollars and/or Bitcoin into The Grayscale Bitcoin Trust and receive GBTC shares in return. Investors are required to hold to GBTC for six months, at which point the GBTC shares can be sold on the open market to retail bag holders. What investors can’t do, at any point, is redeem the Grayscale shares for bitcoin at its NAV. Their only options are to HODL or sell GBTC shares and the prevailing market rate.

During boom cycles, institutional investors like 3AC would dump GBTC shares on the open market after the 6-month lock-up period and capture the premium, sometimes as high as 40%. Given the discount that exists against today’s spot price, institutional investors are unwilling or unable to unwind their GBTC shares & realize a ~40% to 50% loss. Institutions are the new bag holders.

The only path to profitability for institutional investors as well as any holder of GBTC is if the trust is able to redeem GBTC shares for its underlying asset bitcoin, which would return bitcoin to its shareholders at the NAV price pro-rata the amount of GBTC shares owned.

This path to redemption is the opportunity.

Path to redemption

There are three paths through which Grayscale could redeem GBTC shares for the underlying bitcoin asset.

1. Shareholders could vote to dissolve the GBTC trust

Article X in the Amendment of Trust Agreement within Grayscale’s private placement memorandum outlines that any events which materially & adversely affect the interest of shareholders may only succeed upon majority approval of alteast 50% of its holders.

(ii) Any amendments to this Trust Agreement which materially adversely affects the interests of the Shareholders shall occur only upon the vote of Shareholders holding Shares equal to at least a majority (over 50%) of the Shares (not including Shares held by the Sponsor and its Affiliates). For all purposes of this Section 10.1, a Shareholder shall be deemed to consent to a modification or amendment of this Trust Agreement if the Sponsor has notified such Shareholder in writing of the proposed modification or amendment and the Shareholder has not, within twenty (20) calendar days of such notice, notified the Sponsor in writing that the Shareholder objects to such modification or amendment. - Grayscale private placemement memorandum

One such event could be shareholders voting to dissolve the trust. This would be a liquidation event to trigger bitcoin redemptions to shareholder pro-rata the amount of GBTC shares owned. Given there are ~635,235 bitcoins in GBTC, and there are 692,370,100 shares outstanding, each GBTC shareholder would receive ~0.0009 bitcoins per share, discounted at $7.80 with a fair market value of $15.15, not bad.

The challenge is that GBTC ownership is sparse and not centralized. Getting 50% of GBTC shareholders to vote to dissolve the trust is a problematic, uphill battle. Excluding DCG, which owns ~9.53% of the trust (and is excluded from shareholder voting rights), the remaining 13 shareholders represent only 1.45% of shareholder interests…

..even if ARK, Horizon, and the remaining were all on board, they would still need support from ~50% of the aggregate shareholder population to proceed. Given the disparities amongst shareholders, in volume, appetite and investment thesis, I see this option as a non-starter. Zero percent chance of seeing 50% of any shareholder population aligning towards a unified goal.

Probability of option 1 = 0%.

2. Grayscale could dissolve the trust

Grayscale reserves the right, at any time, for any reason, to dissolve the trust, at its sole discretion.

The Sponsor may, in its sole discretion, dissolve the Trust if any of the following events occur:

…the Sponsor determines, in its sole discretion, that it is desirable or advisable for any reason to discontinue the affairs of the Trust. - Grayscale private placemement memorandum

Grayscale charges a two percent management fee to shareholders for the privilege of owning its shares. In a bear market, this equates to approximately $200m/annually on a pre-tax basis.

Grayscale is, without a doubt, the cash cow of Digital Currency Group, its parent company. DCG has deployed capital to 200 individual crypto firms and operates seven subsidiaries. Given the breadth and depth of its reach, it should be no surprise that the DCG CEO announced the firm was on pace to book ~$800m of revenue in 2022.

What is surprising is that despite the broad basket of investments and subsidiaries under the DCG umbrella, Grayscale still accounts for ~25%-35% of DCG’s pretax revenue. Why would DCG elect to dissolve a trust which accounts for 30% of its revenue? They wouldn’t.

Grayscale even stated as such, in their 2022 year-end letter to shareholders:

…we currently expect that we would continue operating GBTC without an ongoing redemption program until we are successful in converting it to a spot bitcoin ETF - Grayscale 2022 end of year CEO letter to investors

Said another way, there is no chance in hell that Grayscale voluntarily dissolves the trust.

Probability of option 2 = 0%.

3. SEC grants Grayscale conversion to ETF

Grayscale’s goal since inception is the conversion of GBTC into an ETF. Repeated multiple times across multiple newsletters, it’s the same talk track:

Grayscale is unequivocally committed to converting GBTC to an ETF. We have left no stone unturned. We have leveraged the full resources of the firm behind this effort and, in true Grayscale fashion, we will always operate in the best interests of our investors. - Grayscale June 2022 investor letter

Grayscale wasn’t the first financial institution, nor will it be the last, to petition the SEC for an ETF conversion. All issuers have experienced the same outcome: rejection from the SEC, as noted in the table below.

Since 2019 there have been at least 14 applications to issue a bitcoin spot ETF. 13 have been denied, including Grayscale. The latest applicant, BlockFi, is subject to bankruptcy proceedings via the FTX fallout, so we assume they are DOA.

ETF conversion matters because of regulatory language related to “Regulation M”, a step in the ETF application process that allows Grayscale to simultaneously create and redeem shares at the NAV. Regulation M is the relief that would make GBTC shareholders whole by bringing the GBTC share price to upside parity with bitcoin.

Unfortunately, Grayscale’s spot bitcoin ETF was denied by the SEC on June 2022. This triggered Grayscale to initiate a lawsuit against the SEC, demanding relief from the SEC’s “disparate, arbitrary and discriminatory treatment of spot ETF applications":

…the Commission has arbitrarily treated spot bitcoin ETFs differently from bitcoin futures ETFs, resulting in discriminatory treatment, even though both derive their pricing from the same underlying spot bitcoin markets. Grayscale lawsuit opening brief

SEC’s reply brief defends its decision on the basis that bitcoin spot ETFs are not subject to the same regulatory surveillance that exists with bitcoin futures contracts, thereby justifying the disallowment of the bitcoin spot ETF application:

Grayscale’s arguments also rest on faulty assumptions regarding the Commission’s analysis. Grayscale asserts that, in approving futures-based products, the Commission “necessarily” determined that the risk of fraud and manipulation in the spot bitcoin market was acceptably low.

….the Commission’s analysis focused on the ability to detect and deter fraud and manipulation of the assets underlying that type of product.

With respect to the approved futures-based products, those underlying assets trade on the Chicago Mercantile Exchange and investors are protected by direct regulation of that market as well as an agreement between the Chicago Mercantile Exchange and the national

…. By contrast, all of the markets for the spot bitcoin underlying Grayscale’s product are unregulated, and Grayscale failed to show that surveillance of the CME bitcoin futures market would detect and deter fraud and manipulation targeting those spot markets. - SEC reply brief

Putting it all together, the SEC approved bitcoin futures ETFs but has been systematic in rejecting bitcoin spot ETFs. The SEC’s rationale for rejecting spot bitcoin ETFs is due to the lack of comprehensive legislation, surveillance, and ability to detect and deter fraud as well as manipulation within the bitcoin spot market.

This is the hurdle Grayscale will need to overcome: proving to the SEC that bitcoin spot ETFs have the appropriate mechanisms to protect retail investors. Grayscale will need to provide a response by February 2023, at which point a disposition will be made by a US Appeals Court on or before Q4 2023.

With the fallout of FTX and the broader collapse of the crypto ecosystem in 2022 there may be a renewed mandate for regulators to enact legislative policies that “help protect retail investors” in 2023. The outcome of this lawsuit could be one such policy.

Probability of option 3 in 2023 = 50%. US Court of Appeals will either approve or deny Grayscale’s bitcoin spot ETF application.

The trade and potential upside

If we assume the disposition of the Grayscale vs. SEC lawsuit is the approval for bitcoin ETF conversion, this means Grayscale will be able to create and redeem shares at the NAV, bringing the spread between the NAV and market cap to zero.

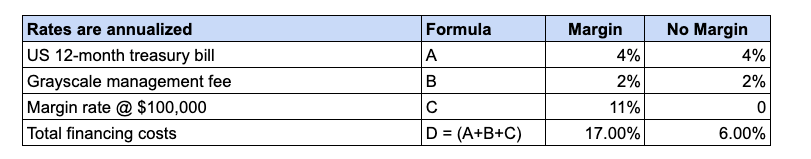

So what are the costs of this trade? We outline three financing costs:

A risk-free rate of return (this is our cost of capital)

Grayscale’s management fee

Margin fees associated with leveraged exposure

GBTC is not an optionable asset, so in order to maximize exposure, we would enter a margin trade and be subject to the broker’s margin rates.

If we sell $100,000 USD, to buy GBTC at the current market rate of $7.80, our annualized financing and opportunity costs are defined below:

A principal deposit of $100,000 with a 1.25x leveraged position

Gives us exposure to ~16,025 GBTC shares at $7.80

…and If the bitcoin spot ETF application is approved:

The underlying GBTC asset would be redeemed at its NAV of ~$15.15

After accounting for financing costs, our trade would yield a pre-tax profit of 100%

A $100,000 position generates $242,788 or a profit of $100,471 after financing costs. The chart below outlines the underlying math:

An unleveraged position based on the same parameters would yield a ~82% return. If the spot ETF application were denied, our downside risk after a one-year holding period would be -10% on a leveraged position and -6% on an unleveraged position.

There’s an important caveat in this analysis in that:

We’re assuming the Grayscale bitcoin trust has bottomed and will trade sideways until a disposition of the spot ETF application

There will be a disposition of bitcoin spot ETF application in 2023

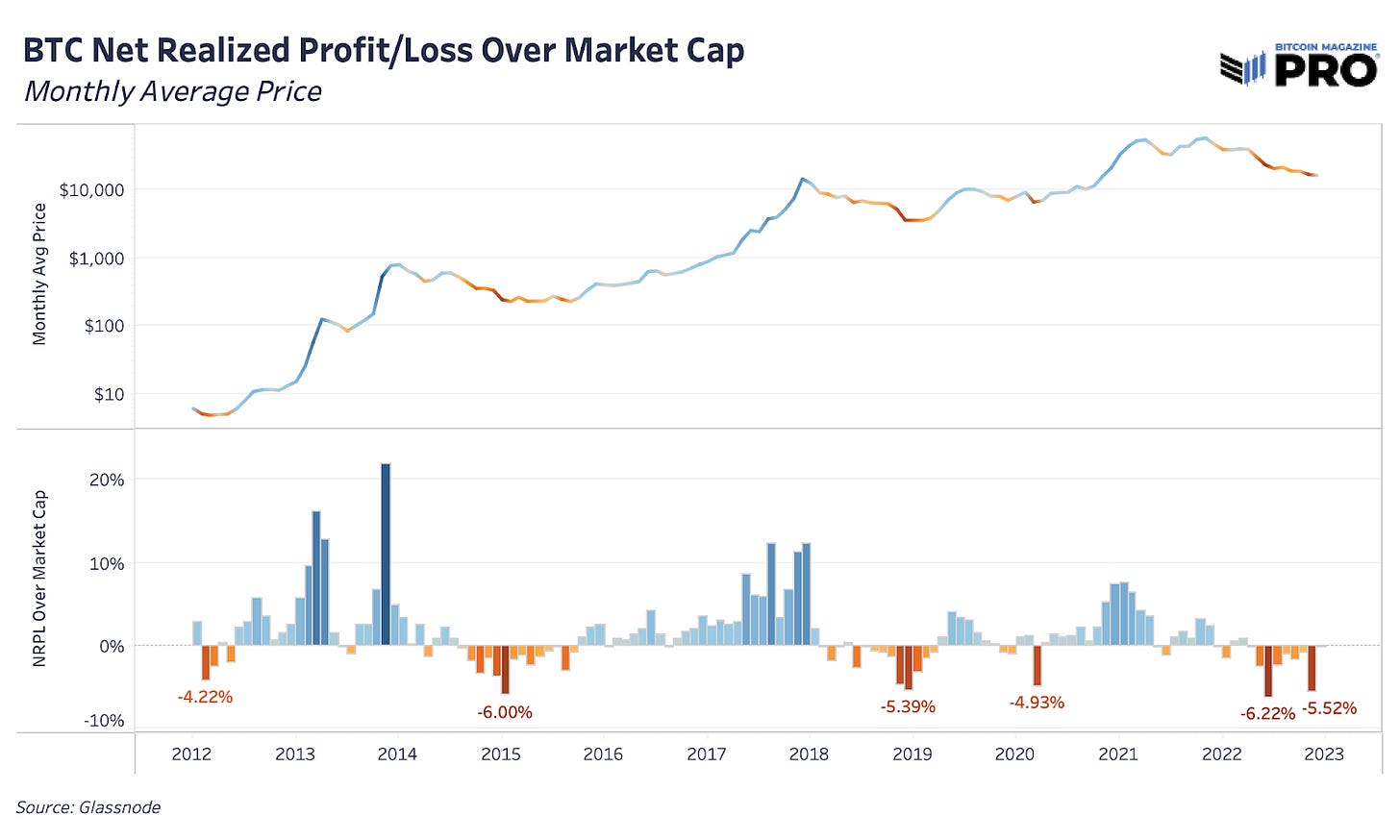

I do believe we are approaching a bitcoin bottom, which we can quantify by analyzing extended periods of forced selling, capitulation & realized losses. Bitcoin Pro posed an interesting analysis by comparing the bottom signals in the November 22 crash vs the July 22 Luna/Terra crash, March 2020 COVID sell-off, and December 2018 cycle bottom:

and concluded signs of bottom-like capitulation with extended uncertainty over the next six months:

On one hand, bitcoin’s realized market capitalization has taken a significant hit in the previous round of capitulation. That’s a promising bottom-like sign. On the other hand, there’s a case to be made that price being below realized price could easily last another six months from historical cycles and the lack of capitulation in equity markets is still a major headwind and concern. - Bitcoin Pro Magazine

…but if the bitcoin spot ETF application were to persist into 2024 and beyond, we’d now have to reprice the return against annualized financing costs. Outlined below, we quantify how a 17% carrying cost for four years would eliminate ~ $53,000 of our principal balance.

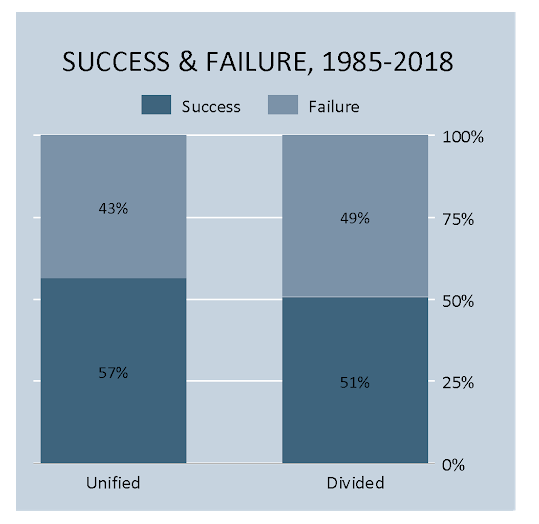

If Grayscale can’t convert to an ETF in 2023, it is doubtful that we’d have such an outcome in 2024, especially against the backdrop of a divided US congress, which has proven to be ineffective at passing bipartisan legislation.

We can glean data from legislative think tanks like the Niskanen Institute, which performed an analysis of each congressional majority’s party political agenda from 1985 through 2018. Niskanen concluded:

..that unified control of national government only modestly improved the parties ability to enacting laws aligned with the the parties agenda priorities.. - Niskanen Institute

A divided congress passes new legislation only 51% of the time. For this reason, I would not hold GBTC beyond 2023 if the bitcoin spot ETF application was denied.

What do we do?

Given the aforementioned assumptions and analysis:

Grayscale’s custodian Coinbase has custody of the bitcoin assets

The trust is not co-mingling its funds with other DCG entities

There will be a 2023 disposition of the spot ETF application

GBTC will trade sideways until said disposition takes place

This is a trade I will be executing in 2023. For every $1 of GBTC bought, we are presented with a pre-tax upside of $1.04. I’ve seen a lot of posts outlining ways to trade the GBTC discount via derivatives and/or perpetual swaps. Although viable options, this is by far the easiest to understand with a controlled risk framework. The outcome is binary:

BTC spot ETF application approved = profit

BTC spot ETF application denied = loss

As always, conviction is built into the analysis. If this analysis sounds unconvincing, or maybe you don’t agree with my assumptions, the path of least resistance is to just buy and hold bitcoin. As disciples of Satoshi, it will pay off in the long run.

To knowledge and wisdom,

John Cook

December 30th, 2022

San Francisco, CA

www.frontruncrypto.com

Article cover generated by DALL-E: “A watercolor painting of Michelangelo predicting the price of bitcoin with an abacus”