How to steal $16 billion dollars

How crypto bank FTX stole $16 billion dollars of depositor funds

⚠️ Author’s note: You may notice archive.org links used throughout this guide. It is because the elites and invisible hands responsible for this diaster are actively trying to delete previously published FTX endorsements from the internet. Too bad the internet never forgets.

Dear frontrunners,

Take a moment and watch the 41-second clip below. It is Sam Bankman-Fried, a 30-year-old crypto billionaire and operator of an online crypto bank called “FTX”. In a 2022 congressional hearing, he is advocating for regulatory oversight to safeguard retail investors from crypto ponzi schemes….

…This same person advocating for regulatory oversight to safeguard the plebs is now being accused of using depositor funds in “bespoke non-reported transactions between financial counterparties”. Did he fool you? Don’t feel bad. He also fooled Blackrock, Forbes, Bloomberg, Sequoia Capital, The City of Miami, Tom Brady, Giselle Bundchen, The Ontario Pension Fund, and the entire Ethereum community, who rallied behind him as a modern-day JP Morgan.

If this is the last paragraph you read: let this be a reminder that the talking heads on TV are not infallible just because they have more money than you, have more followers than you, went to a better university than you did, won more Superbowls than you did, or work for an employer that is more prestigious than yours.

Greed begets greed and in this analysis, we outline how SBF lost $16 billion dollars in depositor funds and destroyed $4 billion in wealth via the collapse of the FTT token.

If you’re looking for a detailed recap of the on-chain events and tweets that transpired over the past week - I recommend you first read Bitcoin Pro’s recap or Bankless Nation. A good timeline of events can be found at “Web3 is going great” and Glassnode published a 28-minute youtube video capturing the contagion and stablecoin bank run in real-time.

Welcome to the party.

The TLDR is that Alameda Research used FTX depositor funds to facilitate bespoke, leveraged investments which ultimately went to zero. This is illegal. The link between Alameda and FTX is The CEO of FTX (Sam Bankman-Fried or SBF, for short) was the founder of Alameda Research.

Alameda Research

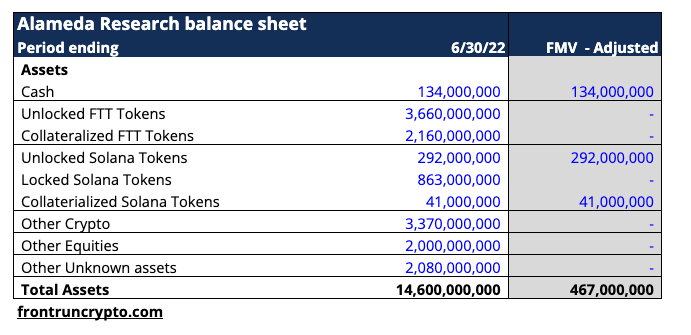

The initial source of contention wasn’t the co-mingling of FTX depositor funds, but rather the insolvency of Alameda Research via a leaked balance sheet shared by Coindesk. On November 2nd it was disclosed that Alameda Research had at least $7 billion in US-dollar-denominated liabilities offset by $14 billion in “assets”. The consensus and my theory are that the assets listed by Alameda are not worth $14 billion for 3 reasons:

The FTT token is illiquid and trades at 50% of the fair market value marked to the FTX/USD order book.

Alameda’s position in the FTT token represents between ~50% to 100% of the circulating supply.

Other equities and crypto investments are in speculative penny tokens and alt-layer 1s like MAPS, OXY, FIDA, SIU and are not easily redeemable for US-denominated dollars at market value.

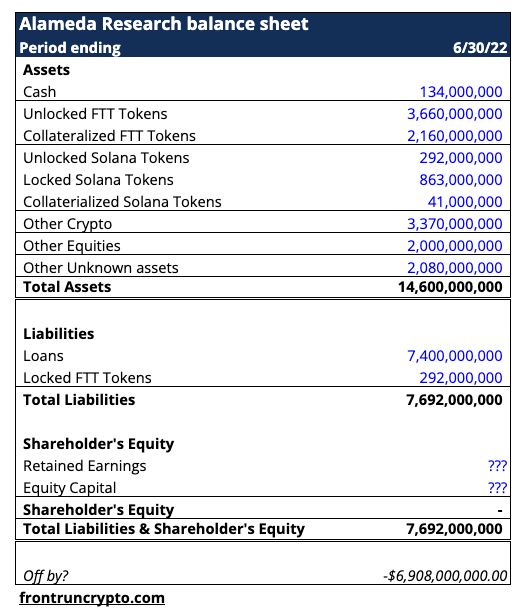

My best guess based on all available data is Alameda’s balance sheet looks like this: $14 billion of “assets” against $8 billion of known debt and $6.9 billion of unknown debt. I doubt Alameda has $6.9 billion of retained earnings or equity on its balance sheet, it is best case an accumulated deficit. Something is wrong.

The leaked, incomplete balance sheet of Alameda Research has many red flags:

There are $5.8 billion of FTT tokens and FTT collateralized tokens (assets borrowed by Alameda backed by FTT tokens). As of 6/30/22 only $3.2 billion of FTX tokens were in the circulating supply. This is highly sus.

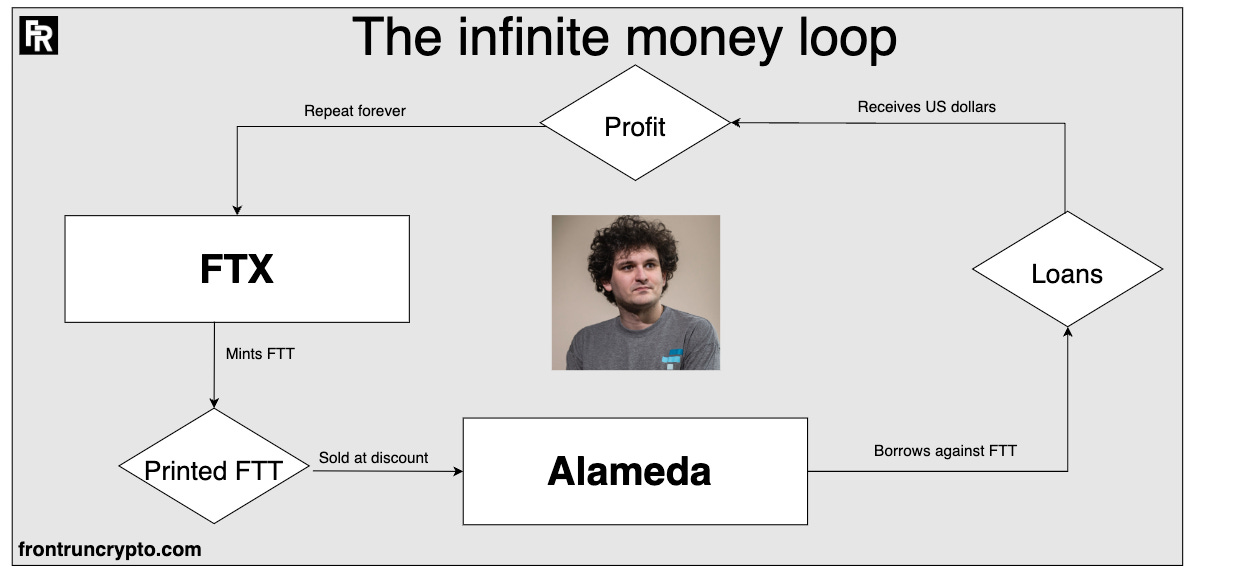

How is it possible that Alameda Research owns $5.8 billion of FTX tokens when only $3.2 billion are in the public supply? The FTT token is controlled and managed by FTX, this means FTT tokens can be created out of thin air in what is called “an infinite money loop”:

FTX pre-mines or “mints” 350,000,000 FTT tokens

Note: All of these tokens exist but are inaccessible to the general public

FTX releases a subset of the FTT tokens to the public supply

FTX transfers a subset of the FTT tokens to Alameda

this is the $5.8 billion of locked and collateralized FTT tokens noted on their balance sheet

Alameda uses the FTT tokens as collateral for US dollar-denominated loans

Alameda makes risky investments, wins some, loses some but mostly loses

FTX releases more FTT tokens and sells to Alameda at a discount

The cycle repeats

What makes this “infinite” is FTX’s ability to control the token supply via burning and buybacks. From the FTX website:

When FTX needs to remove FTT tokens from circulation:

FTX buys back FTT tokens

Tokens are stored in the treasury

When FTX or Alameda needs to raise more capital, uncirculated FTT tokens are then re-released to the public via the infinite money loop

An important point of distinction is when the FTT token is repurchased it is not “destroyed” from the public record. My prediction is that FTX throttled the total circulating supply of FTT tokens and used pre-mined and tokens-not-in-circulation as a backstop for Alameda Research. How else can we explain that Alameda’s position in FTT tokens is greater than the total supply in circulation?

Contrarians to this might argue that FTT tokens are “burned” and removed from circulation via an un-spendable address but there has been zero proof given to this theory and FTX has offered no proof-of-burn mechanism to corroborate their claim.

Moreover, the aggregate value of all crypto-related assets is a reflection of highly illiquid, volatile, penny tokens.

The illiquidity of the FTT token and lack of revenue accruing to token holders implies a worthless token. That is $5.7 billion marked down to $0 (this is the position taken by Sequoia Capital).

“Locked Solana tokens” implies tokens that are out of circulation, a result of a pre-mine on a vesting schedule. That is $863 million marked down to $0.

“Other crypto tokens” reflect nascent web3 projects like MAPS, OXY and FIDA. These are highly illiquid penny tokens, and should be marked down to $0.

My assessment of the fair market value of all assets on Alameda’s balance sheet is ~$500 million, depicted below.

FTX

At this point, all that’s known is that Alameda has between $8 billion and $14 billion of debt backstopped by ~$400 million in real assets. The link to FTX bankrolling Alameda Research was exposed by Coinmetric’s Head of R&D Lucas Nuzzi, who noted that 173 million FTT tokens were activated around September 26th. Note this step 1 in the infinite money loop, creating new tokens from thin air.

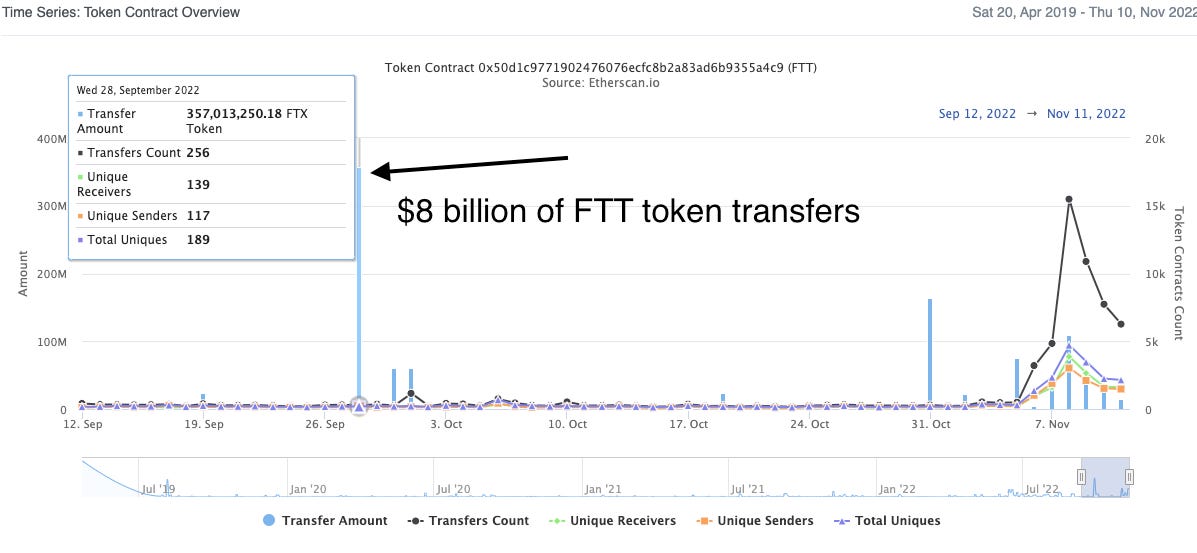

That same day over $8 billion USD of FTT tokens were transferred on chain; the single largest move in the history of FTX.

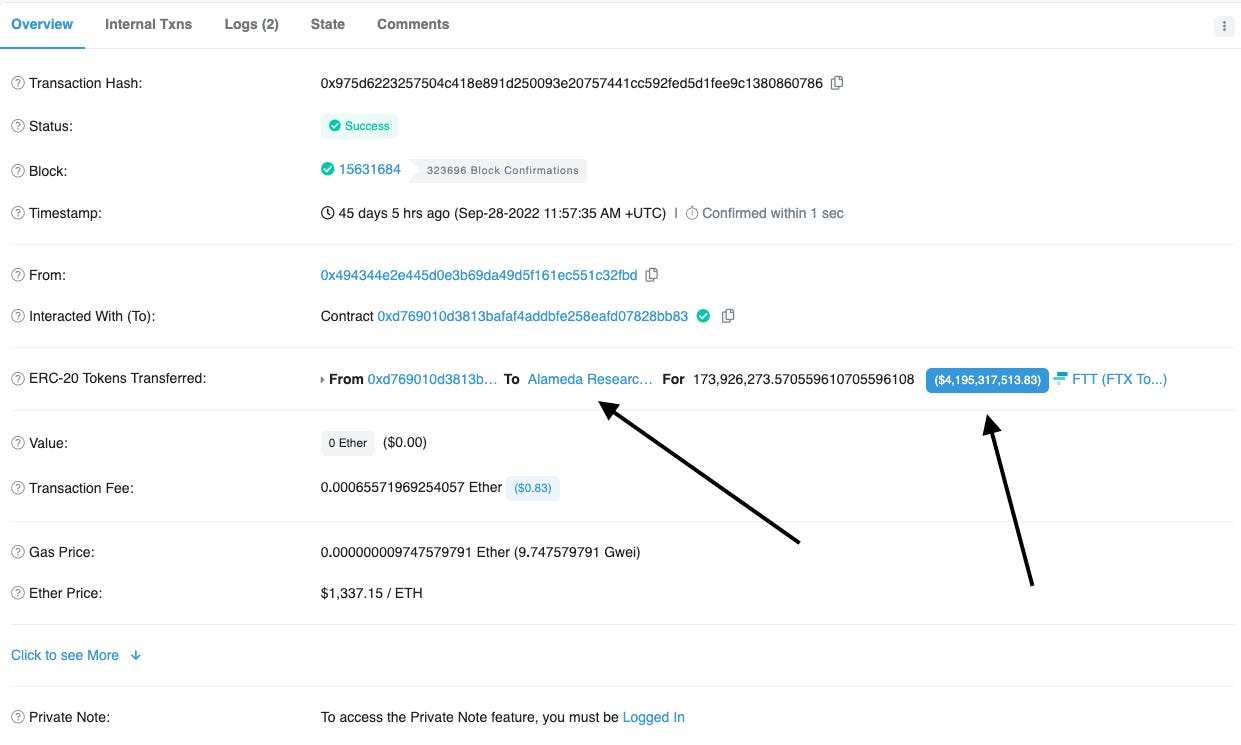

Who was the recipient of the newly activated FTT tokens? Alameda Research. $4.1 billion of newly minted FTT tokens were sent to Alameda.

What’s so damning is the contract that released the 173 million FTT tokens is the same contract from the 2019 FTX ICO! Ouch.

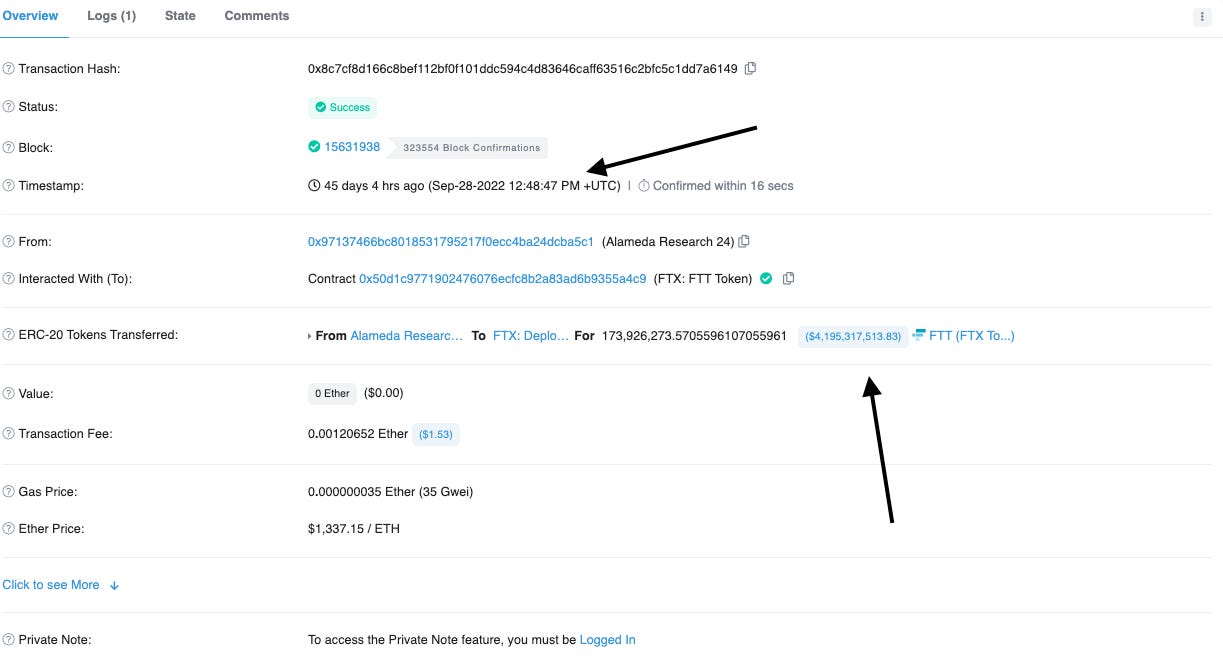

It’s so obvious that Alameda and FTX are deeply interconnected despite the facade of independence previously portrayed by SBF. Alameda participated in the FTX ICO. So what does Alameda immediately do with the $4.1 billion of FTT tokens it received? Alameda posts FTT tokens back to FTX as collateral. We can’t make this up!

Alameda auto-vested $4.1 billion of FTT by immediately sending the tokens back to FTT token creator. The 173 million FTT tokens are effectively used as collateral by Alameda as follows:

173 million new FTT tokens were “activated” on 9/26

$8 billion dollars of FTT tokens were “moved” on 9/26

$4.1 billion dollars of FTT tokens were sent to Alameda Research on 9/26 11:57 AM UTC

$4.1 billion dollars of FTT tokens were sent from Alameda Research back to the deployer of the FTT token on 9/26 12:48PM UTC

This acts as the collateralization mechanism for the 173 million FTT tokens

and enables Alameda to claim $4.1 billion of assets on its balance sheet (the 173 million tokens)

…and once the 173 million FTT tokens are eligible for liquidation (via FTT’s token supply schedule), the deployer of the FTT token (controlled by someone at FTX) programmatically liquidates the position - the debt is paid off.

This is the infinite money loop.

Why would SBF do this?

My theory is that Alameda Research was wiped out during the most recent crypto winter, along with Luna, Celsius, BlockFi and others. It was only able to remain solvent via the 173 million FTT tokens received from FTX.

If Alameda imploded in the April to June timeframe, it would have been a terrible look given SBF’s aspiration for global dominance with a regulatory landscape controlled by FTX. We can see around this time FTX officials meeting US government regulators:

How credible would the FTX team be in the eyes of Gary Gensler and the SEC if their proprietary trading firm went to zero? Would they have a seat at the table? The answer is no.

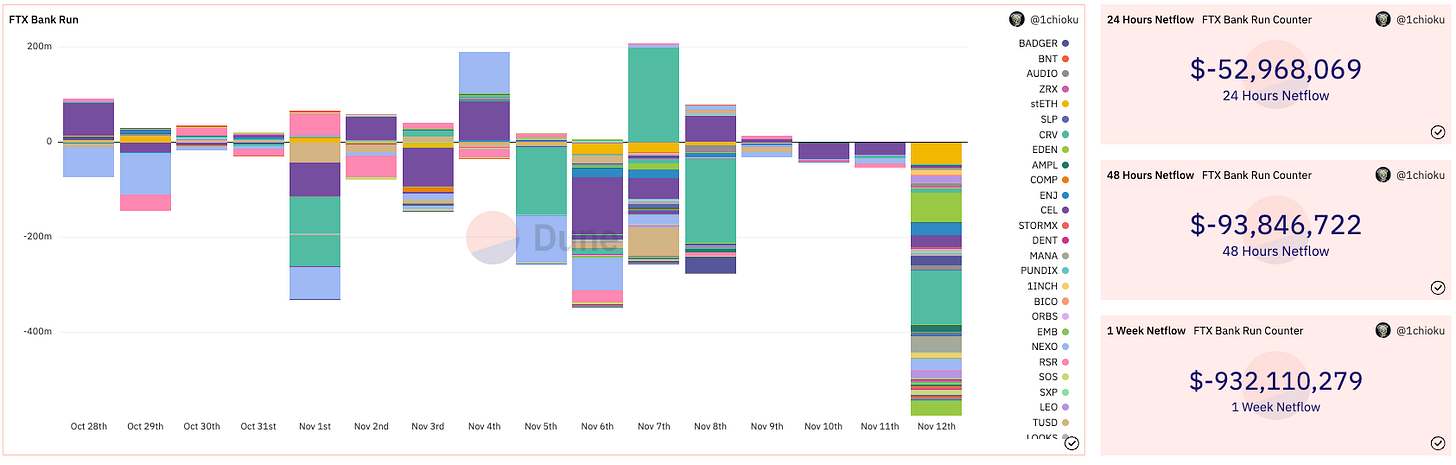

What caused the bank run?

The interplay between FTX and Alameda, although illegal, would have turned out “ok” if a subsequent bank run on the FTT token didn’t ensue. The velocity of the collapse is impressive. I attribute it to 3 people and 5 tweets across 2 days:

Alameda’s CEO tweeting that the coindesk article is incomplete at best….

Binance’s CEO (who is FTX’s number 1 competitor) tweeting that he is liquidating his $2.1 billion FTT position…

Alameda’s CEO responding to Binance’s CEO offering a sale of FTT tokens at $22…

…only to have it declined by Binance…

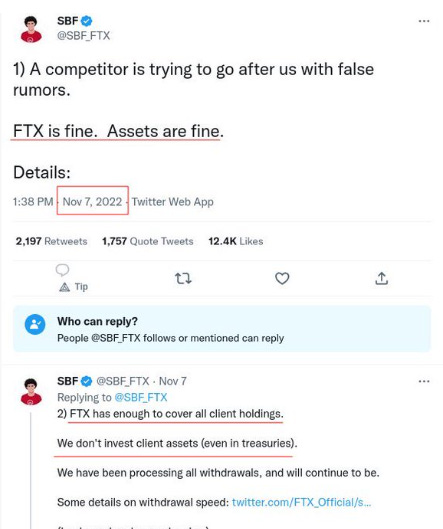

At this point, SBF interjects by tweeting (and deleting) that “everything is ok” and depositor funds were safe…

Retail traders took note and fled to safety by liquidating their FTT positions, causing downward pressure from the token high of $68/token to $1.98/token as of this writing.

$8 billion dollars of ponzi wealth, destroyed.

The only problem? Depositors are unable to withdraw their funds - FTX, including its US domicile, suspended withdrawals as a result of the ongoing liquidity crunch. FTX did not have enough capital to facilitate customer withdrawals because:

The initial loans provided to Alameda Research, collateralized in FTT tokens, were now subject to a liquidity crunch as a result of the declining FTT token price

FTX continued to backstop Alameda by using depositors’ funds but could not maintain pace with the downward pressure of the FTT token price

SBF eventually capitulated and acknowledged depositor funds were not safe and the trading platform was indeed leveraged…

…and unable to fulfill the persistent stablecoin outflows and declining FTT token price…

….FTX and its 134 subsidiaries filed for chapter 11 bankruptcy on Friday 11/11/22, but hey, at least SBF is really fucking sorry.

In closing.

The capital destruction of FTX ($8 billion) and loss of depositor funds ($16 billion) is a black eye for crypto and will result in government regulators demanding “more exchange oversight”, “comprehensive legislation”, and “regulatory clarity” to help protect retail investors. As open finance maximalists, we must reject the call for additional government oversight. The most appropriate response to the persistent destruction of wealth from centralized exchanges is self-custody and decentralized finance.

Would this happen on DeFi platforms like uniswap or AAVE? Could it happen? No. This is because of the permissionless nature of DeFi and the enforcement of counter-party risk via smart contracts.

If you traded crypto in Uniswap - you are safe

If you traded crypto in AAVE - you are safe

If you provided eth on a DeFi lending platform - you’re actually making a decent yield as a result of increased network demand

Now is the time to take custody of your crypto.

John Cook

San Francisco, CA

November 12th, 2022

www.frontruncrypto.com

Article cover generated by DALL-E - “An impressionist oil painting of medieval bankers set on fire by town authorities”

tweet of the week - “..and they call me a criminal” - Edward Snowden