Grayscale misconduct & conflicts of interest within Digital Currency Group

Part 2 of Untangling Digital Currency Group | We review claims of Grayscale misconduct, lack of accountability & competing interests with parent company DCG

Dear frontrunners,

What an interesting turn of events. On January 15th, we published part 1 of “Untangling Digital Currency Group” where we explored the complex relationship between Gemini and DCG’s subsidiaries Genesis and Grayscale, only to have the Genesis lending desk “Genesis Capital” petition for bankruptcy five days later.

Our catalyst for writing this two three-part series remains the same:

Shine the light on Gemini’s double-speak with respect to “advocating for their customers” versus what their lawyers say in legal proceedings

Expose the leveraged DCG merry-go-round

Outline potential subsidiaries’ conflicts of interest and misconduct

…but given the recent backdrop of the Genesis bankruptcy, I’ve decided to extend part 3 to include:

Accounting irregularities and potential fraud associated with Genesis

Conclude with an assessment of the complex legal structure within the DCG ecosystem that made this insanity possible

For the many many new subscribers to Frontrun (hello and thank you!) who have not read part 1, here is the speed run:

There were leverage trades between Genesis, 3AC, and Grayscale

Genesis issued loans to 3AC under its stated collateralization threshold

Genesis was the only legal entity allowed to create shares of GBTC/ETHE

Gemini Earn’s terms of service outline the possibility of complete loss of principal, which no one read.

…while also extrapolating the possibility of the Genesis & 3AC flow-of-funds mirroring something similar to a ponzi or at least a game of hot potato.

How? New funds entered the Genesis, 3AC, Grayscale loop while older deposits were paid out. Describing this as a “ponzi” might be an overstatement, but keep in mind Genesis issued long-term debt to 3AC against its short-term deposits from Gemini. This mean short-term collateral was used to facilitate long-term borrowing. This is a vector of risk because when the depositors of the short-term collateral (Gemini Earn members) collectively demand their money back, you have a “bank run”. Genesis was only able to keep the merry-go-round in action with a new stream of depositors, Gemini Earn members.

It’s unfortunate that the music stopped with the Gemini Earn participants, who were left holding the bag as a result of poor diligence across Gemini, Genesis, and 3AC.

In part 2 (this post) we analyze:

Claims of Grayscale malfeasance & intentional deception

DCG’s Grayscale conflict of interest

Claims of Grayscale malfeasance

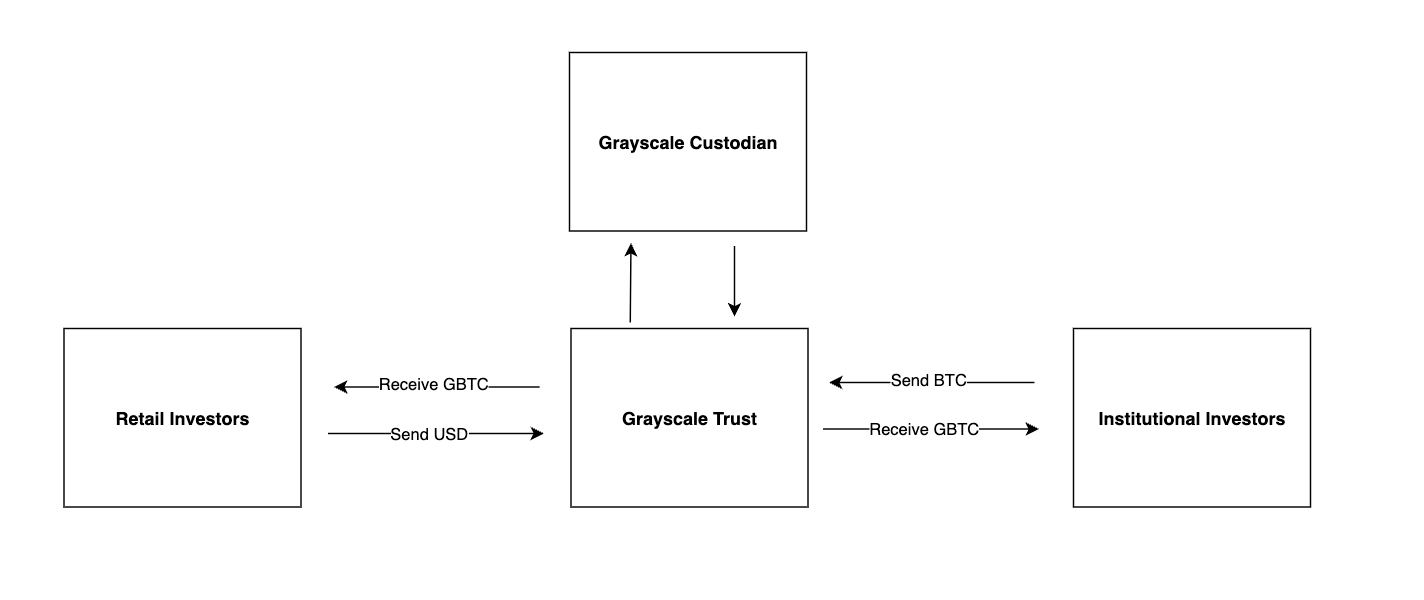

The Grayscale trust was a private investment vehicle formed in 2013 to grant institutional and accredited investors exposure to Bitcoin without the risk of buying, selling, or holding Bitcoin themselves.

Grayscale provided accredited investors the opportunity to own Bitcoin, then Ethereum, without having to worry about private key management. The Trust issued shares to stockholders in exchange for deposits of cash or Bitcoin and, in its early years, distributed Bitcoin to stockholders who sought to redeem their shares. Its investment objective was for the shares to reflect the performance of the market price of Bitcoin..or at least it was.

Two separate lawsuits filed in the past 90 days by different stockholder groups make the same claim, Grayscale is failing to execute the original investment purpose of the trust: “for the shares to reflect the performance of the market price of bitcoin” (and later Ethereum + others).

Nearly a decade later, the Trust has flagrantly disregarded its purpose and utterly failed to achieve its stated objectives. In fact, the opposite has occurred. Grayscale, the Trust’s Sponsor since inception, prohibits investors from redeeming their Shares. The Trust’s Share price has collapsed by 80% within the past year alone. Shares now trade at a steep 40-45% discount to net asset value (“NAV”). This means that for every dollar of Bitcoin owned by the Trust, its corresponding Shares are worth only 55 cents. - Fir Tree Partners v Grayscale Investment

Why would Grayscale intentionally abandon its investment goal of “reflecting the performance of the market price of bitcoin"? Stockholders of Grayscale cite a perverse conflict of interest with its parent organization DCG.

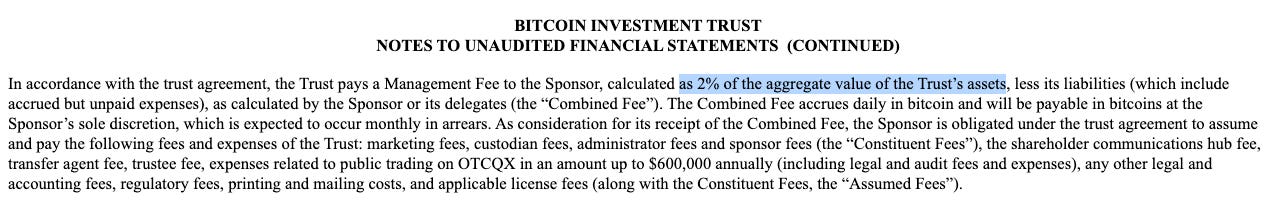

While Grayscale charges a two percent management, what acts as a point of contention for its stockholders is how the fee is calculated: Grayscale calculates it based on the value of the Bitcoin held by the trust, not the market value of the Trust’s shares.

210K Capital says this creates an incentive for the trust to increase the number of investors, horde the Bitcoin, and restrict redemptions. My contrarian point of view immediately compels me to ask investors what drove them to deploy their capital to the trust in the first place? Specifically:

What compels retail investors to deploy US dollar capital into an investment product with a two percent management fee based on NAV with a fluctuating market price that has historically traded at a premium or discount?

What compels an institutional investor to deploy BTC/ETH into a one-way trust that suspended redemptions and has re-stated it will only resume redemptions if approved by the SEC which has denied the prior 13 requests?

There is only one answer, and it is greed, the desire for capital appreciation:

Retail investors deploy US dollar capital into Grayscale because:

They believe BTC/ETH will appreciate in value at a higher rate than other equities in their brokerage account (Thesis up to 2021)

They believe the GBTC/ETHE discount will converge with its holdings/share price to realize a 50-150% gain (Thesis 2021 to current)

Institutional investors deploy BTC/ETH into Grayscale because:

Retail buyers were willing to pay a premium to own bitcoin & ethereum via the GBTC/ETHE trust shares

Institutional investors capitalized on this by depositing BTC & ETH into the trust, receiving GBTC/ETHE shares in return, and selling 6 months later

This was the path to prosperity for both parties, and I even wrote about bullet point 1.1 in a prior article, a thesis I still believe to be true.

Regardless of trade, Grayscale always wins:

The trust receives USD from retail investors in exchange for GBTC

The trust receives BTC from institutional investors and returns GBTC

Grayscale collects the management fee on both sides

So why not withdraw?

If investors are so dissatisfied with the performance and/or management fees of the trust? Why not redeem their trust shares for the underlying asset? A sustained reduction of assets under management would force Grayscale to re-evaluate its management fees, and a mechanism to redeem trust shares for its underlying would force parity with the asset’s spot price. The short answer is trust shares cannot be redeemed for the underlying asset due to regulatory constraints related to a “Regulation M” requirement, only possible with an ETF conversion. For more information on Regulation M and ETF conversion, consider reading this article.

We’ve operated under the assumption that Grayscale is acting in good faith to move toward an ETF conversion. Not only is Grayscale suing the SEC but they’ve stated ETF conversion as a goal in multiple investor newsletters:

Grayscale is unequivocally committed to converting GBTC to an ETF. We have left no stone unturned. We have leveraged the full resources of the firm behind this effort and, in true Grayscale fashion, we will always operate in the best interests of our investors. - Grayscale June 2022 investor letter

But what if the “inability to redeem Grayscale shares for its underlying asset” was not a byproduct of regulatory oversight, but rather intentional restrictions on stockholder redemptions created by Grayscale to maximize management fees?

Reviewing SEC filings and publically available legal documents, we can craft this timeline of Grayscale’s restated declarations and revised trust agreements:

2013 - Grayscale trust launches as a private investment vehicle and shares were redeemable for BTC in “baskets of 100”

2014 - Grayscale suspends redemption program citing Regulation M, but existing stockholders retained redemption rights

2015 - Grayscale trust receives FINRA approval to become the first publically traded bitcoin fund

2016 - Trust declarations are amended to “distribute bitcoin upon redemption of units” and any future amendment could occur “only upon written consent from at least 50% of the stockholders”

2016 - Grayscale settles with SEC via cease-and-desist order against future Regulation M violations and pays a $53,755.59 fine.

2017 - Grayscale completely eliminates redemption rights & limits stockholders’ ability to “remove the sponsor” (Grayscale) except in connection with a few enumerated events

This amendment performed without 50% stockholder’s approval

2018 - Grayscale restates amendment to restrict stockholders from redeeming shares by preventing the trust from operating a redemption program unless otherwise determined by the Sponsor following the receipt of regulatory approval

At this point, it’s 2019 and Grayscale has suspended its redemption program and paid a $53,000 fine. Grayscale has also stated it’s not seeking SEC regulatory approval because it doesn’t believe the SEC would entertain an application for the waiver. In plain English: The only way Grayscale believes its trust shares can be redeemed is via SEC exemption. So how many times did Grayscale submit an application for SEC exemption up to 2019? Just once, in 2016 it withdrew shortly thereafter..

By 2020, stockholders were contesting the hypocrisy in Grayscale’s position to revoke redemption rights subject to SEC approval on two points:

Regulation M compliance only mandates that the creation and redemption of shares not be performed simultaneously

Grayscale has never actually submitted an application for a waiver

How does Grayscale respond? By eliminating the language in their 10-K citing its belief that the SEC would deny approval for the redemption program as an excuse for its failure to resume redemptions!

By 2022, Grayscale has removed all language related to SEC regulatory approval as a pre-condition to redeem shares:

When Grayscale restricted stockholder redemption rights in 2018, the trust had approximately $752M of assets under management with an annualized management fee of $28M. By 2022, AUM grew to $29.6B. Grayscale’s management fee? $615M. An increase of $2,000%. Not bad.

What about the ETF?

If we accept the premise that the only action stopping Grayscale from resuming redemption rights for its stockholders..Is Grayscale. The next question we ask is why? Isn’t Grayscale suing the SEC for ETF conversion? A recent lawsuit by Fir Tree Value Partners laments that the Grayscale crusade to convert the trust into an ETF is:

An exploitative and wasteful campaign destined to drag out in the courts for years

An elaborate marketing expense to lure retail investors into the trust with no way out

How? At its founding, Grayscale stated the trust was only suitable for institutional accredited investors…

…”because of the risky nature of bitcoins, they should not be sold to ordinary retail investors who could buy ETFs. It’s premature for this kind of product to be in the public market. It should not be available to unsophisticated investors” Dealbook, 2013.

Granted that statement was made in 2013, Grayscale stayed true to its founding vision of targeting only accredited investors until 2016, when it launched its #dropgold campaign to attract retail investors, implying that individuals holding gold in their portfolios were stuck in the past…

..and when Grayscale announced its new 34-year-old CEO Michael Sossenshein in 2021, his first mandate was to convert Grayscale into an ETF, stating that it has always been their intention to convert Grayscale into an ETF:

“Each Grayscale product is at various stages of this lifecycle and our intention has always been to convert these products into an ETF when permissible - Micheal Sossenshein, Grayscale 2021.

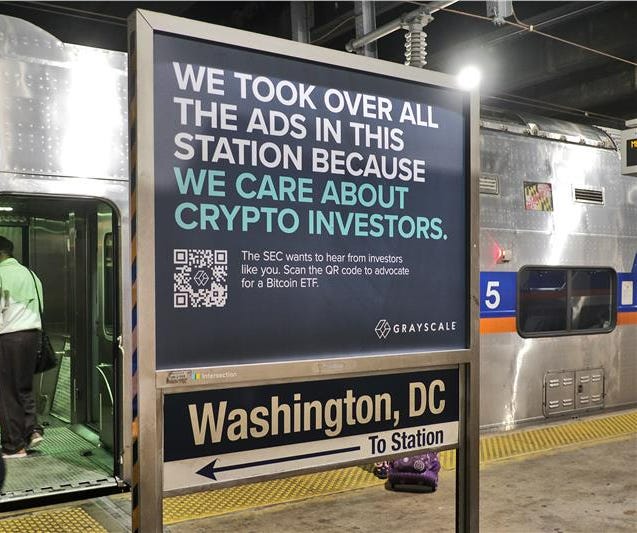

Ultimately this culminates with a series of claims that Grayscale is continuing to push its oversupply of shares to retail traders through various campaigns like:

How dad got into bitcoin

Making crypto accessible to the masses: Grayscale & your 401k

Templated letters of “how you can show your support” with Grayscale & the SEC

Email reminders about submitting comments to the SEC

Advertising that pushed for converting the trust into an ETF

Connection with Digital Currency Group

If you have a sizable position in any Grayscale trust, I encourage you to read the claim against Grayscale here. The central theme in the lawsuit is Grayscale’s conduct as a result of a series of conflicts of interest related to parent company DCG, specifically:

Lack of independent oversight

Grayscale + DCG shared the same CEO

Grayscale + DCG shared the same audit committee including DCG’s CEO, COO & CFO

Grayscale cites no formal procedure to resolve conflicts of interest and instead relies on Grayscale’s management team, the same management team of DCG, to “act in good faith” with no checks and balances

Source - Grayscale 2021 10-K Reliance of affiliated service providers within the DCG corporate entity

Genesis acting as the sole entity to create & redeem Grayscale shares

Grayscale using Coindesk Index to calculate the price of the trust index and management fees

Grayscale relies on Coinbase (of which DCG is a minority owner) to custody its holdings

Do you care to guess how DCG responds to the aforementioned claims of limited independent oversight and reliance of affiliated providers? Complete agreement. Grayscale’s audit committee, the executive team responsible for financial reporting has acknowledged in a recent SEC filing that the described oversight functions are typically performed by an independent audit committee and not the CEO, CFO, and COO of its parent organization (DCG).

Closing thoughts

So if Grayscale is:

Completely beholden to the DCG management team

Intentionally slow-walking the regulation M conversion under a self-imposed set of constraints

Attempting to maximize both institutional and retail investor inflows at the expense of its trust goals

Orchestrating an elaborate marketing campaign to increase inflows on the pretense of an ETF conversion that will never happen

..are the actions to increase its NAV and market price/share at least working? Is the number of Bitcoins in possession of Grayscale, going up? Is the NAV spread decreasing?

Reviewing Grayscale’s annual reports 2019 through 2022 we are able to conclude that over 50% of the fund’s native growth came during the 2020 bull run: 353,000 bitcoins were deposited. Fund contribution declines by 85% in 2021 to 50,738 bitcoins.

Why? That is the year the Trust begins to trade at a discount to its NAV. At the turn of the year, the NAV premium trade disappeared in addition to the six-month lock-up period of shares becoming tradable to the open market on January 2021.

The net result? Institutional traders selling their newly unlocked & still profitable GBTC shares on the open market to retail bagholders at such a clip that Grayscale had to suspend its private placement contributions in 2022 to backstop the widening discount to its NAV. As of 1/28/23, Grayscale’s private placement of both bitcoin & ethereum is still closed.

The NAV discount spread has closed by 15% from its valley of 48% to 41% and Grayscale’s bitcoin trust has seen an increase of 51% from its $7.80/share low to $12.36 (just like I predicted). We can at least attribute a small amount of this gain to Grayscale’s marketing and suspension of new deposits, but continue to proceed with caution. If you have a position in any of Grayscale’s trusts, I encourage you to visit redeemgbtc.com & learn more.

Stay tuned, in part 3 we tie this all together: Grayscale’s lack of accountability, DCG’s conflict of interest, Genesis’ bankruptcy, Gemini & 3AC’s implicit support, in a master class of corporate fraud. It’s the kind of story that eventually becomes a case study in an MBA program..or maybe a movie.

To knowledge and wisdom,

John Cook

January 28th, 2023

San Francisco, CA

www.frontruncrypto.com

✍️ Related content:

Article cover generated by DALL-E: “An abstract oil painting of a white collar criminal conducting a seminar on how to commit securities and accounting fraud through a complex network of shell companies”

When I see these bitcoin "unregulated banks" promising 7% guaranteed interest or more, that should be a tipoff to anyone with knowledge of Finance 101 that it's a scam. If you're promising a guaranteed rate of return higher than the Treasury rate, it's impossible to do that legally.