Did FTX engineer a fake bailout of BlockFi?

Part 2 - How FTX engineered a fake bailout of BlockFi after they lost $1 billion of depositor funds because of FTX!

Dear frontrunners,

The system of complex corporate structures & financially engineered crypto derivatives continues to unravel with every new bankruptcy proceeding, creditor claim, and financial statement leaked on the internet. Two themes permeate throughout every document: FTX is at the center, and more customer funds are lost. It is mentally exhausting that we continue to give this criminal any airtime; it is not my intent to extend his 15 minutes of fame.

We are here to document the criminality of FTX and how a small group of 8 crypto banks and hedge funds intentionally colluded to engineer synthetic bitcoin derivative demand using depositor funds while simultaneously creating complex, opaque corporate structures to obfuscate their true assets and liabilities.

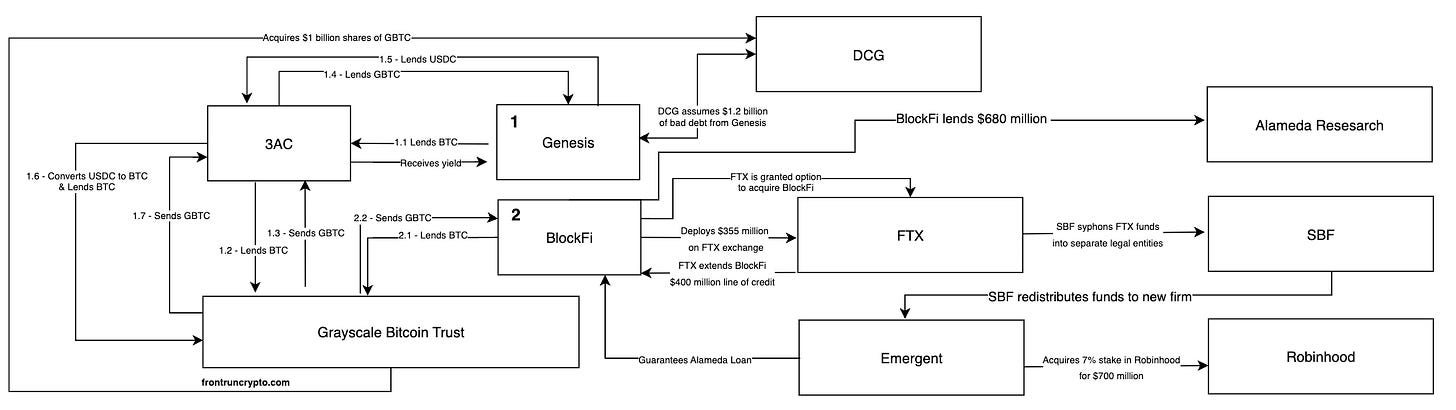

In part 1, we outlined how these firms used depositor and institutional funds to buy bitcoin, to convert to GBTC, to use as collateral to borrow USDC, to buy more bitcoin, to convert to GBTC, to use as more collateral for USDC, to buy more bitcoin, to convert to more GBTC in an infinite loop of synthetic (fake) demand.

If you haven’t read it, I encourage you to start here, as this analysis will expand upon the flow of funds outlined in part 1.

In this piece, we now review the corporate structure engineered by these firms and conclude the opaque framework is an attempt to obfuscate real liabilities and customer obligations, focusing on the recent capitulation of BlockFi, a crypto exchange, and pseudo bank.

The complex demise of BlockFi

BlockFi is a crypto exchange where retail investors buy, sell and trade crypto assets. BlockFi filed for chapter 11 bankruptcy with ~$250 million in assets relative to ~$10 billion in liabilities.

BlockFi’s bankruptcy was a result of poor internal risk management and the continued FTX/Alameda death spiral where BlockFi had exposure to FTX across 3 dimensions:

BlockFi used FTX’s platform to trade crypto and had up to $355 million in crypto assets “trapped” (it’s gone) due to FTX's bankruptcy

BlockFi loaned $680 million to FTX’s affiliated hedge fund Alameda Research as part of BlockFi's broader “lending business” (i.e. investing depositor funds) before the crypto crash in May 2022:

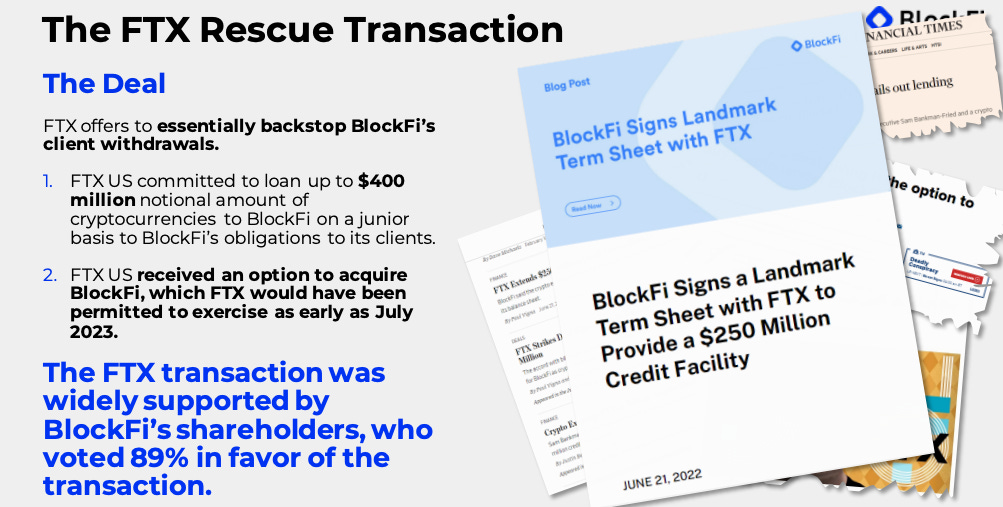

FTX also provided BlockFi with a

$250 million$400 million line of credit to avoid bankruptcy in exchange for an option to acquire the firm at some point in the future.

We question the legitimacy of this acquisition.

We now know that FTX is listed as a creditor to BlockFi for $275 million. How is it possible that BlockFi is seeking relief from FTX for $275 million and demanding a $355 million + $680 million recovery claim against their lost funds? It’s all depositor funds.

Moreover, what’s opaque is an unknown entity BlockFi is seeking relief against. A corporation domiciled in the Islands of Antiqua called “Emergent Fidelity Technologies Ltd.” (Emergent). We assume this claim against Emergent is related to the $680 million collateralized loan BlockFi extended to Alameda and when Alameda became unwilling or unable to adhere to the agreed-upon terms, SBF personally stepped in and guaranteed the loan with the Robinhood holdings via Emergent.

With FTX and SBF approaching insolvency via the collapse of its ponzi FTT token, a claim was filed on 11/9/22 by BlockFi when an “unknown borrower failed to make required payments in accordance with the payment schedule.”

We know:

BlockFi loaned Alameda Research $680 million of depositor funds

The $680 million loan was collateralized by a “crypto token” we assume to be FTT

When Alameda’s balance sheet was leaked, the FTT token went to zero

Alameda’s position was called by BlockFi

Alameda had zero funds to repay lenders, all available assets were deployed to backstop the FTX bankrun

SBF personally guaranteed Alameda’s position via Emergent via the Robinhood shares

We question the risk management profile of BlockFi’s lending desk. FTX and its affiliates controlled ~80% of the total circulating supply of FTT token. It was a highly illiquid asset with minimal trading volume. It will be interesting to see how BlockFi’s attorneys position the $680 million of “secured debt” when the court realizes the underlying asset was a worthless sh*tcoin.

Back to Emergent.

What is Emergent? A shell company. Emergent was created as the legal entity which acquired a non-controlling 7.6% interest in Robinhood.

Who are the directors and majority owners of this shell company? It’s not FTX, Alameda, the FTX board, or any affiliated legal entity. The sole operator is none other than Sam Bankman-Fried:

This explains why Emergent is a corporate entity that functions outside of FTX’s intentionally complex corporate structure. Emergent is a legal entity created at “arms length” between FTX and Robinhood but is funded by FTX exchange revenue.

Why is Emergent not listed as one of FTX’s 134 affiliate debtors in its bankruptcy filing? It is my claim that SBF has intentionally constructed a series of legal entities to shield his personal wealth. SBF’s statement to the NY Times that he has no hidden funds:

I’ve disclosed everything I have… and that I have no hidden funds. I’m down to $100,000 or something like that… and just one working credit card. - SBF, NYTimes Interview

This statement is a lie, true only in the most literal interpretation of corporate law. His wealth is shielded in a series of trusts and corporations to which he is the main beneficiary and sole operator. Although SBF may not have a meaningful amount of wealth in his personal accounts, the shell corporations through which he acts as the sole operator grants him access to at least $700 million in wealth.

Given this new information we’ve uncovered, we adjust the granularity of our flow of funds diagram ….

and replace the BlockFi/FTX box with…

BlockFi lending desk uses ~$1.7 billion of depositor funds and deploys capital to Grayscale to participate in GTBC’s NAV premium trade…

…and also extends Alameda a $680 million loan collateralized by now worthless FTT tokens…

…while BlockFi’s trading desk deploys $355 million to the FTX exchange..

…unfortunately, BlockFi’s risk management team failed to see the GBTC/3AC crypto winter and loses almost ~$1 billion of depositor funds…

..but to avoid bankruptcy FTX extends a $400 million credit facility to BlockFi collateralized by the now worthless FTT tokens…

..only to have Alameda Research caught in its own liquidity crunch vis-a-vis the downward pressure of the FTT ponzi token…

..to stop the bleeding SBF personally guarantees Alameda’s $680 million loan via his Robinhood stake…

….through a shell company called Emergent…

…which legally operates at arm’s length from FTX…

…but is controlled by SBF…

and funded by FTX revenues!

Was any of it real?

Exploring the byzantine bankruptcy and SEC filings of BlockFi and FTX leads us back to where we started. Did FTX engineer a fake bailout of BlockFi? Was any of the money real? Whose money was it anyway?

We know that:

BlockFi took depositor funds and gave it to Alameda guaranteed by FTT tokens

BlockFi took depositor funds and put it on the FTX exchange

Alameda Research used FTX depositor funds to facilitate risky trades and long/short positions all of which went to zero

FTX controlled the FTT token supply & demand curve

FTX used the FTT token as collateral for US dollar-denominated loans

The $400 million credit facility FTX extended to BlockFi was guaranteed by FTT tokens. The $680 million loan BlockFi extended to Alameda was guaranteed by FTT tokens. The $700 million Robinhood position was funded by US dollars vis-a-vis FTT tokens. Yet the entire FTT tokenomics circulating supply and demand was synthetically controlled by FTX.

It was all fake. The bankruptcy was funded with imaginary money due to a group of corporate criminals who lost real depositor funds. SBF may be the centerpiece of the ponzi responsible for the most wealth destruction, but the BlockFi leadership team must be held accountable. They lost $1 billion of depositor funds. Maybe that’s why BlockFi deleted their “Leadership Team” link from their website?

I am incredibly disappointed by the American legal system’s inability to take action. Arrest the FTX and BlockFi leadership team. Seize their assets and seek financial retribution until all depositor funds are returned.

To knowledge and wisdom,

John Cook

December 3rd, 2022

San Francisco, CA

www.frontruncrypto.com

Article cover generated by DALL-E: “An abstract painting of white-collar criminals creating shell companies to rip off regular investors”

Criminals of the week - The BlockFi executive team responsible for losing $1 billion of depositor funds: