A glimmer of hope

Has the real estate market finally turned? Have equities bottomed out? And what the heck happened in crypto?

After a brutal 24 months in the US residential real estate markets, the dynamics between buyers and sellers are finally changing. I should know, my wife and I made a bid on a 3 bed 1 bath single family home in Pleasant Hill, California for $880,000 and we were outbid by $395,000. Yikes.

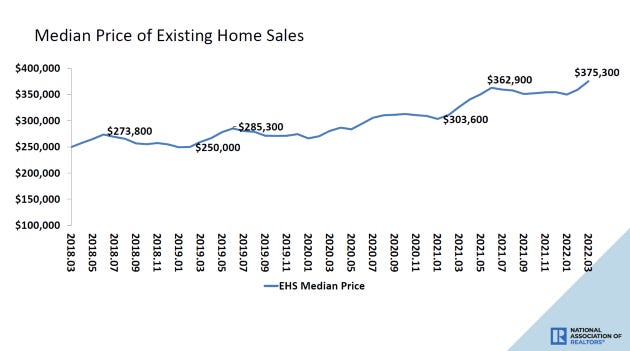

Consider that a prime borrower putting 20% down is now afforded a 30-year fixed rate mortgage at ~5.45%. 12 months prior in May 2021, the same prime borrower would have obtained that same mortgage ~ 3.14%. This increase would cause your principal and interest to increase by 31.6%, but that’s not the bad worst part. Given that home appreciation prices are up almost 20% from 1 year ago, the principal and interest on that same house in May 2022 is almost 51% more today. For the same house.

A house in 2022 is 51% more expensive than in 2021.

You’re probably thinking, “I thought you said the topic of the week is a Glimmer of Hope, where is the hope?”

Macroeconomic indicators are trending towards buyers and sellers at least having a conversation:

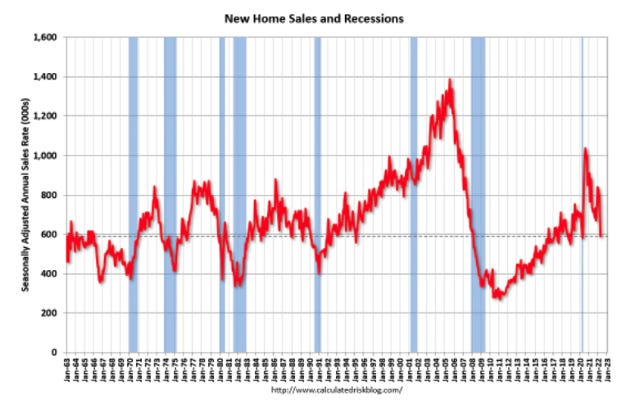

Sales of new single-family houses for the month ending April 2022 were 26% below the April 2021 estimate and 16% below March 2022

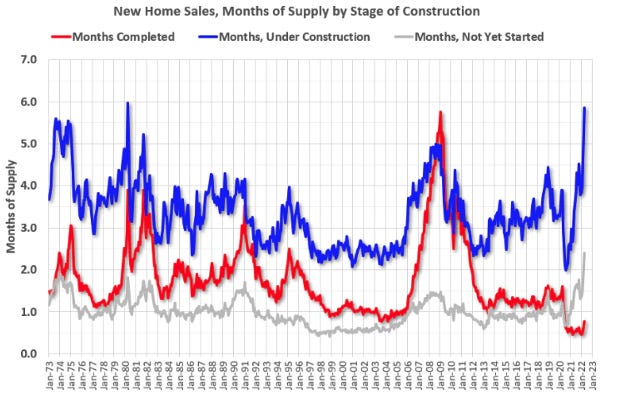

Months of supply for new homes have increased from 6.9 months to 9.0 months (low was 3.5 months in October 2020, the high was 12.1 months in January 2019). A “normal” range is about 4 to 6 months of new housing supply. We can overlay this with another positive data point related to new housing supply under construction;

There is almost 6 months of new homes under construction:

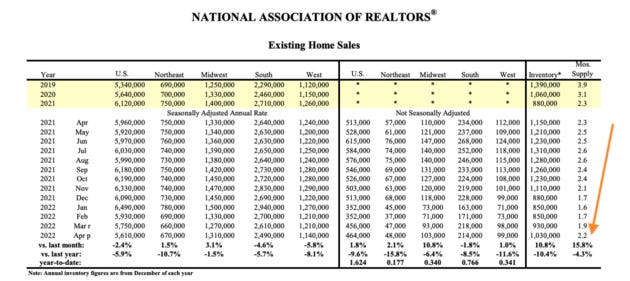

Which is needed to normalize the current inventory of ~1.9 to 2.2 months of unsold inventory. To be clear the active supply of single-family houses in the US is still at a record low.

This is why the NAR reported there have 121 months of year-over-year increases in the median sales price of single-family homes, the longest running streak ever.

This can help explain why payment to income of a median mortgage has reached record levels of unaffordability. The principal and interest on an averaged price home will now consume 31.2% of your net income.

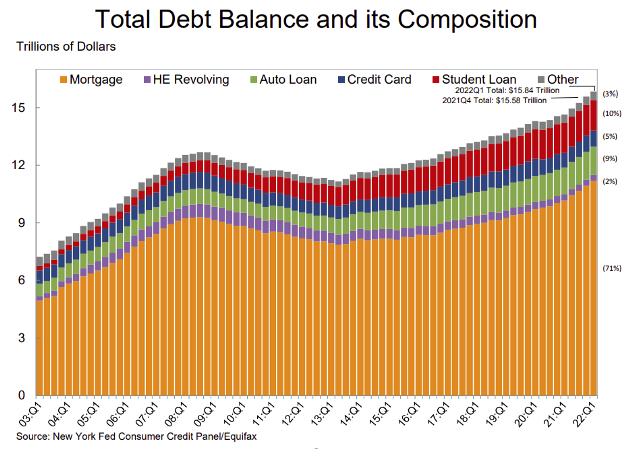

Taking a step back to look at the consumer’s total debt consumption, consumer debt is at a record high:

Aggregate household debt balances increased by $266 billion in the first quarter of 2022, a 1.7% rise from 2021Q4. Balances now stand at $15.84 trillion, $1.7 trillion higher than at the end of 2019, just before the Covid pandemic.

Maybe this is why:

It’s a conflicting conclusion for sure, as there are many drivers of pricing in play, let’s summarize:

The case for a decrease or deceleration in housing prices:

The same house in 2021 is 51% more expensive today, this creates downward pressure

There have been 121 months of consecutive year-over-year growth, this is not sustainable

Principal and interest as a % of income is at a record 31.2%

There are 9 months of new home inventory available, with 6.9 more months being built

Consumer debt is a record 20-year high

The case for sustained pricing:

Inventory is still at a record 2-month low

Fewer houses are available as measured by new listings and active sales (really what’s being said here is that any increase in active inventory is a byproduct of a decrease in buyer demand, not an increase in actual supply)

For my wife and I, despite living in the bay area we are making offers 5 to 15% under asking. 1 year ago we were told to pound sand, but now we’re getting counter offers. We, shall, see.

Stay Alert,

John Cook

San Francisco, CA

www.frontruncrypto.com

Improve your knowledge by reading these articles:

One of the worst starts ever after 100 days, but there is hope.

May 26th, 2022 was the 100th trading day of the year for 2022 and although stocks managed to gain about 1%, it was still the worst start to a year since 1970 for the S&P 500 Index. There is actually some good news in there though, as we’ve usually seen the previous worst starts ever come back nicely — sometimes in record fashion. Personally, throughout 2022, I’ve been aggressively buying SPX LEAPs when the SP500 dips below 4000.

“Down 16.5% after 100 days for the S&P 500 is the worst start to a year since 1970 and one of the worst starts ever,” explained LPL Financial Chief Market Strategist Ryan Detrick. “But the good news is previous bad starts have seen some nice rubber band snap backs and 2022 could be in line to do it once again.”

Welcome to the ‘Postmodern’ Cycle of Higher Inflation and Lower Stock Returns

Our friends at Goldman Sachs have predicted we’re entering a new cycle of the economy dubbed the ‘postmodern cycle’; one that emphasizes physical goods, renewed inflation risk, increased commodity prices and workers (finally) having more bargaining power as we globalization narrative finally resets. I guess people finally realized how thin the vail of a global supply chain built on ‘just-in-time’ economics fails during global catastrophes, like COIVD.

And whereas the modern economy featured rapidly growing world trade that resulted in better profits for companies but pressure on wages for workers in wealthy countries, the postmodern cycle may see the reverse, Oppenheimer says. The pandemic and the war in Ukraine have exposed the frailties of just-in-time inventories, which is likely to result in some manufacturing and supply chains moving back from abroad, a trend that Oppenheimer says supports a tighter labor market and higher prices for goods and commodities.

UST Luna Meltdown: What Happened?

Earlier this month the 3rd largest crypto stablecoin UST lost 99% of its value, destroying more than $41 billion dollars of capital in the process. The result of a death spiral, where more specifically:

UST is vulnerable to what’s known as a “death spiral.” Were holders to lose confidence in the peg, they could exit the system by redeeming their UST and minting LUNA. If enough were to do so at the same time, causing LUNA to lose a significant portion of its value, it could lead to a “run on the bank” in the form of mass redemptions. This then in turn causes LUNA to hyperinflate, rapidly losing more of its value, and trapping UST holders in the system. This scenario outlined in this final point is what we’ve seen play out over the last several days.

Quote of the week:

“Integrate your vocation and your identity by thinking of life as a journey rather than a destination” — Unknown