40 years of failed US monetary policy

A call to reject the US financial system for a more transparent trustless solution

🎧🔥 Click here to listen to the audio version of this guide or search for “Frontrun Out Loud” on your favorite podcast platform 🔥🎧

Frontrunners,

2022 once again reminds us of the risks of a human-centered trust-based system of money. Previously we published an analysis aptly titled “Somebody else has both of our sh*t and they're watching us fight over it” that outlines the rationale behind obscure governmental committees and their inability to define a coherent rules-based framework that serves to benefit the average American. The tldr, it’s all intentional.

The vagueness, opacity, and inconsistency through which our government cannot agree on terms like “what is a recession” all exist to keep the tax base confused as the US continues to debase the value of the dollar while governmental leaders are controlled by the invisible hand of corporate donors who dominate both sides of the political spectrum.

Watch this video and ask yourself, “who is really in charge”?

The persistent state of economic destruction catastrophized by six recessions over the past 40 years is a byproduct of a trust-based financial institution focused on preserving its legacy and lining its pockets at the expense of taxpayers.

In the 1980s, the restrictive US monetary policy championed by Fed Chair Paul Volcker was a trust-based attempt to kill core inflation by raising the short-term fed funds rate…

…subsequently followed by a 90s redux led by Alan Greenspan whereby funding rates were raised six times in 12 months in an attempt to “cool the economy”. The result? On the backdrop of depressed earnings growth and the realization that the 90s money printer style of investing has ended: VCs dumped their post-IPO ponzi pets.com shares to retail traders left holding the bag with worthless penny stocks denominated in US dollars. US dollars with less buying power than the previous five years which preceded it …

..by the mid-2000s, affordable housing policies implemented by President Clinton and championed by President Bush created a regulatory environment that encouraged federally backed mortgage security companies like Fannie and Freddie into the subprime markets without putting in place the means to monitor their increasingly risky investments.

…By 2006, subprime mortgages represented 13% of all outstanding mortgage loans with origination of subprime mortgages representing 20% of new residential mortgages compared to the historical average of approximately 8%. - Michel G. Crouhy, Robert A. Jarrow and Stuart M. Turnbull The Subprime Credit Crisis of 2007

Clinton’s Housing and Urban Development secretary Andrew Cuomo turned the Federal Housing Administration mortgage program into a sweetheart lender with sky-high loan ceilings and no money down, and he legalized a series of 'kickbacks' to brokers that have fueled the sale of overpriced and unsupportable loans. By 2008? Three to four million families were now facing foreclosure.

Again, trust-based government policies, enacted by “experts”, created an environment where commercial institutions and lenders pushed Americans to record levels of residential and revolving credit debt.

A moment of hope emerged from the masses. An awakening where the American people realized that it is not ok for the top 1% to act as the invisible hand of public policy. It is not ok for the top 1% to control 25% of total corporate equity and it sure as hell isn’t acceptable for the government to bail out corporate banks to the tune of $700 billion US dollars via its ‘Troubled Asset Relief Program’', while providing its constituents with absolutely nothing.

By 2011 the Occupy Wallstreet (OWS) movement was born: a protest movement against economic inequality and the influence of money in politics. A rejection of the trust-based institutions that have failed to serve the will of people. A rejection of a system that gave $700 billion dollars to corporate bankers in the form of a bailout, while offering $0 for middle America.

What did the 2011 OWS movement yield? Nothing. A testament to the corporate class which shapes government policy. Both republicans and democrats are beholden to the invisible hand of corporate interests…

..which leads us to today. A series of government-mandated trust-based policies produced the ‘US Cares Act’ - over $2 trillion dollars of new money entering the global money supply system:

With Jerome Powell and the Federal Reserve on a mandate to reduce core inflation by whatever it takes:

I wish there were a painless way to do that, there isn't. So, what we need to do is get rates up to the point where we're putting meaningful downward pressure on inflation, and that's what we're doing - Jerome Powell Press Conference 9/21/22

The problem? Core inflation is also impacted by commodity prices. Jerome Powell cannot influence Taiwan to reduce its commodity prices on circuit boards. He cannot influence OPEC+ to reduce crude oil prices to $50 a gallon. He cannot influence the price of avocados from Mexico. This is why aggregate commodity prices; from milk to poultry to lumber to circuit boards and everything in between are at record highs.

Putting it all together

The six recessions since 1980 were a byproduct of:

The loose monetary policy of the late 70s that led to the Volcker era of quantitative tightening and an early 80s recession

Loss of consumer and business confidence via the global oil supply crisis of the 80s coupled with the Tax Reform Act of 1986 that lowered investment incentives and ended the real estate valuation boom of the mid-1980s led to an early 90s recession

A reckless supply of capital led by silicon valley VCs further enabled by loose monetary policy created the early 2000s “Y2K” boom and a series of worthless dot com startups

Regulatory policy enacted by the US Department of Housing and Urban Development incentivized commercial lenders to underwrite and repackage subprime mortgages (called mortgage-backed securities) in the mid-2000s

A global “pandemic” empowered government regulators to “shut down the economy” with a $5 trillion dollar economic stimulus bill riddled with fat and waste for everyone except you

The impact on money

So what does failed economic policy set forth by government regulators have to do with money, the value of money, and our collective buying power? Government regulators enact policy that influences three areas of money:

The total money supply called “M2”

Total US public debt

Total interest expense on US public debt

We want M2 to grow at a rate of about 2% to facilitate maximum employment and price stability. This enables households to make sound decisions with respect to saving, borrowing, and investing, all of which contribute to a well-functioning economy.

We want the total US public debt to approximate around 30% to 50% of GDP or lower. This ensures our ability to allocate resources to domestic programs like medicare, infrastructure, public safety, education, and the militarization of US allies across the globe.

Finally, we want the total interest expense on US public debt to align with the broader debt obligation while ensuring that we avoid deficit spending. The revenue collected by the government should be greater than the primary deficit plus the interesting bearing debt.

The trust-based policies enacted over the past 40 years have failed to deliver on all three areas of influence:

US public Debt as a % of GDP is > 100%

The total money supply is at a record high of $21 trillion dollar

Public debt interest payments are now the single largest expense costing taxpayers> $ 1 trillion per year

This amount is greater than what the government is expected to spend on veteran programs, food programs, social security, military and civilian retirement, transportation, higher education, housing, and STEM combined

In aggregate our elected leaders have forced the American taxpayer into $31 trillion dollars of public debt with annualized payments of $1 trillion against an annual fiscal spending plan of $5 trillion with continued deficit growth that will push debt as a % of GDP to > 200% by 2050 if left unchanged.

The federal government faces an unsustainable fiscal future. If policies don't change, debt will continue to grow faster than the economy….Difficult policy decisions are needed to address the growing debt and change the government's fiscal path….The underlying conditions driving this unsustainable fiscal outlook existed well before the COVID-19 pandemic and continue to pose serious challenges if not addressed.

Projections from the Office of Management and Budget and the Department of the Treasury, the Congressional Budget Office, and GAO all show that current fiscal policy is unsustainable over the long term.

What is the solution?

We acknowledge that US government regulators have failed. This failure transcends both sides of the political spectrum as a result of trust-based institutions. The people elect individuals to act on their behalf, yet these elected individual individuals fail to deliver.

If trust-based systems have failed, trustless systems are mankind’s beacon of hope. Trustless systems are technologies, policies, and solutions absent of human intervention. Code is law and agreements are automatically enforced via smart contracts. Data is transparent, visible, and final.

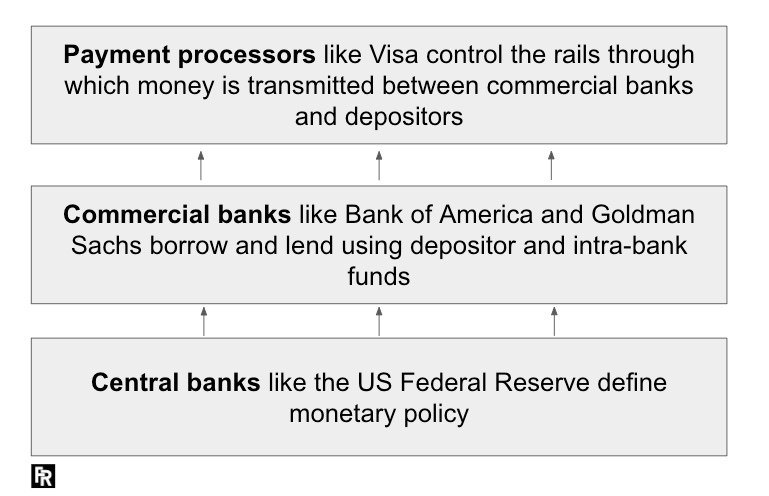

Enter the blockchain. The actors of our economic financial system transcend three participants: central banks, commercial lenders, and payment processors:

Central banks set monetary policy: print more money, print less money, mandate commercial lenders to ease lending standards (HUD) for residential mortgage applicants, create policies which policies allow businesses to source goods overseas (NAFTA), bail out banks, bail out airliners, bail out everyone but you and I

Commercial lenders act in partnership with government regulators to increase or decrease the flow of capital to depositors and other banks. You deposit your money into their institutions and for that service, you are paid .01% APY while they lend your deposits to your neighbor.

Payment processors like Visa, PayPal, and Venmo operate as monopolies to facilitate the transfer of money between lenders and depositors in exchange for a nominal fee. Payment processors are also beholden to central banks in that they will freeze your assets if requested by a regulator.

We are seeing bullet point three spill into the defi world with OFAC rulings related to USDC, uniswap, and others banning applications and wallets which interacted with the Tornado CASH protocol. We must be vigilant and ensure the regulatory oversight of corrupt institutions is shunned by the web3 community.

This legacy financial system and its purpose can be depicted below.

Central banks define policy

Commercial banks manage assets

Payment processors act as the settlement of transactions

There is an opportunity for the entire trust-based legacy financial system to be replaced with an economic solution free of human intervention, void of greed and the gamut of emotions that make man fallible. There is an opportunity to be trustless.

The blockchain of monetary policy

Technologies like Bitcoin and Ethereum do not rely on a system of highly matrixed governmental organizations enacting policies on behalf of their constituents. Instead of relying on government regulators and its corporate donor class, bitcoin and Ethereum rely on a global network of peers (called nodes) enforcing policy set at the base layer.

Bitcoin’s total money supply is capped at 21 million bitcoins and node participation is incentivized by a nominal transaction fee paid to miners. The means for Bitcoin to depreciate in value as a result of debasement or inflationary policy is not possible - this is sound monetary policy.

Ethereum’s monetary policy encourages holders of the eth token to “stake” their holdings to the base layer to facilitate the verification of transactions. Stakers are awarded new eth pro-rata the amount of network activity and staked nodes on the network. Ethereum’s base layer is framed as deflationary when network activity yields gas prices above ~ 8 gwei. Ethereum’s ability to act as a deflationary asset is called ultra-sound monetary policy.

Neither bitcoin nor Ethereum relies on a central enforcement mechanism to verify transactions and enact government policy. The base layer enforces the scarcity of its currency as a result of miners and node participants who are incentivized to verify transactions. Moreover, blockchain monetary policy enforces equal taxation on all participants. The legacy of industry bailouts that transcend the financial, automotive, and broader business communities are rejected in this new era of trustless financial systems.

The blockchain of asset custody

In a trust-based financial system, we require the legal system and government regulations to enforce our rights to ownership. Unfortunately, we have seen this system fail as our elected officials time and time again decide the winners and the losers by proxy of bailouts.

The assets of Goldman Sachs and JP Morgan Chase were protected during the 2008 housing bubble. Your assets? Foreclosed.

The assets of airlines, cruise ships, and publically traded companies were protected during the 2020 COVID pandemic. You? A $1,200 stimulus check.

Government regulators decide what types of liabilities are subject to bankruptcy proceedings and what liabilities are exempt….

…for example, you must pay your $100,000 student loans until you die, but the executive team of hertz rental car can seek regulatory bankruptcy approval on $19 billion dollars of debt during the peak of COVID while issuing $16 million dollars in bonuses to themselves at the same time.

The interplay between asset forfeiture, forgiveness, and the government’s philosophies of socializing losses while privatizing gains are eliminated on the blockchain. Ownership is enforced through cryptography. By replacing a bankruptcy judge with a private cryptographic key, both Bitcoin and Ethereum have introduced a technology that can operate outside of legacy financial systems.

Personal sovereignty and a sense of self-agency on the blockchain will create an environment that encourages ownership without a governmental body deciding who wins and who loses.

The blockchain of settlement

Today we pay payment processors like Visa, Paypal, and Venmo to process our transactions. We trust that these payment systems will act with integrity and objectivity. With blockchain, humans are not the deciders of truth and cannot determine which transactions are valid. In the blockchain, the node operators verifying transactions enforce the rules defined by the base layer.

If a node operator attempts to break a rule, its peer nodes will reject the information. In Ethereum, this is called a slashing event and staked eth is subject to burn. Proposed changes to the code and subsequent forks are of no merit unless the majority of the community decides to accept the change as valid. Consider the bitcoin forks: btc cash, bitcoin xt, bitcoin sv, litecoin: failed. Ethereum’s forks: eth classic, eth pow: failed.

Ethereum’s DeFi technology has the potential to make its base layer the settlement layer for all financial transactions while Bitcoin’s sound monetary policy represents the future of money. Moreover, unlike traditional financial systems with opaque transactions and off-chain investments, participants in the blockchain benefit from native verification tools and the ability to view all transactions via an audit of the blockchain explorer.

It is my belief that these verification tools’ which enable financial auditability will be the catalyst that encourages entities to build services on the blockchain.

In conclusion

Although we’re not able to ascertain which blockchain will emerge as the winner, it is our belief that blockchain technology will create the possibility of a new global trustless monetary system not controlled by humans. By rejecting the trust-based institutions which have failed to serve their people over the past 40 years, we welcome a new and novel economic organization that is paving the way for a more transparent and fair monetary system.

John Cook

October 8th, 2022

San Francisco, CA

www.frontruncrypto.com

tweet of the week - “how high is your risk tolerance??”